August 24, 2022 – Splunk Inc. (NASDAQ: SPLK), the data platform leader for security and observability, today announced results for its fiscal second quarter ended July 31, 2022.

Second Quarter 2023 Financial Highlights

- Total revenues were $799 million, up 32% year-over-year.

- Cloud revenue was $346 million, up 59% year-over-year.

- Cloud Dollar-Based Net Retention Rate was 129%.

- 723 customers with total ARR greater than $1 million, up 24% year-over-year.

“The value we bring customers is evident in our Q2 results, with total revenues growing 32 percent. We also delivered substantially higher non-GAAP operating margin for the quarter, driven by our laser focus on balancing growth with profitability,” said Gary Steele, President and CEO of Splunk. “Splunk is well-positioned to deliver long-term, durable growth and profitability as we help the world’s largest and most innovative enterprises improve their cybersecurity and business resilience. These customers appreciate the unique and unmatched level of visibility we provide into their data and consider Splunk their partner of choice to secure and strengthen their mission critical operations.”

“In the face of some headwinds, we had solid execution in Q2, including $346 million in cloud revenue, a 59 percent increase over last year,” said Jason Child, CFO of Splunk. “Given the continued normalization of our revenue model, plus good progress on our expense optimization efforts, we substantially outperformed on the top and bottom lines for the quarter, and we’re increasing our revenue, operating profit and cash flow outlook for the second half.”

Q2 2023 Business Highlights

- Splunk Delivers Advancements Across its Products and Partner Community at .conf22: Over 12,500 attendees, including thousands of partners, came together during Splunk’s annual user conference to discuss how organizations are overcoming the barriers between data and action. Key product announcements included:

- The Splunk Platform, including Splunk Cloud Platform and Splunk Enterprise 9.0, allows customers to access more data sources easily, find and operationalize insights even faster, secure and scale deployments, build cloud-ready custom applications, and streamline administration to turn data insights into business outcomes.

- Data Manager for Splunk Cloud Platform delivers a scalable data onboarding experience across Amazon Web Services and Microsoft Azure, with Google Cloud Platform support available later this summer, providing an easy-to-manage hybrid cloud control plane of data flowing into Splunk within minutes.

- Splunk Log Observer Connect allows customers to visualize all their data in one place. By combining the power of Splunk Cloud Platform and Splunk Observability, site reliability engineers and DevOps engineers can access their metrics, traces, and Splunk Cloud logs in a single interface for faster, in-context debugging.

- Splunk Ranks First in Both IT Operations and Security Markets in Gartner® Market Share Report: Splunk leads in market share for IT Operations for Health and Performance Analysis (HPA) segment and in the Security Information and Event Management (SIEM) segment, worldwide in the Gartner Market Share: All Software Markets, Worldwide, 2021 report*. In the report, Splunk once again maintained its highest position in both IT and security operations markets.

- Splunk Names New Chief Customer Officer and EMEA General Manager: Splunk appointed Katie Bianchi as its Chief Customer Officer and Petra Jenner as Senior Vice President and General Manager for Europe, Middle East and Africa (EMEA).

Financial Outlook

The company is providing the following guidance for its fiscal third quarter 2023 (ending October 31, 2022):

- Total revenues are expected to be between $835 million and $855 million.

- Non-GAAP operating margin is expected to be between 6% and 8%.

The company is providing or updating the following guidance for its fiscal year 2023 (ending January 31, 2023):

- Total revenues are expected to be between $3.35 billion and $3.4 billion (was previously between $3.30 billion and $3.35 billion).

- Non-GAAP operating margin is expected to be approximately 8% (was previously 2%).

- Total ARR is expected to be approximately $3.65 billion; Cloud ARR is expected to be approximately $1.8 billion (was previously $3.9 billion and $2.0 billion respectively).

- Operating cash flow is expected to be at least $420 million (was previously $400 million).

- Free Cash flow is expected to be at least $400 million.

