Leading or Lagging? Three Things That Will Move Observability for Financial Services Forward

This guest blog was authored by Laura Vetter, Evolutio Co-founder and CTO.

The Splunk State of Observability 2024 report indicated that financial services organizations have an edge when it comes to observability compared to other industries. Financial services consistently reported excellent visibility across both self-owned network infrastructure (53%) and public cloud infrastructure (50%) at above-average rates.

However, a deeper dive into the state of observability in financial services also showed that just 12% of financial organizations are leaders in observability. Leaders typically have excellent visibility across the tech stack, are able to detect issues with context, can get ahead of issues, and rely on disciplines like platform engineering to embed observability into the organization. Most — 40% — of financial institution survey respondents report being in the beginning stages of their observability journey.

The findings make sense. As an observability-focused consultancy and Splunk partner, Evolutio has seen observability maturity play out at different levels across banking, insurance, retirement, wealth management, trading, and fintech companies. We’ve seen firsthand that these organizations typically have intensive IT stacks designed to help get transactions out of physical branches and into the hands of consumers. The depth and breadth of financial services tech stacks and legacy techniques, such as log-based monitoring processes, have made it hard to achieve true observability with a business-centric view efficiently.

But that doesn’t mean implementing a leading observability practice isn’t worth the effort. In fact, in financial services, it should be a top priority for one critical reason: Small investments in observability can make all the difference in the highly competitive race for fast-twitch, data-driven operations.

An Observability Inflection Point for the Financial Services Industry

There are many reasons to be optimistic about the future of observability in financial services.

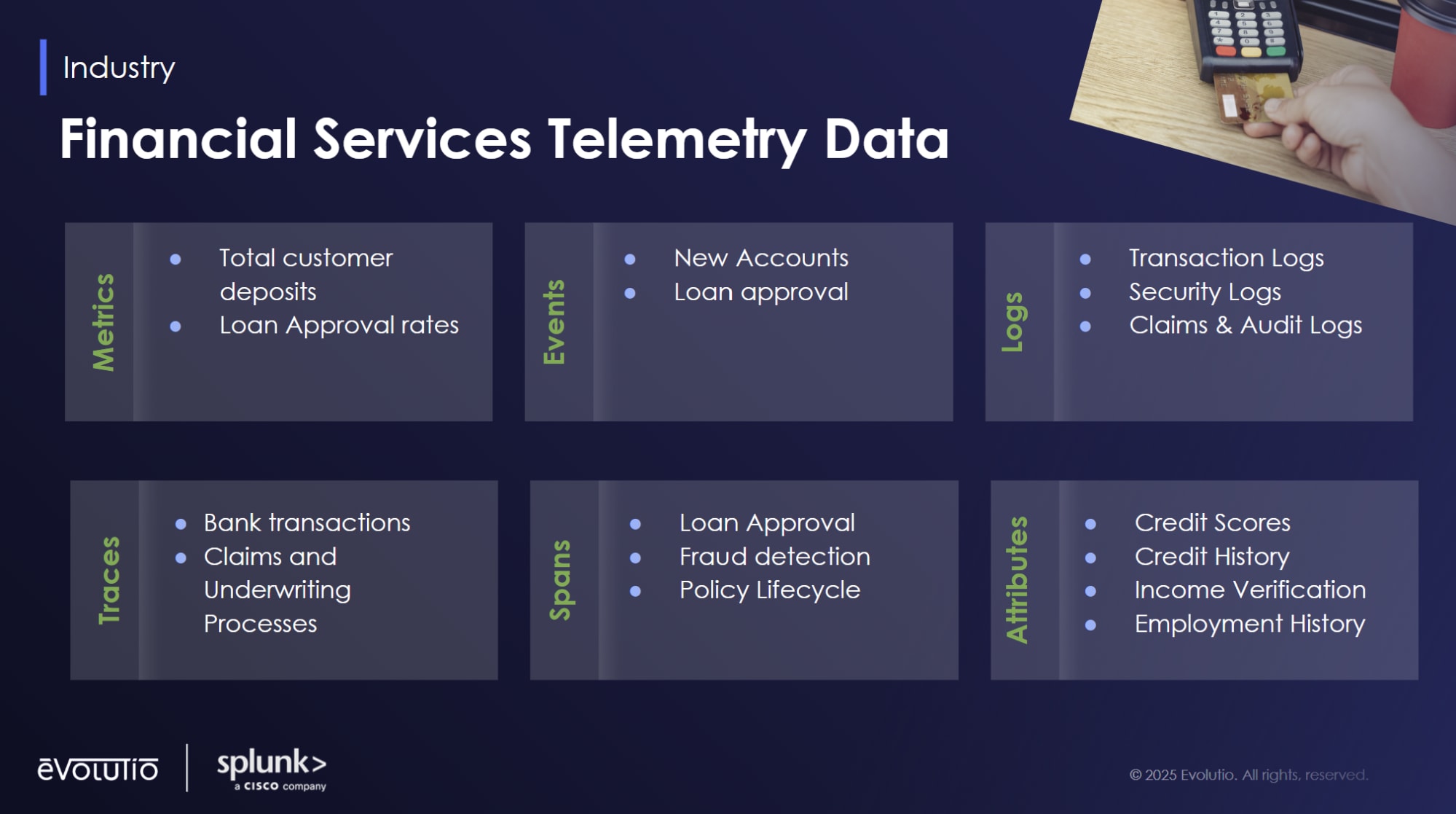

With new innovations, financial services organizations can move from log-based observability to a more metrics- and traces-based approach. This can help contain costs to keep up with the explosion of data in the industry. Even more, observability helps financial institutions derive deeper business insights by answering questions such as:

- Which of my branches are struggling?

