SAN FRANCISCO – March 4, 2020 – Splunk Inc. (NASDAQ: SPLK), provider of the Data-to-Everything Platform, today announced results for its fiscal fourth quarter and full year ended January 31, 2020.

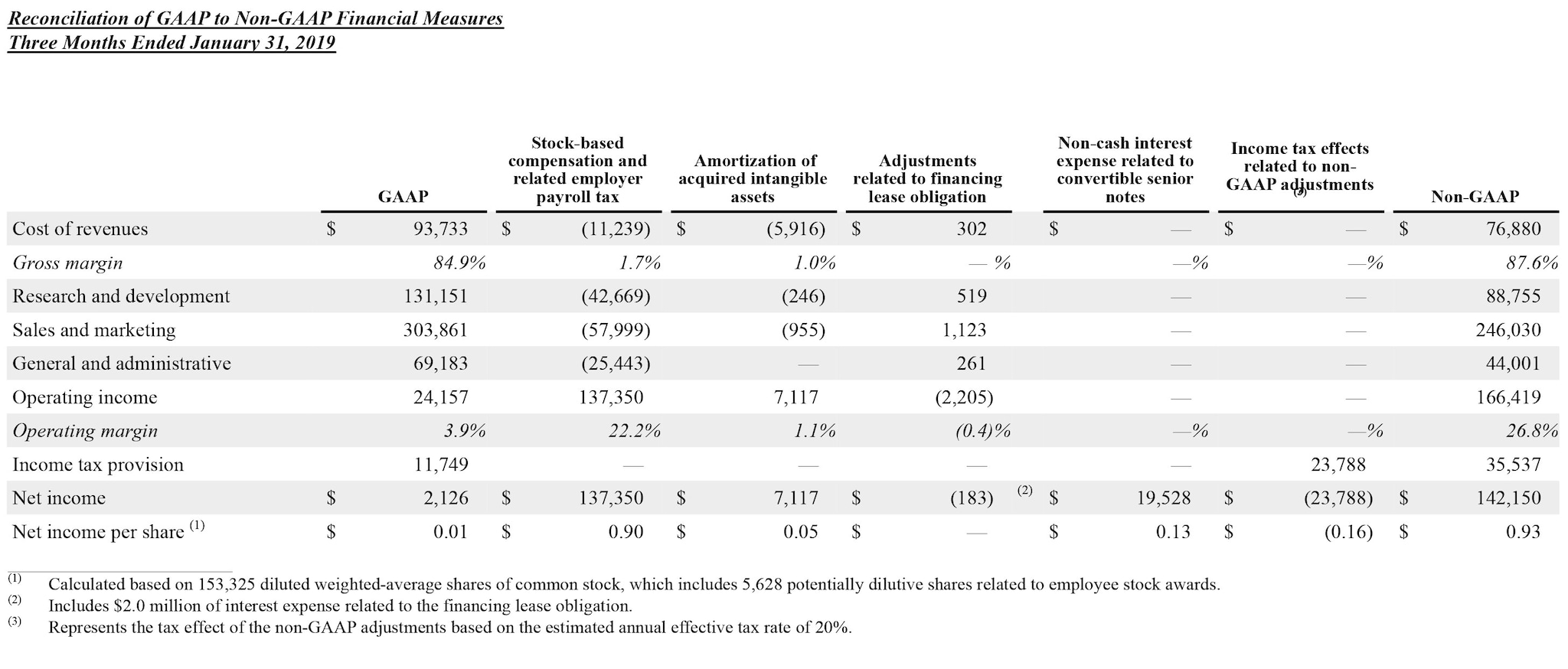

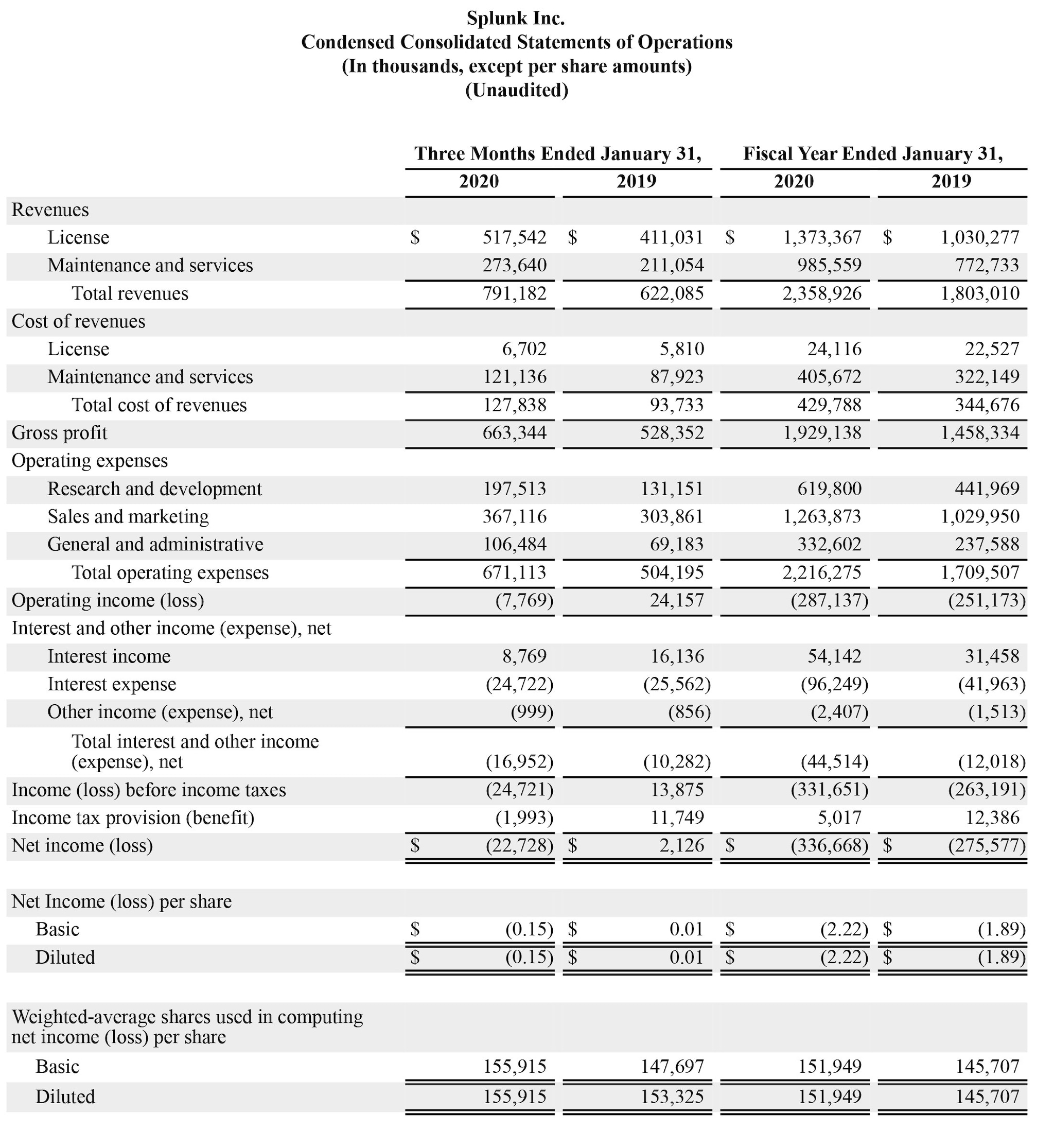

Fourth Quarter 2020 Financial Highlights

- Software revenues were $617 million, up 33% year-over-year.

- Total revenues were $791 million, up 27% year-over-year.

- GAAP operating loss was $7.8 million; GAAP operating margin was negative 1.0%.

- Non-GAAP operating income was $191 million; non-GAAP operating margin was 24.1%.

- GAAP loss per share was $0.15; non-GAAP income per share was $0.96.

