Discover data-driven CX

Drive superior customer experiences and navigate the open banking landscape with data-driven insights to boost performance and strengthen security.

- Elevate the performance and security of your customer-facing digital systems.

- Gain complete visibility across every touchpoint of the customer journey.

- Confidently embrace open finance, proactively reducing risk.

- Build transparent and seamless open banking experiences.

Discover data-driven CX

Drive superior customer experiences and navigate the open banking landscape with data-driven insights to boost performance and strengthen security.

- Elevate the performance and security of your customer-facing digital systems.

- Gain complete visibility across every touchpoint of the customer journey.

- Confidently embrace open finance, proactively reducing risk.

- Build transparent and seamless open banking experiences.

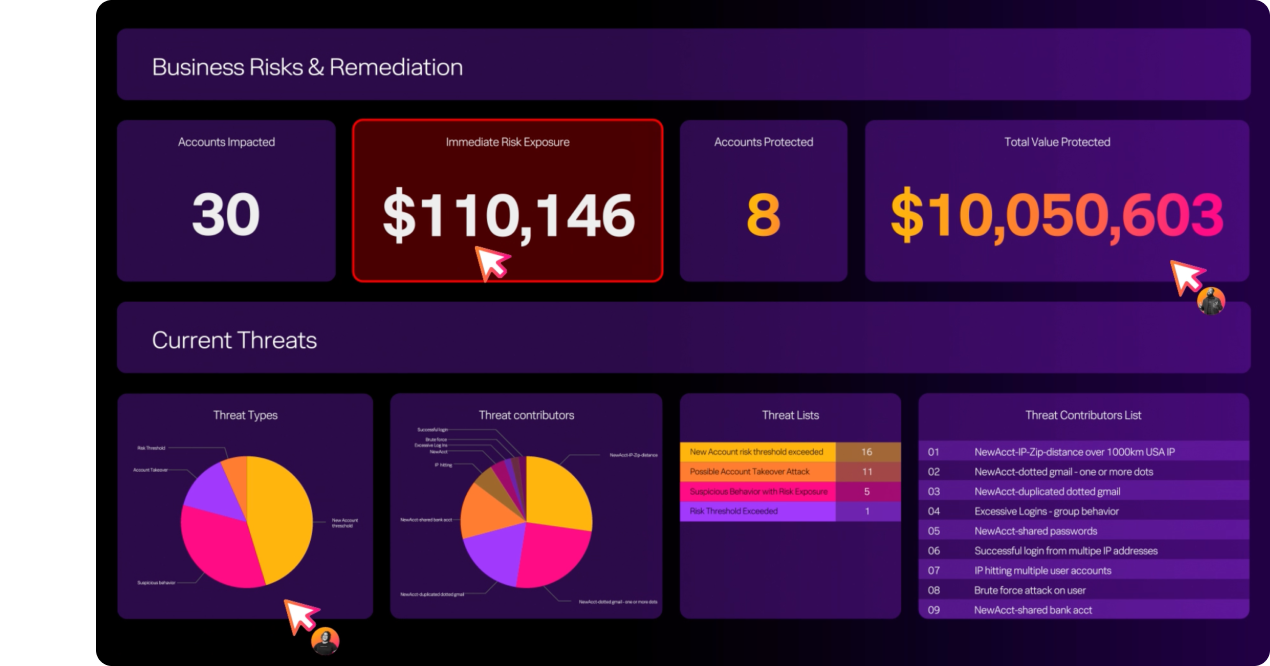

Boost profits, stop fraud

Shift your perspective: Fraud prevention isn't just a cost, it's a strategic advantage that boosts your bottom line and builds customer trust.

- See how lower fraud rates directly increase your profitability.

- Leverage powerful analytics to outsmart financial crime.

- Strengthen customer loyalty and retention with smarter fraud defense.

