Tech the Halls - Part 1

The holiday season is once again upon us! It’s a time of joy, giving, and celebration. It is also a time for wonder, curiosity and amazement!

With this in mind, the big guy and the many, many helpers have put their heads together and come up with a few novel holiday themed videos and blogs to share with you in the build up to the big day. Join us over the coming weeks on the Tech the Halls journey.

How Splunk Can Help You Financially Prepare for the Festive Season🎄

Whether you’re shopping for gifts, decorating your home, or preparing for festive feasts, staying on top of your spending is more important than ever. While most of us associate Splunk with Security or IT data, its powerful analytics capabilities extend far beyond the traditional use cases. For example, did you know you can use that analytical power to manage your personal financial data and even forecast your spending?

In this first video and blog, we explore how Splunk can make financial planning simpler and smarter. Whether you’re tracking your holiday expenses, identifying spending trends, or preparing for unexpected costs, Splunk equips you with the insights you need to make better financial decisions.

Let’s dive into how we can turn financial data into a stress-free holiday season.

---

Using Splunk to Analyse Financial Data

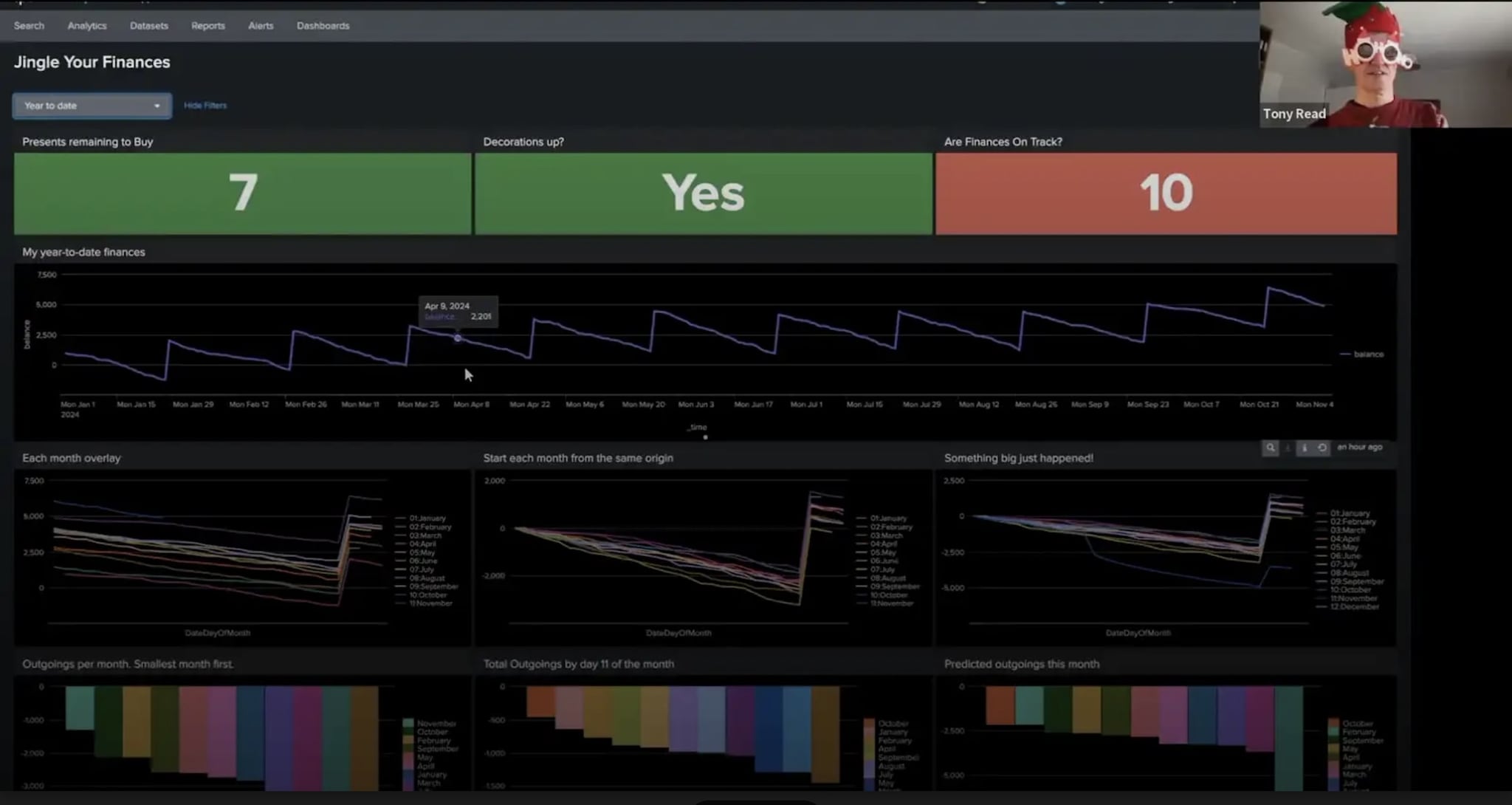

Our friendly elf, Tony, demonstrates the art of the possible by using Splunk to analyse personal financial data. By leveraging Splunk’s ability to process, visualise, and alert on data in real-time, Tony shows how you can stay ahead of your finances during the holiday season.