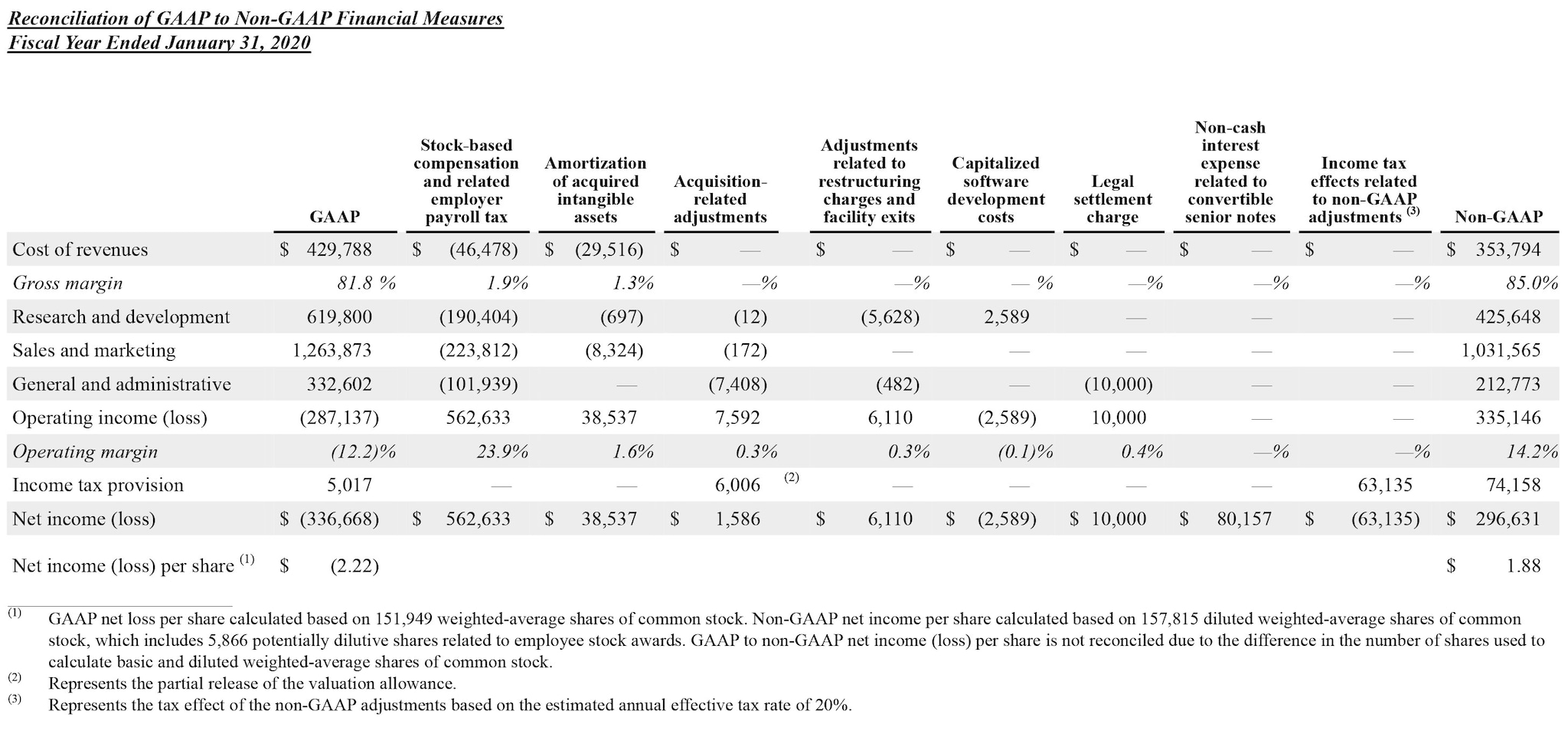

Full Year 2020 Financial Highlights

- Software revenues were $1.686 billion, up 40% year-over-year.

- Total revenues were $2.359 billion, up 31% year-over-year.

- GAAP operating loss was $287 million; GAAP operating margin was negative 12.2%.

- Non-GAAP operating income was $335 million; non-GAAP operating margin was 14.2%.

- GAAP loss per share was $2.22; non-GAAP income per share was $1.88.