Conference Call and Webcast

Splunk’s executive management team will host a conference call beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss financial results and business highlights. Interested parties can register for the conference call through the following link: https://register.vevent.com/register/BIbf790aaaf90848e587b036c45117a877. Registered participants will receive an email containing conference call details with dial-in options. A live audio webcast of the conference call will also be available through Splunk’s Investor Relations website at http://investors.splunk.com/events-presentations. A webcast replay of the call will be available for the next 12 months.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk’s long-term prospects, including growth and profitability, Splunk’s guidance for revenue and non-GAAP operating margin targets for the company’s fiscal third quarter 2023 and Total ARR, Cloud ARR, revenue, non-GAAP operating margin, operating cash flow and free cash flow for the company’s fiscal year 2023; statements regarding our market opportunity, including trends in the pace of customer digital and cloud transformation; our global presence and trends in customer demand and engagement; the growth of our cloud business; our products and technologies, including the unique and unmatched level of visibility they provide; the market for data-related products and the importance of data and our ability to leverage these trends; our strategy, technology and product innovation; expectations for our industry, business and products, such as our business model, customer demand and trust, our partner relationships, customer success and feedback, expanding use of Splunk by customers, and expected benefits and scale of our products. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: risks associated with Splunk’s rapid growth, particularly outside of the United States; Splunk’s inability to realize value from its significant investments in the company’s business, including product and service innovations and through acquisitions; Splunk’s shift from sales of licenses to sales of cloud services which impacts the timing of revenue and margins; a shift from generally invoicing multi-year contracts upfront to invoicing on an annual basis, which impacts cash collections; Splunk’s transition to a multi-product software and services business; Splunk’s inability to successfully integrate acquired businesses and technologies; Splunk’s inability to service its debt obligations or other adverse effects related to the company’s convertible notes; the macroeconomic environment, including inflationary pressures and economic uncertainty; COVID-19 and related public health measures on our business and the business of our customers, as well as the impact of new variants on the overall economic environment, including customer buying capacity, urgency and patterns; and general market, political, economic, business and competitive market conditions.

Additional information on potential factors that could affect Splunk’s financial results is included in the company’s Quarterly Report on Form 10-Q for the fiscal quarter ended April 30, 2022, which is on file with the U.S. Securities and Exchange Commission (“SEC”) and Splunk’s other filings with the SEC. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

*Gartner, Inc., Market Share: All Software Markets, Worldwide 2021, Neha Gupta et al, April 12, 2022

Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s Research & Advisory organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Splunk Inc. (NASDAQ: SPLK) helps organizations around the world turn data into doing. Splunk technology is designed to investigate, monitor, analyze and act on data at any scale.

Splunk, Splunk>, Data-to-Everything and Turn Data Into Doing are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2022 Splunk Inc. All rights reserved.

Splunk Inc.

Operating Metrics

Total Annual Recurring Revenue (“Total ARR”) represents the annualized revenue run-rate of active cloud services, term license and maintenance contracts at the end of a reporting period. Cloud Annual Recurring Revenue (“Cloud ARR”) represents the annualized revenue run-rate of active cloud services contracts at the end of a reporting period. Each contract is annualized by dividing the contract value by the number of days in the contract term and then multiplying by 365.

