The High Cost of Security Investigations

Let’s start with an obvious statement, and then let’s dig into it. Security incident investigations are expensive. Period. Especially when multiple highly-skilled team members are involved. Every hour spent hunting down threats or false alarms carries a real dollar cost. Industry research shows that the fully-loaded labor rate for IT security staff averages about $62.50 per hour. In serious incidents, the hourly cost can climb even higher — IBM and Ponemon Institute estimates put incident response personnel rates in the $75–$150 per hour range, depending on skill level. And if outside experts are needed (for example, digital forensics consultants), rates of $1,500–$2,000 per hour are not uncommon. Clearly, each hour of investigation time translates to significant spend. Investigations are expensive.

Let’s put this into perspective. A single major incident often requires dozens to hundreds of person-hours from SOC analysts, incident responders, and security engineers. Ponemon’s analysis of real-world breaches found organizations expended 50 to 150 hours of staff time per incident on response activities. Let’s take it a step further. One study of hundreds of incidents reported an average direct investigation cost of about $58,000 per incident — much of that driven by analyst and responder hours. For businesses, this is a substantial expense. Every extra hour an analyst spends is money out of the security budget (or worse, time the threat remains active). And beyond the labor costs, prolonged incidents rack up other expenses like system downtime and lost revenue. (Gartner famously estimated the average cost of downtime at $5,600 per minute ($336K per hour) , illustrating how time literally equals money during cyber crises.)

The Impact of Missing Asset & Identity Context on Investigation Costs

Unfortunately, many investigations take longer (and thus cost more) than they should because analysts lack quick access to accurate asset and identity context. An alert often arrives telling the SOC that “device X is behaving suspiciously” — but if the team doesn’t know what device X is, who owns it, and how critical it is, they must pause detection to scramble for basic info. Analysts spend countless hours collecting context from CMDBs, identity directories, old VISIO diagrams, and ticketing systems just to understand what they’re investigating. What is it? What does it do? Where is it? What software is it running? What operating system does it have? What vulnerabilities does it have, and who is logging into it, or from it. This manual data gathering process delays responses and ties up skilled staff on low-level lookup tasks instead of actual threat-hunting.

Industry data underscores how pervasive this problem is. Organizations admit they have major visibility gaps in their asset inventories. In one study, 79% of enterprises reported visibility gaps across their cloud infrastructure (up 10% from the prior year), and 75% said the same about end-user devices and IoT. Basically, most companies do not have a unified, up-to-date view of all assets. A Ponemon survey in healthcare found only 36% of organizations know where all their devices are — meaning nearly two-thirds are flying blind for a large portion of their network. When an incident involves one of these “unknown” or undocumented assets, investigations grind to a halt while teams try to identify the system, its owner, and its importance. That’s a PROBLEM.

This lack of context has real cost consequences. Inefficient investigations eat up a huge chunk of the SOC’s time and budget. A 2023 study revealed that SOC analysts spend about 32% of their day investigating alerts that turn out to be false alarms. Why so much wasted effort? One big factor is poor context — without context, analysts have to chase every alert down rabbit holes to figure out if it’s benign or malicious. The same study noted that 81% of SOC professionals said manual investigations (with many disconnected tools) were the #1 contributor to slowed detection and response. In other words, not having integrated context and automation drags out the mean time to investigate. Another Ponemon report found that while teams thought they could identify incidents in hours, it actually took about a month to fully investigate, contain, and verify resolution of incidents in practice. That delta — hours vs. a month — speaks to the hidden inefficiencies (like context-gathering) that extend the incident lifecycle.

The financial impact of these delays is significant. IBM’s data shows breaches that take longer than 200 days to contain cost 23% more on average than those contained faster. Every extra minute or hour that a threat remains unresolved can escalate the damage. Conversely, speeding up investigations and containment has a direct dollar benefit; for example, organizations with faster, more automated responses shaved 108 days off their breach lifecycle and saved $1.76 million in breach costs on average. In short: slow investigations = higher costs, while fast, well-informed investigations = substantial savings.

Case in Point: Why Context Gaps Drive Up Costs

Imagine a security analyst investigating an endpoint malware alert without asset context. Is this device a CEO’s laptop, a dev test VM, or an abandoned server in a closet? Without knowing, the analyst must spend the first hour just querying asset databases, contacting IT, or searching spreadsheets to learn the basics. If those sources are outdated (as they often are), the analyst might pursue the wrong machine or miss that the device was reimaged and reassigned to a new user. These wild goose chases burn valuable hours. Multiply that by dozens of alerts a week, and the hours of analyst time wasted on context hunting quickly adds up. It’s not hard to see how investigation costs balloon when teams lack a “source of truth” for assets and identities.

