CapEx vs. OpEx for Cloud, IT Spending, and Business Operations: The Ultimate Guide

Key Takeaways

- Definitions and Differences: CapEx (Capital Expenditures) involves significant, long-term investments in tangible assets (like buildings and equipment) that are depreciated over time, while OpEx (Operational Expenditures) refers to ongoing, recurring costs (like rent and utilities) that are fully deducted in the year they are incurred.

- Implications for IT Spending: Organizations must strategically choose between CapEx and OpEx models for IT investments, especially as many IT services shift to cloud-based, subscription models that favor OpEx for flexibility and cost predictability, while CapEx allows for complete control over assets.

- Future Trends: There is a growing trend towards OpEx in IT spending due to its agility and ability to align costs with usage, leading many organizations to adopt hybrid strategies that combine both CapEx and OpEx to optimize their IT budgets.

Introduction

Capital expenditures (CapEx) and operational expenditures (OpEx) are two ways organizations categorize their business expenses. Every organization has a variety of expenses, from office rent to IT infrastructure costs to wages for their employees. To simplify accounting, they organize these costs into different categories, two of the most common being CapEx and OpEx.

In this in-depth article, we’ll explore what’s included in CapEx vs OpEx, how to calculate each, and how to create a CapEx and OpEx strategy that best fits your organization.

What are capital expenditures (CapEx)?

Broadly, capital expenses are purchases that improve the value of the company beyond the current fiscal year. These are most often the cost of goods sold, or tangible assets that are critical for the organization’s business operations and long-term financial health such as land, buildings, machinery and vehicles, among other things. Any expense to improve or enhance the current business value of these assets — expanding the physical structure of a factory, for example—would also be considered a capital expenditure.

Examples of capital expenditures

Capital expenditures include fixed assets, such as the purchase, maintenance, and improvement of land, buildings, equipment, and other goods and services. Generally, an item can be considered a capital expenditure if it’s a one-time purchase that’s meant to benefit the organization beyond the year it’s purchased, where it will be considered an existing asset.

Some common examples of capital expenditures in IT include:

- Servers, network switches, routers, firewalls, etc.

- Physical plants

- Data centers and the land for data center facilities

- Universal Power Systems

- Building systems such as HVAC, generators, etc.

- Computers, mobile devices, printers

- On-premises/legacy software licenses

Accounting for CapEx

In terms of accounting, CapEx spending has both benefits and drawbacks. CapEx assets are usually types of expenses requiring significant up-front outlays that can quickly deplete IT budgets and reduce cash flow for the rest of the business.

However, because the asset’s useful life must extend beyond a year, its cost can be expensed by depreciation, typically over 5 to 10 years from its purchase date. In the case of land, depreciation can occur for 20 years or more, reducing the amount of earnings on which the organization’s taxes are based, and thus, reducing the amount owed for tax purposes.

Ways to finance capital expenditures

Capital expenditures tend to be expensive, requiring significant funding. Some common ways to finance CapEx are:

- Bank loans: The most straightforward way for organizations is to secure loans from banks and financial institutions. They repay the loans over time with a predefined interest rate. These loans can be short-term or long-term depending on the requirements of the CapEx project.

- Issuance of bonds: Companies can raise funds by issuing bonds. In this process, investors lend money in exchange for regular interest payments and repayment of the principal amount at maturity.

- Vendor financing: In this method, vendors of suppliers provide financing options to help organizations purchase equipment or services. In this option, payments are made by the organizations in installments over time.

- Venture capital: This option is more suitable for startups or companies with high-growth potential. Venture capital firms provide funding to organizations in exchange for equity. This option is usually good for innovative or large-scale projects.

- Asset-backed financing: In this method, loans are secured by the assets being purchased, such as machinery or real estate. This reduces risk for lenders and offers favorable terms.

Benefits and drawbacks of CapEx

CapEx offers several benefits to organizations, including:

- Stability: You know your exact costs for a CapEx purchase. Both the initial cost of the item and how it will depreciate over time are certain.

- Autonomy: Purchasing hardware and software outright gives you complete control of how you implement and use it, allowing you to modify your infrastructure as your needs change.

- Continuity: Investing in your own equipment removes many of the roadblocks you may encounter when subscribing to cloud-based IT services. When you purchase your own servers, for example, you don’t need to deal with license renewals as you would if you procured them on an OpEx basis.

- Long-term value: CapEx items are investments that fill needs and provide value for the business for years to come.

CapEx also comes with several risks, including:

- Buying more than you need: In trying to account for future needs, there’s always the risk you’ll buy more capacity than you’ll ultimately use, or invest in technology that becomes outdated before you get a return on your investment.