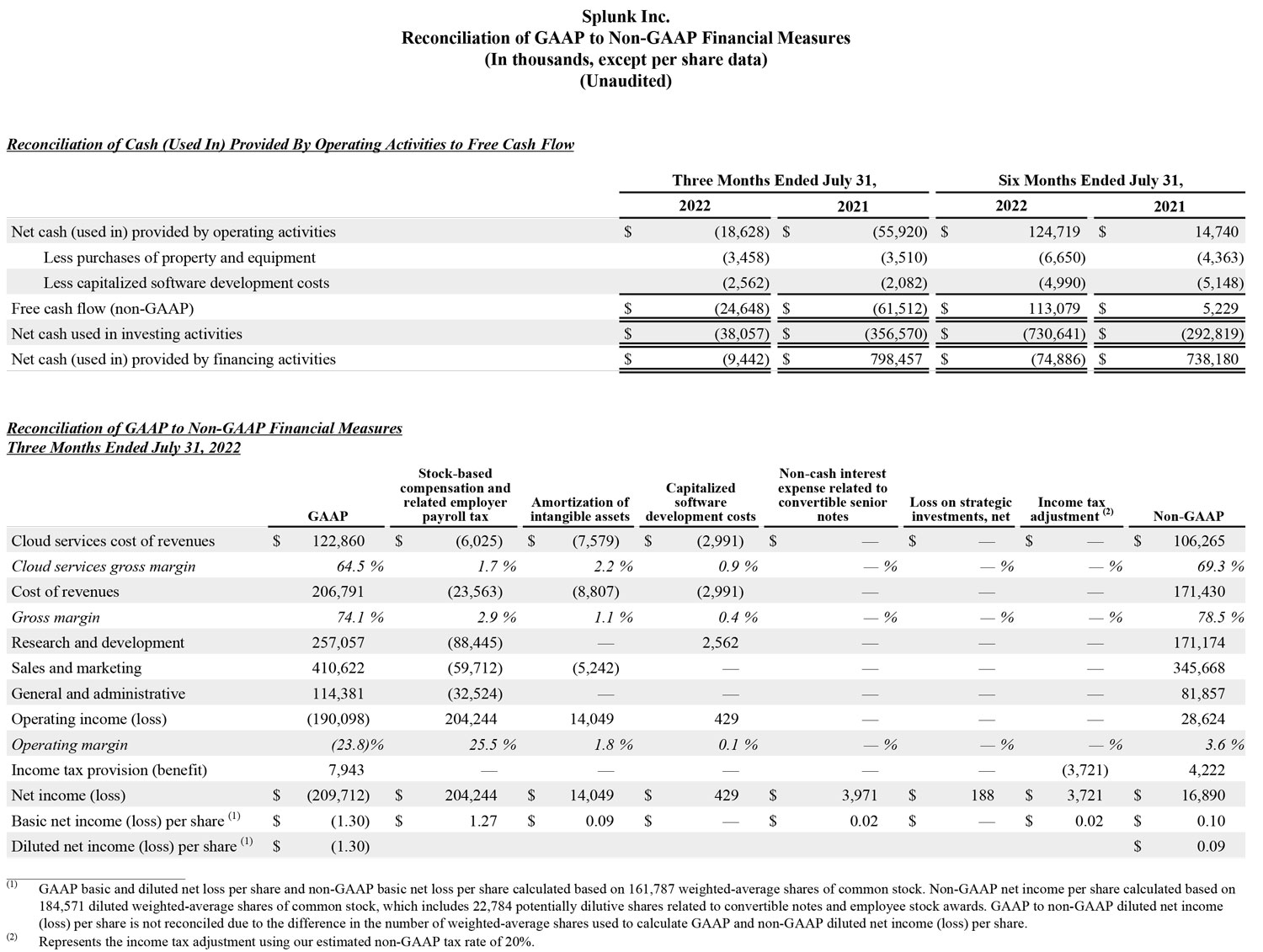

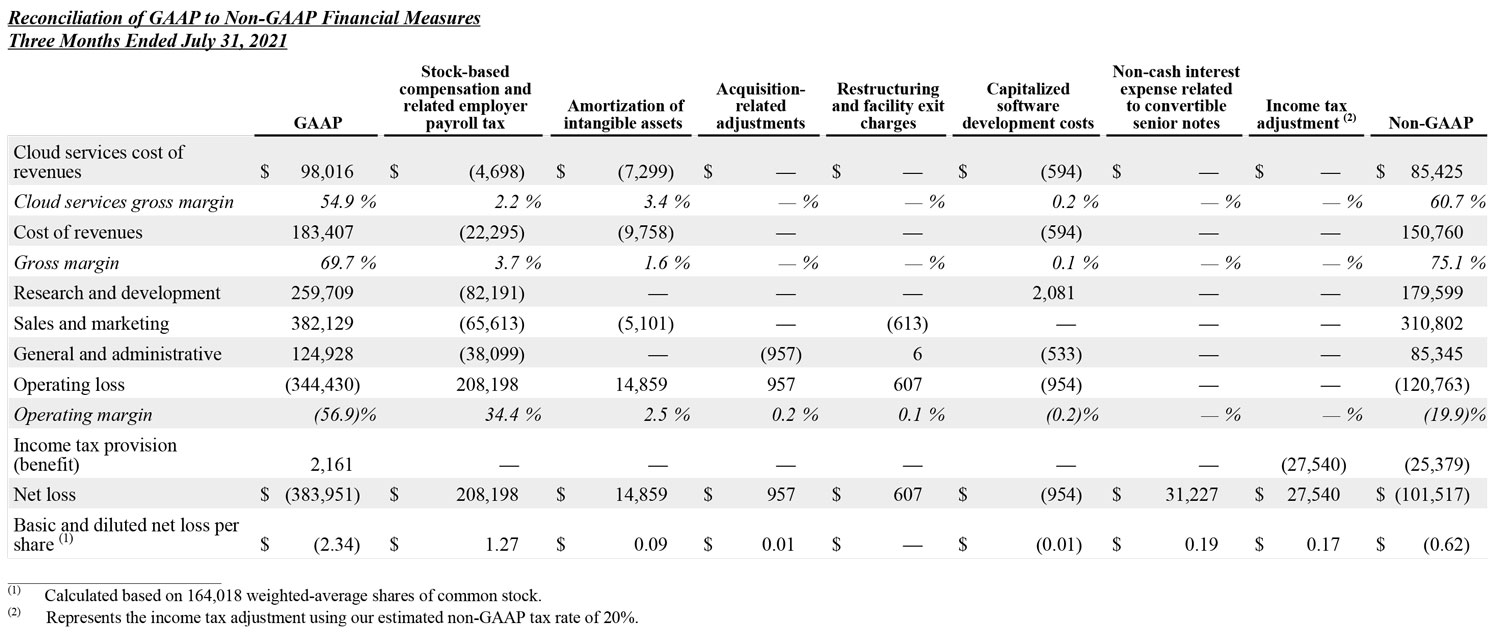

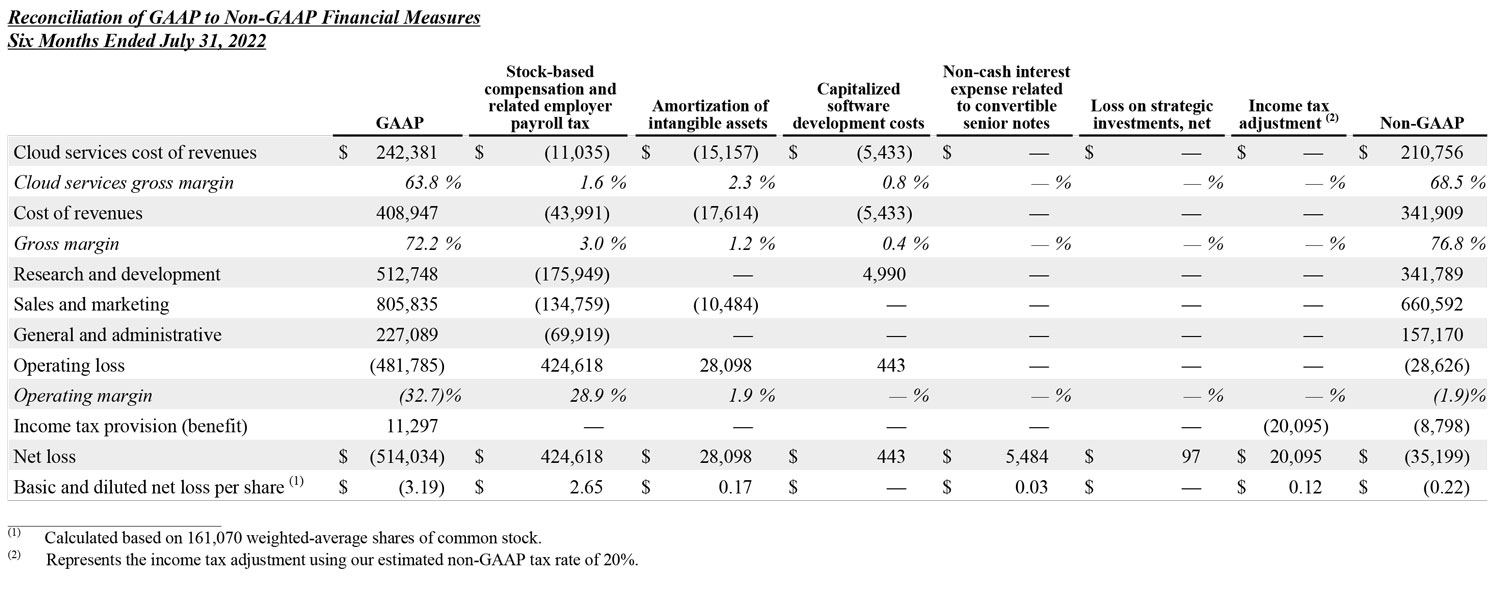

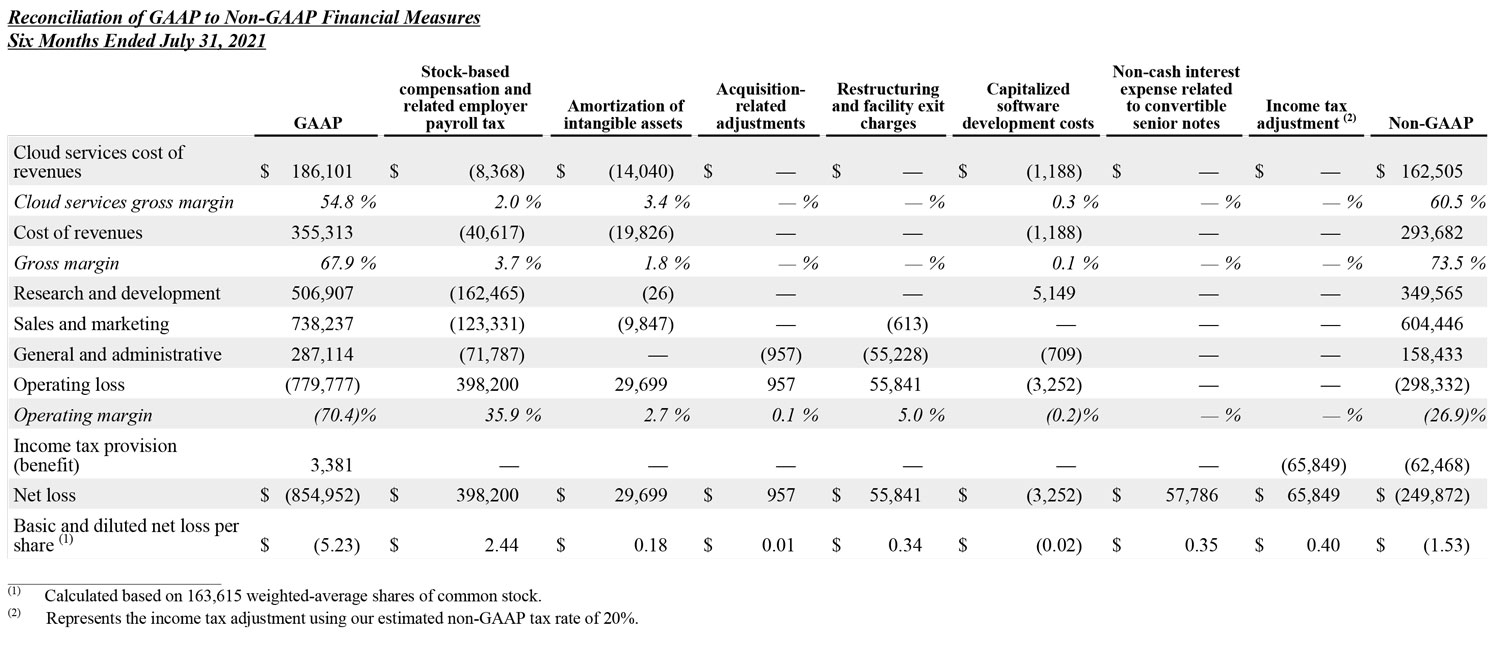

Non-GAAP Financial Measures and Reconciliations

To supplement Splunk’s condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Splunk provides investors with the following non-GAAP financial measures: cloud services cost of revenues, cloud services gross margin, cost of revenues, gross margin, research and development expense, sales and marketing expense, general and administrative expense, operating income (loss), operating margin, income tax provision (benefit), net income (loss), net income (loss) per share and free cash flow (collectively the “non-GAAP financial measures”). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation tables): expenses related to stock-based compensation and related employer payroll tax, amortization of intangible assets, acquisition-related adjustments, restructuring and facility exit charges, capitalized software development costs and non-cash interest expense related to convertible senior