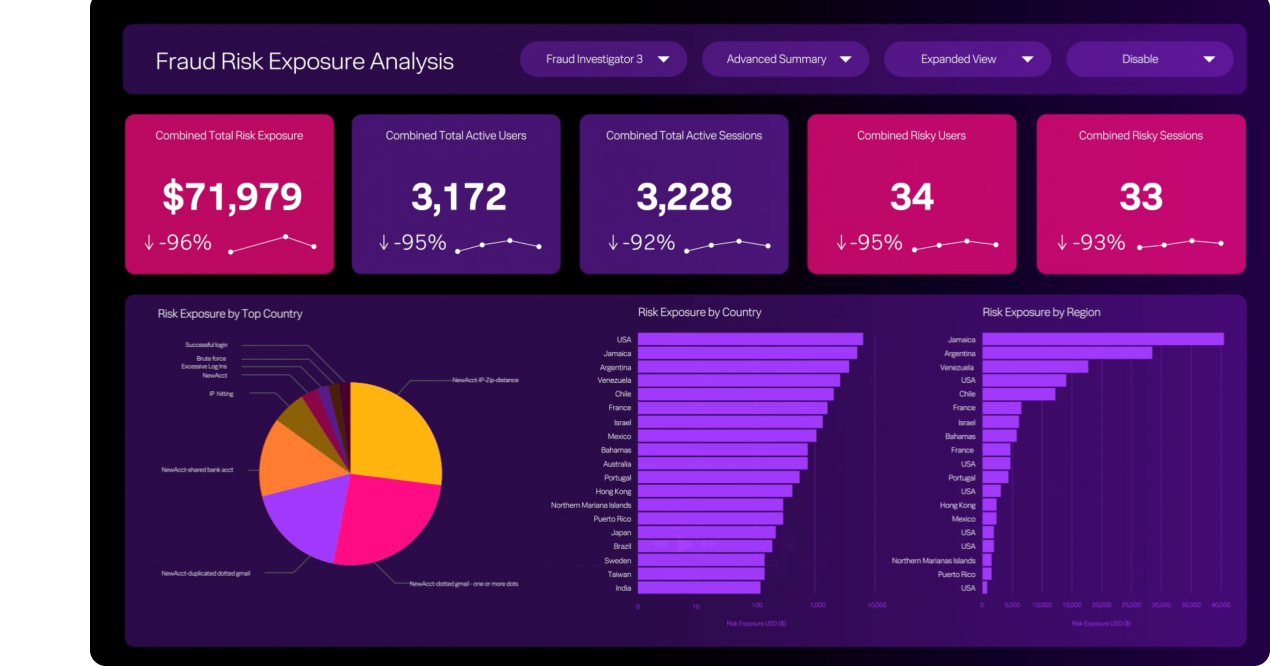

Protect growth, secure payments

Develop risk indicators, identify suspicious activity, and resolve issues swiftly to protect your payment systems.

- Trace end-to-end payment journeys for rapid threat detection.

- Enable your teams to collaboratively pinpoint suspicious payment behavior.

- Use powerful security capabilities to resolve payment incidents faster and with greater accuracy.

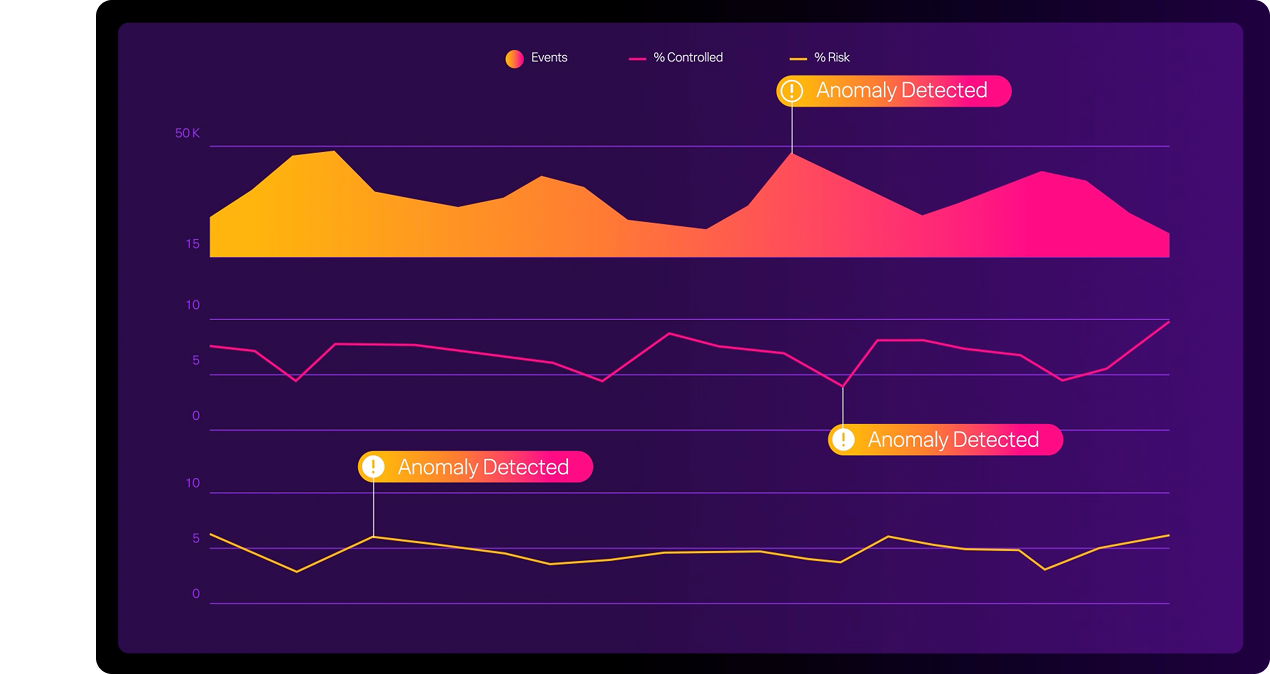

Explore smart compliance

Navigate new regulations by achieving speed, transparency, and resilience in financial services.

- Gain real-time insights into your complete risk posture.

- Automate data collection with a centralized Splunk solution to meet all compliance requirements.

- Pinpoint compliance gaps using automated tasks and tailored reports.