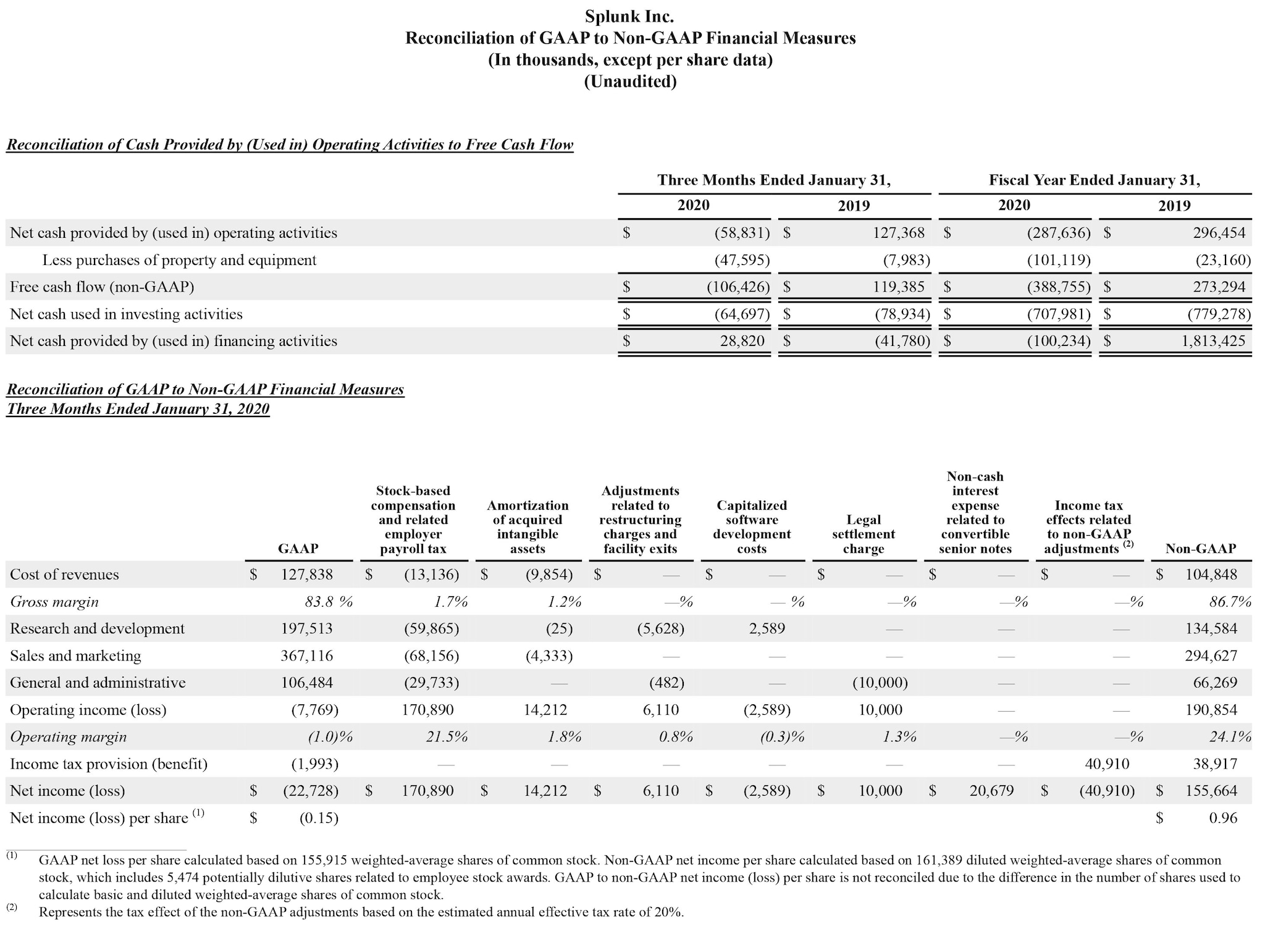

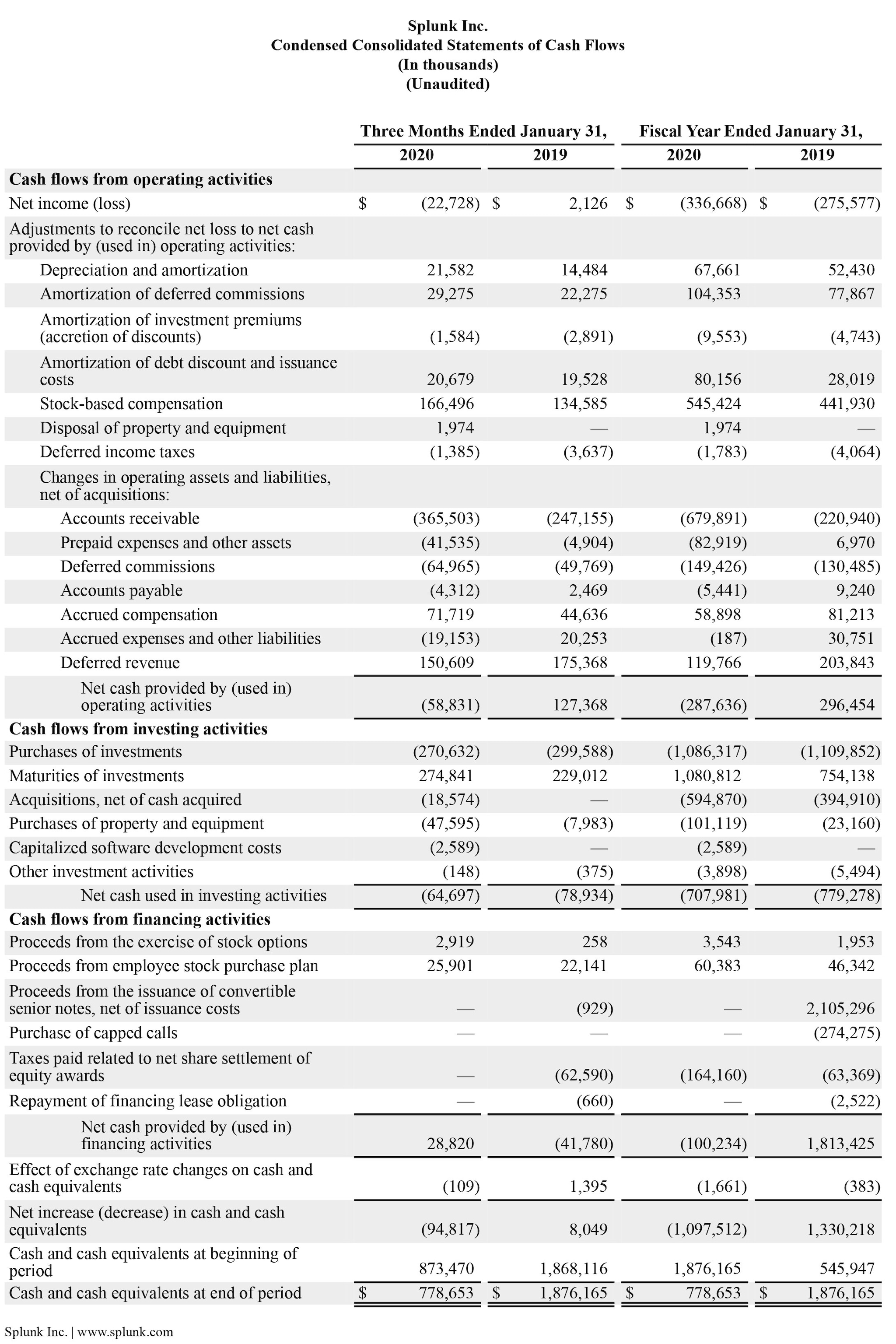

- Operating cash flow was negative $288 million with free cash flow of negative $389 million.

“This was a transformational year for Splunk. We have transitioned our business model, our product strategy and introduced new and enhanced pricing models as part of our company-wide, cloud-first approach. These shifts have provided unprecedented value to our customers by bringing Data-to-Everything,” said Doug Merritt, President and CEO, Splunk.

“As we deliver increasing value from our expanding product capabilities, customers are turning to our cloud offerings more and more. We expect our cloud products could represent more than 60% of our total software business in the next few years and during this shift, ARR is the best metric to evaluate our growth,” said Jason Child, chief financial officer, Splunk. “We grew ARR by 54% in fiscal year 2020 and are targeting a 40% ARR CAGR over the next three fiscal years.”