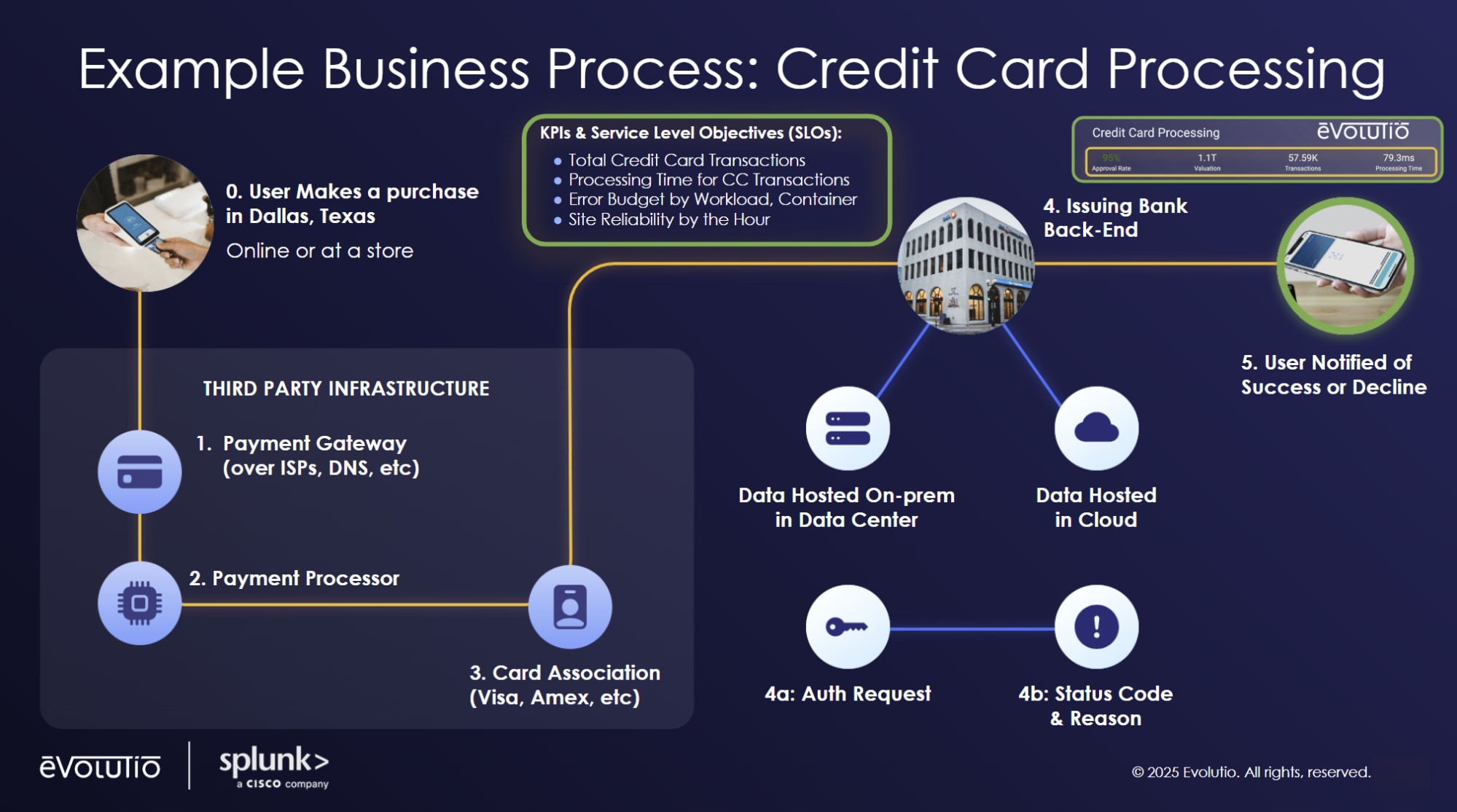

- Which low-latency, high-frequency transactions, such as payment processing and trading, are lagging, and why?

- Where are the friction points across the entire loan application process?

At Evolutio, we’re excited about the Cisco and Splunk integration because it empowers financial services organizations with access to richer business context across their digital footprint to answer those questions. With Splunk Observability, which is now supercharged by Splunk AppDynamics, organizations get full visibility across the network, infrastructure, and applications that make innovative financial processes not just possible but a vehicle for growth — spanning homegrown and third-party applications, three-tier and microservices running on-premises or in any cloud.

