Building Resilience with Energy Management in the Financial Services Industry

Environmental sustainability in the financial services industry (FSI) has matured from a “nice-to-have”, feel-good environmental, social, and governance (ESG) initiative to a numbers- and data-driven imperative that directly ties to organizations’ greenhouse gas (GHG) emissions reduction goals as well as strategic business objectives.

Examples of reasons why environmental sustainability - and in particular energy management - is now a business priority for the FSI include:

1. Environmental Sustainability Reporting

Many companies have been voluntarily reporting on their environmental sustainability performance and progress against their goals for years. In recent years, we have seen a shift from voluntary reporting to mandatory reporting.

Governments around the world remain increasingly focused on addressing environmental sustainability by setting public policy goals and implementing new rules and mandates applicable to corporations. A key focus area for regulators is on environmental sustainability reporting and transparency.

To cite some examples:

- In the European Union (EU), the Corporate Sustainability Reporting Directive (CSRD) modernizes and strengthens existing rules concerning the social and environmental information that companies have to report. The CSRD aims to ensure that investors and other stakeholders have access to the information they need to assess the impact of companies on people and the environment, and for investors to assess the financial risks and opportunities arising from climate change and other sustainability issues. A broader set of companies will now be required to report on sustainability, and companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS); and,

- On a global level, multiple jurisdictions are actively pursuing or considering adoption roadmaps and pathways toward mandatory application of International Sustainability Standards Board (ISSB) IFRS® Sustainability Disclosure Standards (SDS).

2. Smart Buildings Imperatives

Due to the characteristics of the FSI, organizations often own and operate a high number of physical buildings such as branches and offices. As EU buildings in 2023 accounted for 40% of all energy consumption, they are the single largest energy consumer in the EU and this is driving smart buildings imperatives.

Financial services organizations have ambitious energy and GHG emissions reduction targets. In addition, cross-industry initiatives, such as the Alliance of CEO Climate Leaders, to which many FSI companies are members, have their own environmental sustainability ambitions. Further, regulations, such as the revised EU Energy Performance of Buildings Directive (EPBD), continue to enhance the energy performance requirements for new buildings.

3. High GHG Cluster Risk with OnPremise Data Centers

Financial services companies typically operate in-house on-premise data centers instead of migrating to the cloud. These in-house data centers pose a carbon footprint risk since they contribute to the overall carbon footprint of FSI organizations.

As a result, the well-established management wisdom applies:

You can’t manage what you can’t measure

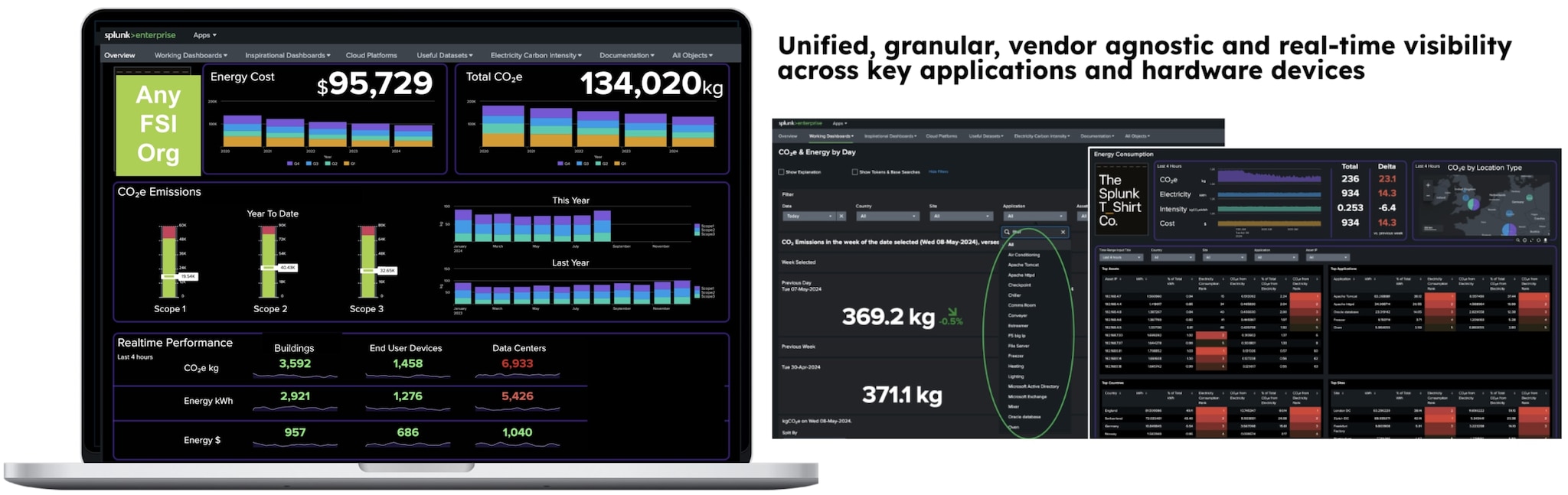

Organizations need to have unified, granular, vendor agnostic and real-time data insights on energy consumption, GHG emissions and costs so that they can optimize business operations and align with stakeholder requirements.

Building Resilience with a Unified Environmental Sustainability Solution

A unified environmental sustainability solution which focuses on energy management metrics for buildings and data centers is an effective way to provide data visibility and advance key business outcomes. Dashboards contain customizable visualizations, metrics, business and technical KPIs and built-in AI/Machine Learning for detecting outliers, forecasting, clustering and recommendations.

Unified Environmental Sustainability Solution

Disclaimer: Figures are for illustrative purposes only

Key Business Outcomes

- Increase energy efficiency

- Reduce energy cost

- Reduce carbon emission footprint

- Enhance Environmental Sustainability Reporting

- Augment security through energy consumption anomalies

- Identify hardware issues through energy consumption anomalies

- Increase trust of shareholders, investors & customers

- Be an attractive employer, competitive advantage

Business Impact

- Unified, granular, vendor agnostic, real-time visibility

- Optimizations at scale through relevant correlations and KPIs, e.g. energy efficiency per building or per workload

There is an additional benefit to having this type of real-time data visibility: predictive security. Energy spikes and energy consumption anomalies in relation to servers may point to a cyber attack. This is another example of how data visibility enables organizations to respond quickly to issues that threaten their resilience.

In summary, a unified environmental sustainability solution for energy management leverages end-to-end visibility for energy efficiency, energy cost and GHG emissions for optimizations at scale and as such can be a critical building block for improving resilience in the FSI.

Related Articles

About Splunk

The world’s leading organizations rely on Splunk, a Cisco company, to continuously strengthen digital resilience with our unified security and observability platform, powered by industry-leading AI.

Our customers trust Splunk’s award-winning security and observability solutions to secure and improve the reliability of their complex digital environments, at any scale.