notes. The non-GAAP financial measures are also adjusted for Splunk's estimated tax rate on non-GAAP income (loss). To determine the estimated non-GAAP tax rate, Splunk evaluates financial projections based on its non-GAAP results and the tax effect of those projections. The estimated non-GAAP tax rate takes into account many factors including our operating structure and tax positions. The non-GAAP tax rate applied to the three and nine months ended October 31, 2021 was 20%. The applicable fiscal 2021 tax rates are noted in the reconciliations. In addition, non-GAAP financial measures include free cash flow, which represents operating cash flow less purchases of property and equipment. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated or used by the business.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk’s operational performance and allows investors the ability to make more meaningful comparisons between Splunk’s operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk’s operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk’s common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk’s business. Splunk also excludes amortization of intangible assets, acquisition-related adjustments, restructuring and facility exit charges, capitalized software development costs and non-cash interest expense related to convertible senior notes from the applicable non-GAAP financial measures because these adjustments are considered by management to be outside of Splunk’s core operating results.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk’s competitors and exclude expenses that may have a material impact upon Splunk’s reported financial results. Further, stock-based compensation expense has been and will continue to be, for the foreseeable future, a significant recurring expense in Splunk’s business and an important part of the compensation provided to Splunk’s employees. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk’s operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors’ operating results. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following tables reconcile Splunk’s GAAP results to Splunk’s non-GAAP results included in this press release.