- Getting locked in with a vendor: Investing in your own hardware can create business dependencies on vendors that handcuff you when you need to adapt your infrastructure to changing demands or if the vendor doesn’t follow through on its promises.

- Incurring high maintenance costs: Ownership requires greater resources to manage your facilities and equipment. That means paying people to watch over these assets, either by reallocating existing staff from more business-critical activities or hiring additional staff, either of which eats into profits.

- Sacrificing agility: Long-term IT commitments can limit your ability to adopt newer, better technologies and approaches. Investing large amounts of money, time, and manpower in CapEx assets may make you reluctant to change, even when the market demands it, putting you at a disadvantage against more agile competitors.

What are operational expenditures (OpEx)?

Operational expenditures are recurring expenses, often intangible assets, incurred to support day-to-day operations. These funds are typically spent on consumable items or contracts that will be used up and deducted from taxes at the end of the accounting period, or within the year they are purchased.

Examples of operational expenditures

Operational expenditures are ongoing costs that support the organization’s daily business activities. A hallmark of OpEx items is that they are typically used up within the year they are purchased. Here are some examples:

- Rent and property taxes

- Insurance, utility, and telecom bills

- Contracts such as website hosting, web domain registrations, annual maintenance, and service agreements

- Repair and maintenance costs

- Wages and salaries

- Office supplies

- Marketing and advertising costs

- Travel costs

However, cloud computing, automation, and as-a-service offerings have changed the cost model for many IT products and services, enabling them to be more readily classified as OpEx rather than CapEx. These include:

- Anything as a service: SaaS, PaaS, IaaS, and more

- Data storage, such as data lakes and data warehouses

- Managed IT services

- Development and Deployment Tools like GitHub Actions, GitLab CI/CD

Accounting for OpEx

On the accounting side, OpEx purchases include pay-as-you-go items that are recorded in an organization’s profit and loss statement. Instead of depreciating like CapEx items, they are deducted from income as follows:

- Costs are assigned to your operating expense budget.

- When an OpEx purchase is made, the expense is recorded in your profit and loss statement.

- Monthly expenses are tracked and deducted from the bottom line as you incur them.

Benefits and drawbacks of OpEx

OpEx offers many benefits to organizations, including:

- Lower risk: Purchasing IT resources and services, as OpEx expenses introduce less risk than CapEx purchases. If technology advances and the market evolves, your budget can change accordingly. Also, if you’re not satisfied with the vendor, you have the ability to pivot to one that better meets your needs.

- Reduced maintenance costs: The vendor takes care of all the basic network and equipment maintenance, allowing you to allocate your staff to other activities that improve your products and increase your profits.

- Shorter lead times: On-demand services can shorten product deployment lead times from months and years to days and hours, resulting in more satisfied customers and workers.

- More adaptable architecture: Subscription IT models enable you to reconfigure an architecture or service easily and quickly if it isn’t working for you. Similarly, when a project is completed or aborted, you can delete the supporting architecture that’s no longer needed without paying for resources you don’t need.

- Budget flexibility: Pay-as-you-go services and other IT operational expenditures leave more free cash flow for other needs.

OpEx also comes with a few challenges, including:

- Less control: When you procure IT services, you are relinquishing control of the hardware, operating system software and maintenance to the provider. While the advantages generally outweigh the risks, you may encounter trouble if the vendor can’t meet your agreements, has a service outage, or goes out of business.

- Increased costs: In some cases, adopting cloud services may increase costs compared to ownership, though that fact may be obscured because you’re paying for the solution with smaller expenditures over a longer period.

- Complicated forecasting: While there are considerable financial benefits to pay-as-you-go models, they can complicate long-term forecasting for an organization if its usage fluctuates drastically from month to month.

How to calculate CapEx and OpEx

Understanding how to calculate CapEx and OpEx is essential for effective financial planning and budgeting. It helps organizations track investments and operational costs to optimize resource allocation.