There are real-world examples of this. In one incident response case, a major breach went undiscovered for weeks partly because the affected server wasn’t listed in any inventory — nobody realized it was exposed to the internet. By the time responders pieced together what that server was and who had been responsible for it, the attackers had already exfiltrated data. The investigation hours (and breach impact) could have been drastically reduced with immediate asset insight. While not every incident is that dramatic, even an extra 1–2 hours spent per alert due to missing context can cost five figures in labor over time when you consider a team of analysts at ~$75/hour each. And if missing context causes an incident to slip through the cracks or delays containment by days, the cost in downtime or data loss can reach into the millions.

Reducing Investigation Costs With Splunk’s Asset & Risk Intelligence

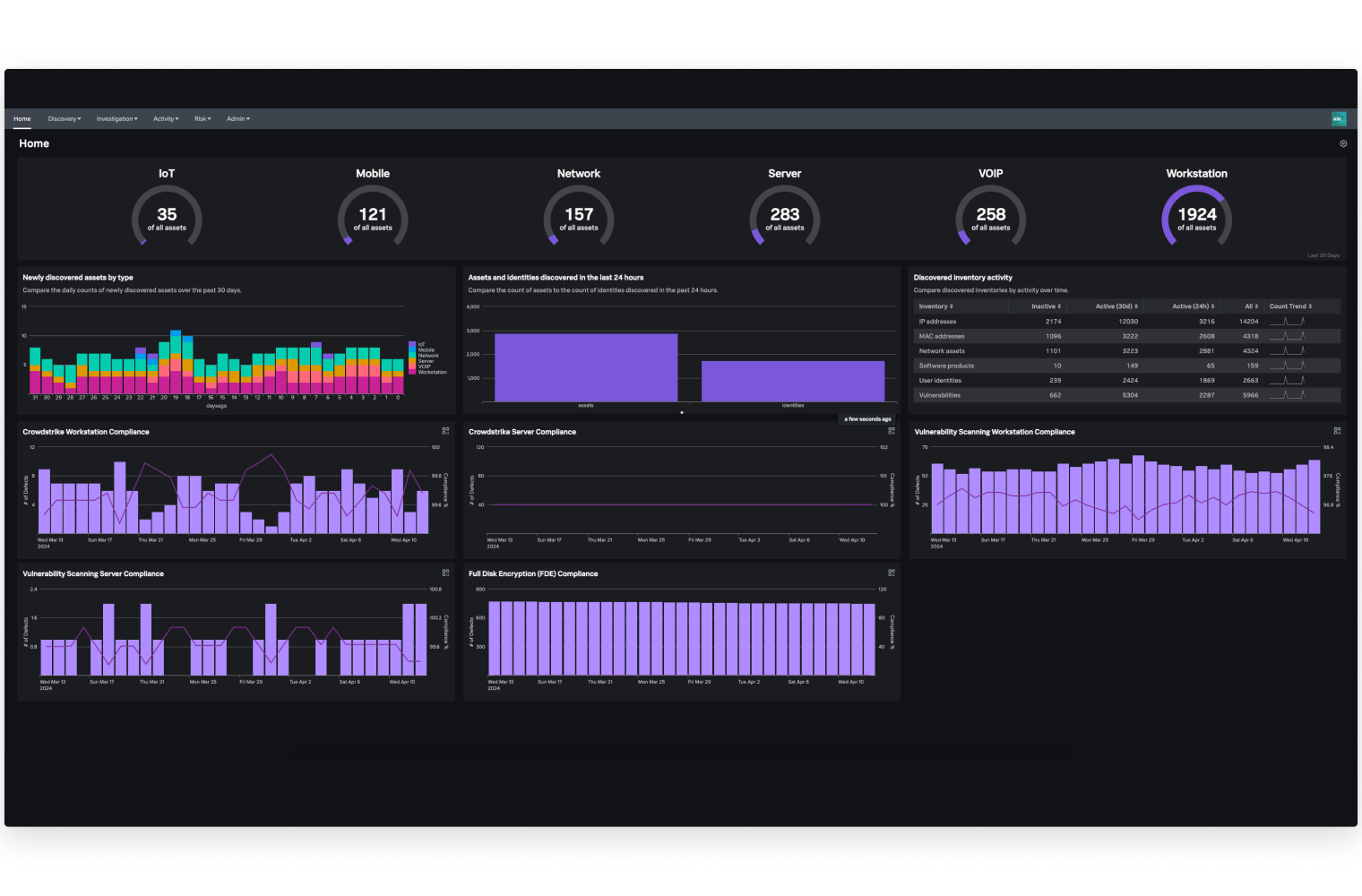

This is where Splunk Asset & Risk Intelligence (ARI) delivers value. Splunks ARI is purpose-built to fill the context gap by providing real-time asset and identity intelligence to SOC teams. It continuously discovers and enriches asset data across on-prem, cloud, and IoT environments, aggregating information from network tools, endpoint agents, vulnerability scanners, CMDBs, user-directories and more. The result is a unified, continuously updated inventory where each device, user, and application is catalogued along with critical context (operating system, what software it’s running, every IP address or Mac address it’s had, what vulnerabilities it has, is it bound by various compliance regulations or industry mandates, and which users are using it.).