Customers

- Signed more than 450 new customers.

- New and Expansion Customers Include: ADT LLC, Blue Nile, Carvana, Dairy Farmers of America, Department of Industry, Innovation and Science (Australia), Discovery, Inc., FamilySearch, Mars, Inc., McLaren Racing (England), Mercari (Japan), NHS Digital (England), Nordea (Finland), Swisscom AG (Switzerland), University of California San Diego, The Washington Post

Fiscal Year 2020 & Recent Business Highlights

- Splunk Unveils The World’s First Data-to-Everything Platform: Splunk’s Data-to-Everything Platform, launched in September 2019, helps over 19,000 global customers unlock trapped value by bringing data to every question, decision and action. Powered by major new products including Splunk Data Fabric Search (DFS), Splunk Data Stream Processor (DSP) and Splunk Business Flow, the Data-to-Everything platform helps customers remove the barriers between data and action, allowing them to know what is happening within their organization and turn data into doing.

- Strategic Acquisitions Establish Splunk as a Leader in Monitoring and Observability: Splunk continued to lean into an aggressive M&A strategy, helping its customers drive business outcomes with data. Key acquisitions include SignalFx, a SaaS leader in real-time monitoring for cloud infrastructure; Omnition, a SaaS startup that is innovating in distributed tracing; and Streamlio, an open source distributed messaging leader. Each acquired technology will enhance our customers’ ability to bring together operations and development for every kind of IT organization.

- New Pricing Programs Provide Flexibility to Help Customers Deliver Business Outcomes: Splunk announced new, predictive pricing programs which facilitate long-term planning for customers and extend flexible, transparent pricing as data volumes grow. Splunk also announced new infrastructure-based pricing which allow customers to purchase Splunk based on compute power; and new “Rapid Adoption” packages, which help customers accelerate their data journey with Splunk with the most common IT and Security Operations use cases.

- World-Class Partners Help Enable Customer Success: Building on its rich partner ecosystem, Splunk continues to invest in new and expanded partnerships that help customers turn data into doing. Notable Splunk Partner+ Program agreements include those with Accenture, who offer more trained and certified Splunk resources than any partner; Cisco, who is rapidly bringing integrated Splunk solutions to market; Deloitte, who now incorporates Splunk Phantom in its Fusion Managed Services offerings; and SAP, who partners with Splunk to help customers enable the Intelligent Enterprise.

- Global Splunk Workforce Grows in Parallel with Rise of Data: Splunk is a destination workplace for employees looking to create trophy experiences in their career. Splunk opened and expanded several significant new offices around the globe, reaching nearly 6,000 global employees. Splunk also continues to be recognized as an outstanding place to work, being listed as a 2019 LinkedIn Top Company, and also a 2019 Fortune Best Workplace for Diversity and Women, as well as a 2019 Great Place to Work Best Workplace for Millennials and Parents, amongst others.

Financial Outlook

The company is providing the following guidance for its fiscal first quarter 2021 (ending April 30, 2020):

- Total revenues are expected to be approximately $450 million.

- Non-GAAP operating margin is expected to be approximately negative 25%.

The company is providing the following guidance for its fiscal year 2021 (ending January 31, 2021):

- Total revenues are expected to be approximately $2.6 billion.

- Non-GAAP operating margin is expected to be approximately breakeven.

All forward-looking non-GAAP financial measures contained in this section “Financial Outlook” exclude estimates for stock-based compensation and related employer payroll tax, acquisition-related adjustments, amortization of acquired intangible assets and capitalized software costs.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of these costs and expenses that may be incurred in the future. The company has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fiscal fourth quarter and full year 2020 non-GAAP results included in this press release.