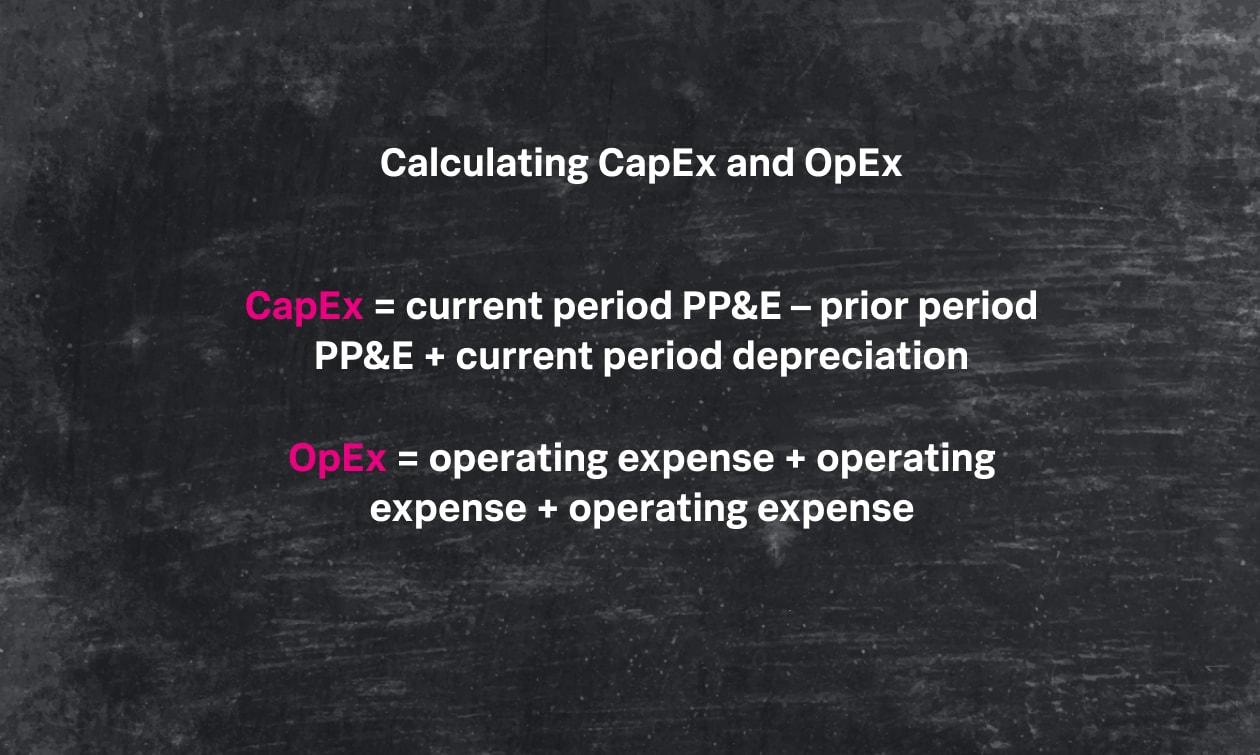

Calculating CapEx

CapEx can be calculated using your organization’s income statement and balance sheet:

- On the income statement, locate depreciation and amortization.

- On the balance sheet, locate the current period PP&E, then the prior period PP&E.

- Next, use the following formula to determine CapEx:

CapEx = current period PP&E – prior period PP&E + current period depreciation

This formula states that the current period PP&E equals the prior period PP&E plus new capital expenditures less depreciation.

Calculating OpEx

Calculating OpEx is much more straightforward. You simply add all your operating expenditures together over a stated period of time. An example OpEx formula looks like this:

Operating expenses = rent + insurance + supplies + licensing fees + legal fees + marketing and advertising + payroll and wages + repairs and equipment maintenance + taxes + travel + utilities + vehicle expenses

Strategies to track expenditures

- Establish a clear budget: Begin by setting a comprehensive project budget. Try to break it down into categories like labor, materials, equipment, and contingencies. Then allocate funds for each phase of the project to create a financial roadmap.

- Use project management software: It is ideal to use tools like Microsoft Project, Jira, Trello, or specialized budgeting software to track expenditures in real-time. Most of the tools out there can integrate with financial systems to monitor spending against the budget.

- Implement cost tracking systems: Use cost tracking sheets or software to log every expenditure. Categorize these expenditures as planned or unplanned costs. You must regularly update these sheets to ensure transparency and highlight deviations early.

- Monitor key financial metrics: Tracking critical financial indicators such as burn rate, cost variance, and earned value help assess whether spending aligns with progress and projections.

- Maintain detailed documentation:Keep a record of all invoices, receipts, contracts, and financial reports. This documentation not only ensures compliance but also simplifies audits and financial analysis.

- Automate where possible: Automate repetitive tasks like generating financial reports or updating expense logs. This automation reduces manual errors and saves time.

Considerations around CapEx and OpEx

It's important to understand CapEx and OpEx because these accounting models have a big impact on IT spending and budgets. IT and finance departments will have to determine how best to classify both on-premises and cloud costs and when it makes sense to shift IT costs from CapEx to OpEx to stretch their budgets.