For investigators, this means the answers to “What is this asset? Who uses it? Is it important?” are available instantly, right when an alert comes in. Splunk ARI maps relationships between assets and identities, so analysts can immediately see, for example, that “Suspicious IP 10.1.1.5” is a finance department server running Windows, last scanned 5 days ago, missing 2 critical patches, and tied to host name FIN-DB-01 used by the payroll department.” Having this rich context at their fingertips focuses and accelerates investigations. Analysts no longer waste time pivoting through multiple systems or chasing down asset context — ARI saves hours of effort by eliminating manual data gathering. One Splunk customer noted that with ARI, their team cut out the need to query CMDB or AD during an incident, reducing a process that used to take 30 minutes of an analyst’s time to just a few clicks within Splunk.

Investigation accuracy also improves with real-time context. False positives can be dismissed faster (e.g. you can quickly determine an “unusual login” came from a known safe user), and true threats stand out more clearly (e.g. spotting a critical database server out of compliance). Splunk ARI essentially brings the needed context to the analyst, rather than forcing the analyst to go find it elsewhere. By streamlining these investigative processes, organizations not only save staff time but also respond to incidents more decisively. Faster, more precise investigations mean threats are contained sooner, reducing the likelihood of a minor security issue snowballing into a major (and costly) breach.

Crucially, Splunk Asset & Risk Intelligence integrates directly into Splunk’s security operations ecosystem. It populates the Splunk Enterprise Security (ES) SIEM with enriched asset and identity data continuously. This means alerts in Splunk ES are automatically annotated with context (asset details, risk scores, identity info) in real time. Analysts can use ARI’s investigation dashboard to pivot through connected entities (seeing, for instance, all alerts in the last 24 hours involving the same laptop or user account) without jumping to external tools. By reducing context switches and data silos, ARI not only saves time but reduces analyst fatigue — an important factor given the cyber talent shortage. (It’s worth noting that organizations with staffing shortfalls experienced breach costs $1.76M higher than those fully staffed; tools like ARI help smaller teams do more with less, offsetting skill shortages and preventing analyst burnout.)

Splunk Asset and Risk Intelligence Guided Product Tour

ROI: Financial and Operational Benefits for Security Leaders

For Executives and CISOs, the value proposition of improving asset context is clear in both dollars and outcomes. By shrinking investigation timelines, companies can significantly lower their incident response costs and overall breach losses. Faster containment and more efficient use of analyst time directly translate into savings. For example, in a Forrester economic analysis, deploying Splunk’s security solutions (inclusive of context and automation capabilities) reduced the cost of a security breach by 37% on average. Much of that comes from catching issues earlier and resolving them faster. When incidents are resolved in hours instead of days, the business saves money not just on labor but by avoiding extended downtime, customer harm, regulatory fines, and notification costs. This also makes a company more resilient.

Splunk ARI’s benefits also accrue in day-to-day operations. Security teams become far more productive. Analysts who used to spend a third of their day on fruitless investigations can reallocate that time to genuine threats and proactive defense. In effect, ARI gives you more “investigation output” per analyst, which might mean you don’t need to hire that extra Tier-1 analyst (saving a full salary), or that your existing team can handle a growing alert volume without compromising on thoroughness. The improved accuracy – knowing exactly which asset is affected and its criticality – helps teams prioritize better, so high-risk incidents get tackled first, preventing costly oversight.

There’s also a compliance and risk reduction angle that senior leaders care about. A continuously updated asset inventory with risk insights helps ensure coverage of security controls (no forgotten assets running unpatched software). This reduces the likelihood of a breach in the first place, and it eases compliance reporting (which in itself can consume many man-hours). Splunk ARI provides out-of-the-box metrics dashboards for compliance status and highlights assets missing critical controls. For a CISO preparing for an audit or board meeting, having these real-time metrics is invaluable – it saves the team from a fire drill to compile asset data, and it demonstrates a strong security posture to stakeholders (possibly yielding better cyber insurance rates or avoiding audit penalties).

Bottom line for business leaders: investing in Splunk Asset and Risk Intelligence is an efficiency and cost-reduction play. It’s about empowering your highly-paid security experts to focus on high-value investigative work instead of data janitorial work. With complete context, incidents are resolved faster and with greater confidence. That means fewer hours billed to incident response, fewer breaches slipping through, and less financial fallout overall. As we at Splunk put it… combining asset intelligence with modern SIEM and SOAR improves the efficacy, efficiency, and economics of security operations. In dollar terms, the platform pays for itself by shrinking the labor costs per incident and by mitigating expensive cyber risks before they spiral out of control.

Related Articles

About Splunk

The world’s leading organizations rely on Splunk, a Cisco company, to continuously strengthen digital resilience with our unified security and observability platform, powered by industry-leading AI.

Our customers trust Splunk’s award-winning security and observability solutions to secure and improve the reliability of their complex digital environments, at any scale.