Conference Call and Webcast

Splunk’s executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company’s financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk’s Investor Relations website at http://investors.splunk.com/events-presentations. A replay of the call will be available through March 11, 2020 by dialing (855) 859-2056 and referencing Conference ID 2863284.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk’s revenue and non-GAAP operating margin targets for the company’s fiscal first quarter and fiscal year 2021 in the paragraphs under “Financial Outlook” above and other statements regarding our market opportunity, the market for data-related products, future growth and related targets, including our cloud software business mix, momentum, strategy, technology and product innovation, expectations for our industry and business, including our business model, customer demand, customer success and feedback, expanding use of Splunk by customers, our acquisitions and acquisition strategy, and expected benefits and scale of our products and pricing strategy. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: risks associated with Splunk’s rapid growth, particularly outside of the United States; Splunk’s inability to realize value from its significant investments in its business, including product and service innovations and through acquisitions; Splunk’s shift from sales of perpetual licenses in favor of sales of term licenses and subscription agreements for our cloud services; Splunk’s transition to a multi-product software and services business; Splunk’s inability to successfully integrate acquired businesses and technologies; Splunk’s inability to service its debt obligations or other adverse effects related to our convertible notes; and general market, political, economic, business and competitive market conditions.

Additional information on potential factors that could affect Splunk’s financial results is included in the company’s Quarterly Report on Form 10-Q for the fiscal quarter ended October 31, 2019, which is on file with the U.S. Securities and Exchange Commission (“SEC”) and Splunk’s other filings with the SEC. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) turns data into doing with the Data-to-Everything Platform. Splunk technology is designed to investigate, monitor, analyze and act on data at any scale.

Splunk, Splunk>, Data-to-Everything, D2E and Turn Data Into Doing are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2020 Splunk Inc. All rights reserved.

Splunk Inc.

Operating Metrics

Total Annual Recurring Revenue (“ARR”) represents the annualized revenue run-rate of active subscription, term license, and maintenance contracts at the end of a reporting period. Contracts are annualized by dividing the total contract value by the number of days in the contract term and then multiplying by 365.