Balancing upfront investments and long-term flexibility

CapEx purchases require a large outlay upfront, but because they depreciate over the useful life of the asset, they offer some accounting predictability. These projects also grant you total autonomy. Investing in your own data center, for example, gives you complete control over how it’s implemented and used, removing roadblocks when you want to modify your infrastructure to meet changing market demands.

CapEx technology purchases can be tricky, though. A large up-front investment requires you to predict your organization’s needs for the next several years. Buying physical servers is the classic conundrum — how do you decide the optimum amount of storage you will need to meet highly dynamic business workflows? Underestimate, and you’ll have to outlay more money to increase storage again. Overestimate and you’ll have overspent on servers that aren’t being used.

The rapid pace and evolving nature of the technological lifecycle can also mean a piece of hardware becomes outdated just a few months or years after it’s purchased, resulting in another large outlay of cash to replace it.

OpEx purchases, on the other hand, require smaller up-front outlays and offer long-term cost savings because you’re only paying for items you use. Cloud data storage, for example, allows you to buy storage on a monthly basis and scale up or down as your needs dictate, rather than trying to guesstimate how much capacity you will need far in the future. And because OpEx purchases usually follow a pay-as-you-go model, they enable you to keep more cash on hand and create a predictable recurring cost structure that aligns with net income.

Budgeting and approval processes

Organizations may follow a similar procurement process for both capital expenditures and operational expenditures, including:

- Soliciting a bid

- Contracting with a provider

- Performing legal review

- Arrangement of payment

Because of the magnitude of most CapEx investments, they usually have to go through several cogs of management approval before they can be purchased. For most organizations, this is a slow process that can significantly delay procuring the item. By contrast, OpEx items can be procured as long as they’re considered in the operating expense budget.

- Operational expenditures can be deducted from taxes in full the year they are incurred.

- Capital expenditures, on the other hand, are depreciated, meaning they must be deducted over their expected useful life. An asset purchased for $10,000, for example, might depreciate by $2,000 a year over an expected five years of use.

Shifting IT costs

Under the traditional hardware and software ownership model, the bulk of IT infrastructure expenses, (servers, networking hardware, data center facilities, etc..) are classified as CapEx, as they’re major purchases intended to serve the organization for more than a year. But as organizations transition to as-a-service models, it makes more sense to shift many IT costs to OpEx, which allows you to spread costs out over time and bring more predictability to budgeting.

Understanding the implications of these models will allow you to strategically employ them to maximize your IT budget utilization.

Shifting IT expenses from CapEx to OpEx brings greater flexibility and predictability to budgeting. It also allows you to deduct the full costs of these items from your taxes in the year they are purchased, which generally improves the business’s profit margin. But while moving to the cloud is often touted for its cost savings, it’s more accurate to say it helps control costs. You may ultimately spend more outsourcing your data center than operating your own, for example, but you pay for the solution with smaller expenditures over time instead of upfront.

Creating a strategy for your organization

To determine the best way to employ CapEx and OpEx strategies in your organization, start by considering the following questions:

- Does your organization currently have an IT CapEx/OpEx policy?

- Is CapEx or OpEx more likely to get approval in your organizational culture?

- What can your organization afford?

- What’s your organization’s 10-year plan?

- How much can your organization invest in IT right now?

- How much is a service you are considering going to cost over the next decade, and how does that compare to purchasing what you need over the same span?

Ultimately, many organizations choose a hybrid IT approach, combining their on-premises data center with various cloud technologies. This provides the flexibility to purchase some equipment as CapEx investments while strategically contracting with services under an OpEx model when it makes sense.

The future of enterprise spending

In the future, organizations will increasingly adopt an OpEx approach to IT expenditure. The flexibility and agility that OpEx resources provide is critical in IT as modern businesses rely more and more on cloud solutions. OpEx also solves many of the problems businesses have long struggled with when investing in private infrastructure. While the traditional IT ownership model may not disappear, it’s likely the current script will eventually flip, and CapEx purchases will become more strategic while OpEx procurement will become the norm.

See an error or have a suggestion? Please let us know by emailing splunkblogs@cisco.com.

This posting does not necessarily represent Splunk's position, strategies or opinion.

Related Articles

About Splunk

The world’s leading organizations rely on Splunk, a Cisco company, to continuously strengthen digital resilience with our unified security and observability platform, powered by industry-leading AI.

Our customers trust Splunk’s award-winning security and observability solutions to secure and improve the reliability of their complex digital environments, at any scale.