Splunk’s State of Observability 2024 report highlights promising developments on three fronts that could define the leaders from the laggards in financial services observability. These include:

- OpenTelemetry

- AI

- Platform Engineering

1. Can OpenTelemetry inject agility into the financial services observability approach?

In financial services, implementing a leading observability practice will mean going beyond detecting total outages and major problems. It’s also about detecting and correcting low-level code defects or infrastructure problems before they disrupt or impact the user experience.

That’s why OpenTelemetry is important. It provides a robust and cost-efficient way to collect business-relevant data, even across complex, hybrid IT environments, without vendor lock-in to a proprietary agent or collector.

However, the State of Observability report found that financial services organizations face more than their fair share of compatibility challenges with OpenTelemetry adoption: 57% struggle, compared with 46% across all industries.

It might be that the industry’s early leadership in legacy observability techniques, like logs and synthetic tests, is now holding it back.

The industry must change how it builds software to advance beyond legacy systems and tap into the full benefits of modern resources like OpenTelemetry. The first step? Shift-left thinking by embedding observability experts within development teams. That way, the question of how new apps, processes, or tech will be observed is considered earlier in the Software Development Lifecycle (SDLC).

2. Will integrating AI into observability make the industry faster?

Speed is everything in financial services. Take new loan acquisitions, for example. The first bank to deliver an offer — be it for a $10,000 car loan or a $1 million mortgage — usually wins. The faster you can collect and act on business-relevant data, the better outcomes you’ll drive for the business.

For example, with AI, things like automated root cause remediation are now realistic — saving organizations time and resources with the ability to remediate that issue automatically.

But AI needs excellent data, the kind of data that can answer big questions: Which auto loans had the most uptake? Was that because of speed, the offer, borrower demographics, dealership type, or something else?

Of financial services respondents to Splunk State of Observability, 99% are exploring generative AI in observability practices. What’s going to make the difference is doing it strategically.

At Evolutio, we believe that Cisco and Splunk are in a position to convert AI exploration into value generation, bringing together all the right data. When financial firms apply AI on top of those capabilities, it will have a big impact on the industry.

3. How does platform engineering play into the race to deploy new features faster?

While AI is getting all the buzz, the adoption of dedicated platform engineering teams within the financial services industry is also a real trend. At its core, platform engineering embodies an approach where software engineers utilize common toolchains, workflows, and self-service platforms, so they can spend less time managing their tools and focus more on pushing new, innovative products to market.

Nearly three-quarters (73%) of responding financial services firms already practice platform engineering extensively or for select projects. An additional 23% say they’ll implement it over the next year, according to the State of Observability in financial services.

Financial services is a competitive market — where milliseconds on a banking or trading transaction can matter. Organizations need to remain agile in the face of rapidly shifting customer demands, competitor advances, and regulatory headwinds.

Platform engineering can create agility for financial services’ greatest priorities — whether that’s moving to the cloud, adopting a microservices approach, or simply scaling capacity up and down faster and more cost-effectively. The State of Observability 2024 reported organizations with platform engineering teams most often say their top achievement is increasing IT operations efficiency, improving tasks like scaling, monitoring, and troubleshooting (55%).

Start Where You Are: The Journey to Observability Leadership

Mature observability practices aren’t built overnight, especially in an industry where mitigating risk and maintaining security remain critical priorities. Establishing true observability leadership also requires a cultural shift, and that’s a journey.

We advise our financial services clients to take that journey one step at a time. Greater adoption of OpenTelemetry, AI, and platform engineering are important and exciting — but they are not the whole story.

Having the right roadmap, backed by good processes and the right platform, is crucial. You can’t skip ahead in an observability journey. You have to start where you are and set a strategic pace toward building a leading observability practice that will ultimately prove worth the effort.

Learn more about the State of Observability in Financial Services.

Wherever you are on your observability journey, Evolutio, in partnership with Splunk Observability, can help you be an observability leader.

To learn how Evolutio, powered by Splunk Observability, can transform your observability practice, visit evolutiops.com/financial-services.

Laura Vetter is a subject matter expert in methodology and tooling for Monitoring, SRE, and Observability, namely with Cisco Observability, Splunk, AppDynamics, and other Performance Monitoring Tools in the competitive landscape. She is also well-versed in monitoring global SAP ERP landscapes and works with DevOps teams on governance for more secure and quality software deployments. With over 20 years of hands-on experience working in IT Ops and leading large teams, she is exceptionally skilled in understanding how those tools can meet the visibility needs of application-driven, Fortune 500 organizations.

Laura Vetter is a subject matter expert in methodology and tooling for Monitoring, SRE, and Observability, namely with Cisco Observability, Splunk, AppDynamics, and other Performance Monitoring Tools in the competitive landscape. She is also well-versed in monitoring global SAP ERP landscapes and works with DevOps teams on governance for more secure and quality software deployments. With over 20 years of hands-on experience working in IT Ops and leading large teams, she is exceptionally skilled in understanding how those tools can meet the visibility needs of application-driven, Fortune 500 organizations.

As a CTO and technology transformation visionary, Laura leads strategy for alerting and business-relevant dashboarding demands at scale. She leads a team that helps clients roadmap an observability strategy to mature along the curve, wherever they are in the journey.