We can break it down into a few areas of analysis:

1. Understanding Your Spending Trends

One of the first steps in financial planning is understanding where your money goes. Splunk makes this easy by transforming raw financial data into clear, actionable insights. For example, Tony’s Splunk dashboard provides:

- Monthly income and expenditure patterns: A visualisation of how salaries are deposited and expenses are tracked each month.

- Spending trends over time: By analysing historical data, you can see whether you’re spending less or more over time. More importantly, using this data to make informed decisions on adjusting your spending habits accordingly.

For Tony, October turned out to be the least expensive month, while June was the most costly. With this information, it’s easier to predict and prepare for high-spending months in the future. Wouldn’t it be helpful to know when your most expensive months are likely to occur?

2. Detecting Cyclical Patterns

Splunk’s visualisations make it simple to spot cyclical patterns in your finances. By overlaying spending data from multiple months, Tony could identify recurring behaviors in his spending habits. This kind of insight is particularly useful for:

- Budgeting: Plan ahead by allocating resources to months when expenses are typically higher.

- Identifying anomalies: Recognise when spending deviates from normal patterns.

In our example, Tony noticed that January had a lower starting and closing balance than February, and February’s balance was lower than March. These patterns help refine the budget over time, making every dollar count.

3. Real-Time Anomaly Detection

One of the standout features of Splunk is its ability to detect anomalies in real-time. In the video, we can easily identify an unusual spending pattern on November 11th, warning that November could become the most expensive month of the year. With this early warning, we could take corrective action before it was too late.

Whether it’s a sudden shopping spree or an unexpected bill, anomalies in spending can derail your financial plans. Splunk’s anomaly detection ensures that you’re always aware of potential issues, helping you stay financially secure during the festive season.

Why Splunk for Financial Data?

Splunk excels at transforming complex data into actionable insights. Here’s why it’s the perfect tool for financial analysis:

- Real-time monitoring: Track your financial health in real-time and receive alerts for potential issues.

- Custom dashboards: Visualise your data in ways that matter most to you, whether it’s monthly spending, year-over-year trends, or specific categories.

- Anomaly detection: Identify unusual activity before it becomes a problem, ensuring you stay ahead of the curve.

With Splunk, the possibilities are endless. Whether you’re analysing personal finances, business budgets, or seasonal expenses, Splunk empowers you to make informed decisions.