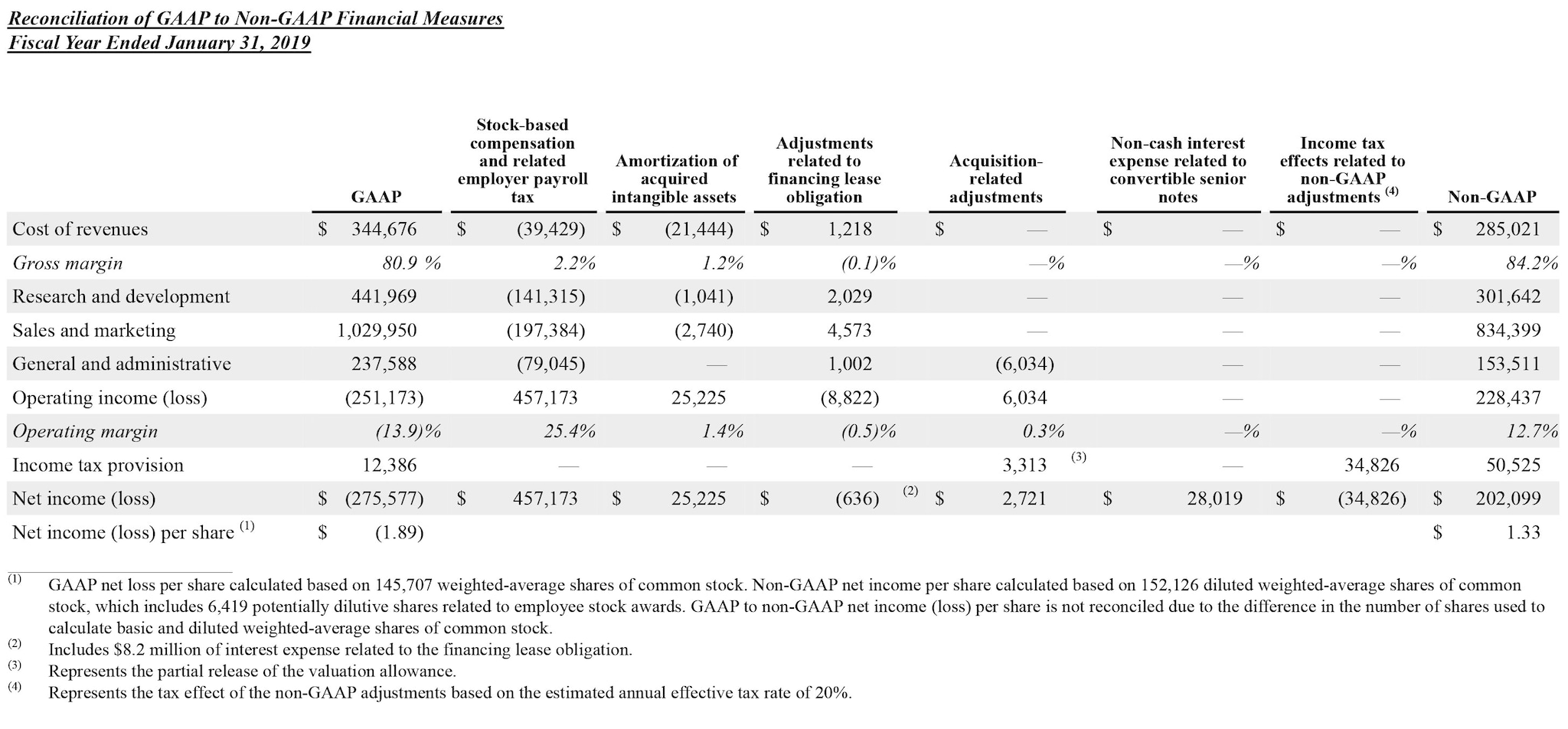

Non-GAAP Financial Measures and Reconciliations

To supplement Splunk’s condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Splunk provides investors with the following non-GAAP financial measures: cost of revenues, gross margin, research and development expense, sales and marketing expense, general and administrative expense, operating income (loss), operating margin, income tax provision (benefit), net income (loss), net income (loss) per share and free cash flow (collectively the “non-GAAP financial measures”). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation tables): expenses related to stock-based compensation and related employer payroll tax, amortization of acquired intangible assets, adjustments related to a financing lease obligation, acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions, adjustments related to restructuring charges and facility exits, capitalized software development costs, a legal settlement charge and non-cash interest expense related to convertible senior notes that were issued in the fiscal third quarter of 2019. The adjustments for the financing lease obligation are to reflect the expense Splunk would have recorded if its build-to-suit lease arrangement had been deemed an operating lease instead of a financing lease and is calculated as the net of actual ground lease expense, depreciation and interest expense over estimated straight-line rent expense. The non-GAAP financial measures are also adjusted for Splunk's estimated tax rate on non-GAAP income (loss). To determine the annual non-GAAP tax rate, Splunk evaluates a financial projection based on its non-GAAP results. The annual non-GAAP tax rate takes into account other factors including Splunk's current operating structure, its existing tax positions in various jurisdictions and key legislation in major jurisdictions where Splunk operates. The non-GAAP tax rate applied to the three and twelve months ended January 31, 2020 was 20%. Splunk provides updates to this rate on an annual basis, or more frequently if material changes occur. The applicable fiscal 2019 tax rates are noted in the reconciliations. In addition, non-GAAP financial measures include free cash flow, which represents cash from operations less purchases of property and equipment. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk’s operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors’ operating results.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk’s operational performance and allows investors the ability to make more meaningful comparisons between Splunk’s operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk’s operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk’s common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk’s business. Splunk also excludes amortization of acquired intangible assets, adjustments related to a financing lease obligation, acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions, adjustments related to restructuring charges and facility exits, capitalized software development costs, a legal settlement charge and non-cash interest expense related to convertible senior notes from the applicable non-GAAP financial measures because these expenses are considered by management to be outside of Splunk’s core operating results. Accordingly, Splunk believes that excluding these expenses provides investors and management with greater visibility to the underlying performance of its business operations, facilitates comparison of its results with other periods and may also facilitate comparison with the results of other companies in its industry. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in its business, making strategic acquisitions and strengthening its balance sheet.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk’s competitors and exclude expenses that may have a material impact upon Splunk’s reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in Splunk’s business and an important part of the compensation provided to Splunk’s employees. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following tables reconcile Splunk’s GAAP results to Splunk’s non-GAAP results included in this press release.