What Is Cryptomining?

Gone are the days when banks were the only way to send or receive money. Now, cryptocurrency serves as a more secure medium of exchange — and it prevents transaction delays and fees.

Instead of relying on a centralized authority, cryptocurrency networks rely on cryptomining. Miners solve cryptographic puzzles to add new blocks of transactions and earn a reward in return.

We will explore cryptomining in detail today.

Understanding cryptomining

Cryptomining is the foundation of the blockchain network that verifies and adds new coins. Simply put, miners solve complex puzzles, validate the transaction, and earn a fraction of the minted blocks as a reward.

This process maintains crypto transactions in a public ledger, so they're easily trackable in the future. The computational power of these miners is measured in hash rate — a higher hash rate means better chances of winning.

Since cryptomining consumes a lot of power, electricity cost is an essential factor that impacts your profitability and functionality. So, choose a location with cheap energy.

(Related reading: sustainable technology & the environment impact of AI.)

Solo vs. pooled mining: Which one's best

In the early days of crypto, mining was relatively easy, and anyone could mine crypto on their home computers. As more people became part of this decentralized workforce, solving puzzles became harder and required more computational power. Today, massive warehouses with specialized machines dominate the scene.

Let's compare solo and pooled mining so you can decide which one is better:

Solo mining

Solo mining is when individual miners use their hardware to solve mathematical puzzles. The probability of winning in solo mining is very low, as many miners compete to solve the same puzzle.

It also requires a lot of electricity and takes years to make a significant profit, so it's only suitable if you have a heavy investment.

Pooled mining

Pooled mining combines your computational power, divides the mining tasks into smaller sub-tasks, and distributes the rewards based on your contribution. The pros of this type of mining include:

- Consistent returns

- Lower investment

- Higher chances of validating transactions

No doubt, pooled mining comes with several benefits, but you shouldn't ignore its downsides too:

- The centralized nature of these pools makes them vulnerable to attacks.

- Lower rewards because more miners are participating.

- You pay a fee for contributing.

With that understanding, let’s turn to the various types of cryptomining available.

Types of cryptomining

Types of cryptomining vary from cloud mining to ASIC mining. You should choose the one that suits your budget and resources.

Cloud cryptomining

Cloud cryptomining is popular among miners because it doesn't require the necessary hardware and software. Instead, they hire a third party to manage the mining process.

In simple words, they receive the block rewards and transaction fees from mining while someone else deals with all the complexities.

You can do cloud cryptomining in two ways:

- Choose a cloud managing company and send them your ASIC (application-specific integrated circuit). They manage and operate it for you.

- Rent an ASIC or fraction of one, and let the third party manage and operate.

CPU mining

CPU mining uses your computer's CPU to mine cryptocurrencies. This type of mining can be worth it if you have a powerful processor and don't need your computer for other tasks.

However, using your CPU for mining can make your computer slow and unresponsive, especially on Windows machines. But if you're a small-scale miner, you can go for CPU mining.

GPU mining

GPU mining is very similar to CPU mining, but the big difference is that it uses graphic cards for cryptomining. Their high processing speeds allow them to be used for more extensive applications and complex mining tasks.

If you compare it with CPU mining, GPU is preferred because it:

- Doesn't make your computer unresponsive.

- Mines all types of coins more efficiently.

- Can add 12 graphic cards to one system.

(Related reading: CPUs vs GPUs: what’s the difference?)

ASIC mining

With ASIC mining, you use specialized machines specifically made for mining. These machines can only mine a specific coin or algorithm. For example, you'll need a Bitcoin miner for bitcoins.

ASIC miners can outperform CPU and GPU mining if you don't want to mine multiple coins. However, the resale value of these mining machines depends on the current market value of the coin they mine. And the cost of building these machines is relatively higher than the previous two types which makes it difficult for low-budget miners to consider this option.

Benefits of cryptomining

Cryptomining contributes to the maintenance of the crypto blockchain and here are some of its key benefits:

- Decentralized setup: Anyone can participate in the mining because of its decentralized nature which makes cryptocurrency a transparent system.

- Adds new currency into circulation: It generates new coins, which expands the supply and liquidity of crypto to secure your money in the form of digital assets.

- Ensures security: Different miners participate and confirm a transaction, which makes it secure and non-reversible.

- Gives rewards: Miners who validate the transactions earn block rewards. It motivates them to join in the future mining process.

- Prevents double spending: The complexity of the puzzle solved by miners creates proof-of-work (PoW). So, it's impossible to create fake transactions and double-spend coins.

Limitations of cryptomining

With benefits come some limitations, too. Let’s look at a couple of limitations associated with cryptomining:

Costly practice

Cryptomining has high upfront costs and ongoing maintenance costs because of electricity overconsumption. Suppose if you rent a data center, its accommodation costs are another expense. Plus, hardware and software require ongoing maintenance, which adds to overall expenditures.

Consumes higher electricity

Blockchain networks use a proof-of-work (POW) mechanism, which consumes a lot of electricity. This means the more electricity miners consume, the more mining power they have.

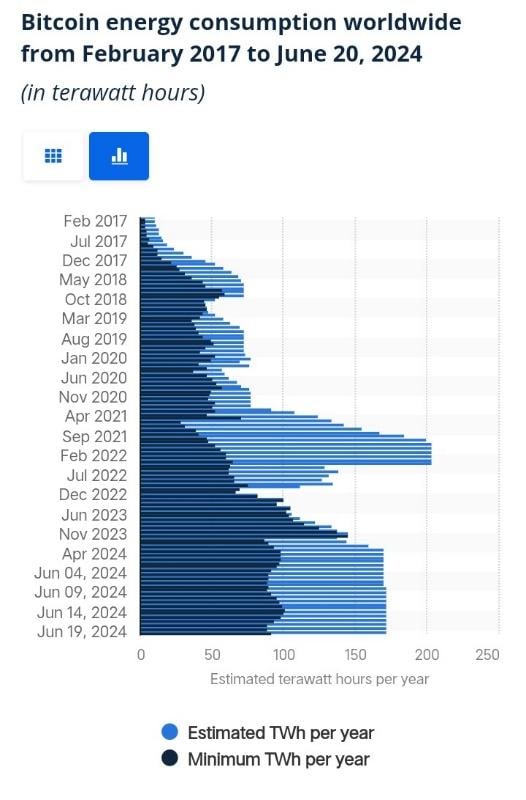

However, this mining protocol contributes to disrupting climate change. In 2022, electricity consumption for mining hit a record high of 200 TWh worldwide. Considering this situation, finding a sustainable and eco-friendly mining process is more needed than ever.

Bitcoin energy consumption throughout the years

Selfish miners pools

Individual miners join pools to increase their chances of earning rewards consistently. This leads to vulnerabilities, known as selfish mining attacks.

Here, selfish miners earn more rewards — at the expense of honest miners. They build a secret long blockchain and release it, which makes others with a real one immediately lose.

Cryptomining is not for everyone

Cryptomining seems like an attractive money-making opportunity as miners have no entry barrier. But there's so much to consider before you get your feet into it. If making quick money is your primary goal with this, you can invest elsewhere. It's a slow process with high electricity costs and no guarantee of rewards.

See an error or have a suggestion? Please let us know by emailing splunkblogs@cisco.com.

This posting does not necessarily represent Splunk's position, strategies or opinion.

Related Articles

About Splunk

The world’s leading organizations rely on Splunk, a Cisco company, to continuously strengthen digital resilience with our unified security and observability platform, powered by industry-leading AI.

Our customers trust Splunk’s award-winning security and observability solutions to secure and improve the reliability of their complex digital environments, at any scale.