The Elfs Data is Private

How We Created Realistic Financial Data in Splunk

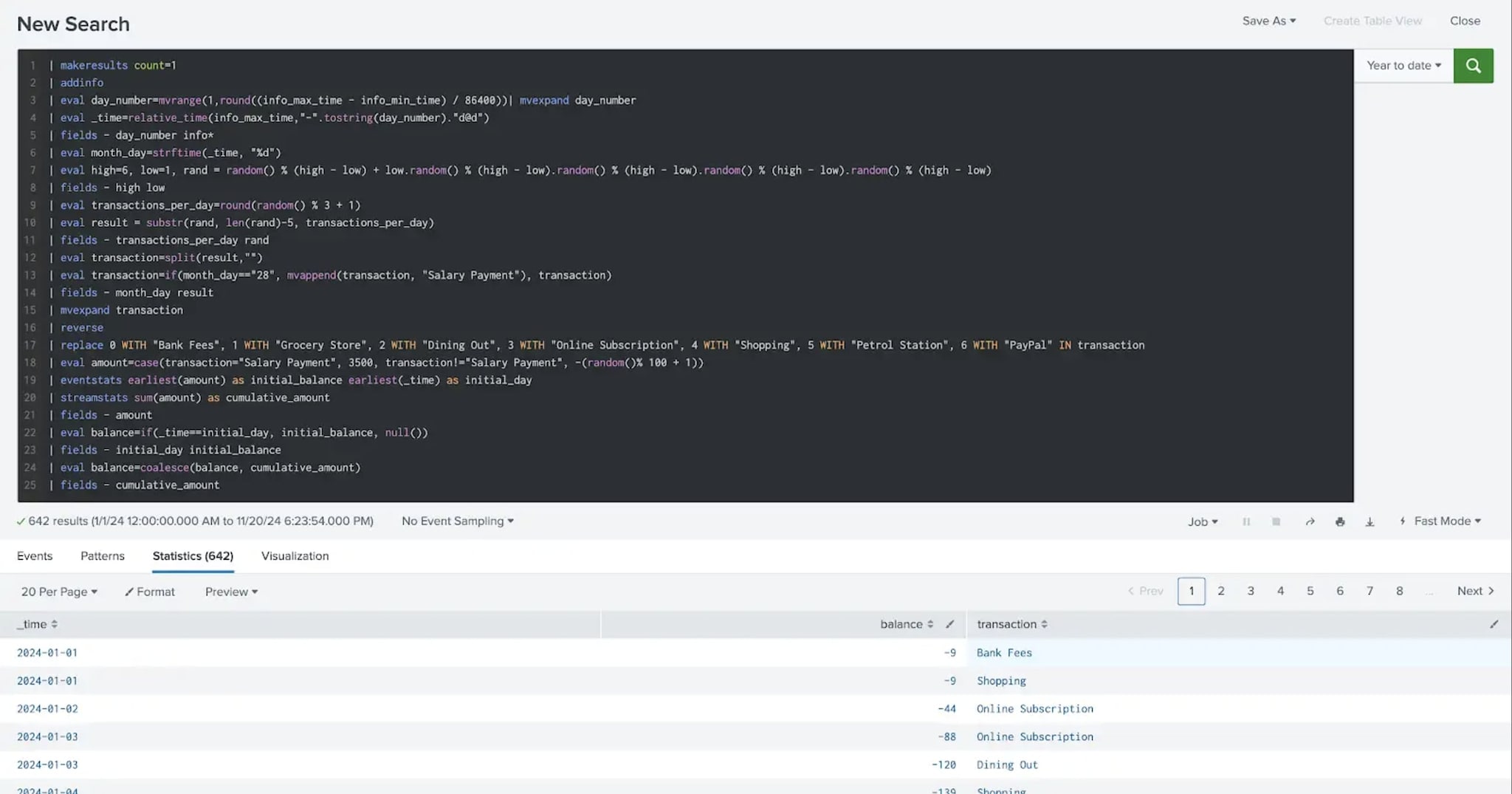

Now, we haven't used Tony the elfs real banking data, that would not get us on the Good List. What we have done, using Splunk schema-on-read ability, is create a fictional data set right there in the search bar.

Using Splunk’s ‘makeresults’ command we were able to fabricate lifelike bank statement data that dynamically spans multiple years. Here’s how we modeled the data to make it realistic and useful:

- True-to-Life Transactions: Each transaction was designed to reflect typical financial activities, including salaries, bills, shopping, dining out, and holiday purchases. We added randomness to transaction amounts and categories to mimic real-world variability.

- Running Account Balance: A running account balance was calculated across transactions, ensuring the data reflected how real accounts behave. This made it possible to visualise cash flow and account trends accurately.

- Dynamic Date Ranges: The data dynamically adjusts to include historical trends as well as the current month, enabling year-over-year comparisons and future predictions.

This approach to data creation not only showcases Splunk’s flexibility but also highlights its ability to deliver meaningful insights, even with fabricated data. If you’re looking to test your own data, or detections, or even demonstrate Splunk’s capabilities, the ability to create your own datasets using `makeresults` is a great place to start.

Beyond Personal Finances

While this example focuses on personal financial planning, the same principles apply to business scenarios. Splunk’s versatility makes it an invaluable tool for managing all kinds of financial data, such as:

- Software license renewals: Stay on top of expiration dates and avoid costly renewals at the last minute.

- Procurement and supply chain management: Track the cost of parts or materials for manufacturing projects.

- Budget monitoring: Analyse organisational budgets to identify overspending or areas for improvement.

By leveraging Splunk for financial data, businesses can make smarter decisions, optimise resources, and reduce waste—all while staying within budget.

Many global organisations, of all sizes, have harnessed Splunk’s power to solve complex financial challenges. For example:

- Financial Sector: Major banks leverage Splunk to monitor transaction flows, detect fraud, and ensure compliance with regulatory requirements. By identifying unusual activity in real-time, they protect customers and build trust.

- Retail: Retailers use Splunk to optimise supply chain costs by analysing payment data and vendor contracts, ensuring they get the best value during procurement cycles.

- Public Sector: A number of Public Sector customers also rely on Splunk to track recurring expenses, such as subscription renewals and payroll, to maintain financial health and avoid costly oversights.

These real-world stories demonstrate how Splunk’s financial analytics capabilities extend beyond personal finance into areas like fraud prevention, cost optimisation, and compliance. If you’re managing financial data at scale, Splunk is a trusted ally. If you're interested in learning more about the detail, visit Splunk's Customer Stories Page.

Prepare for the Next Festive Installment

In our next video and blog, we’ll explore how Splunk can analyse Santa’s “naughty and nice” list. By combining creative data modeling and external lookup capabilities, with Splunk’s analytics capabilities, we’ll show how even the most whimsical datasets can drive better decision-making. After all, who wouldn’t want to know how they decide who gets presents?

Related Articles

About Splunk

The world’s leading organizations rely on Splunk, a Cisco company, to continuously strengthen digital resilience with our unified security and observability platform, powered by industry-leading AI.

Our customers trust Splunk’s award-winning security and observability solutions to secure and improve the reliability of their complex digital environments, at any scale.