SAN FRANCISCO – May 21, 2020 – Splunk Inc. (NASDAQ: SPLK), provider of the Data-to-Everything Platform, today announced results for its fiscal first quarter ended April 30, 2020.

First Quarter 2021 Financial Highlights

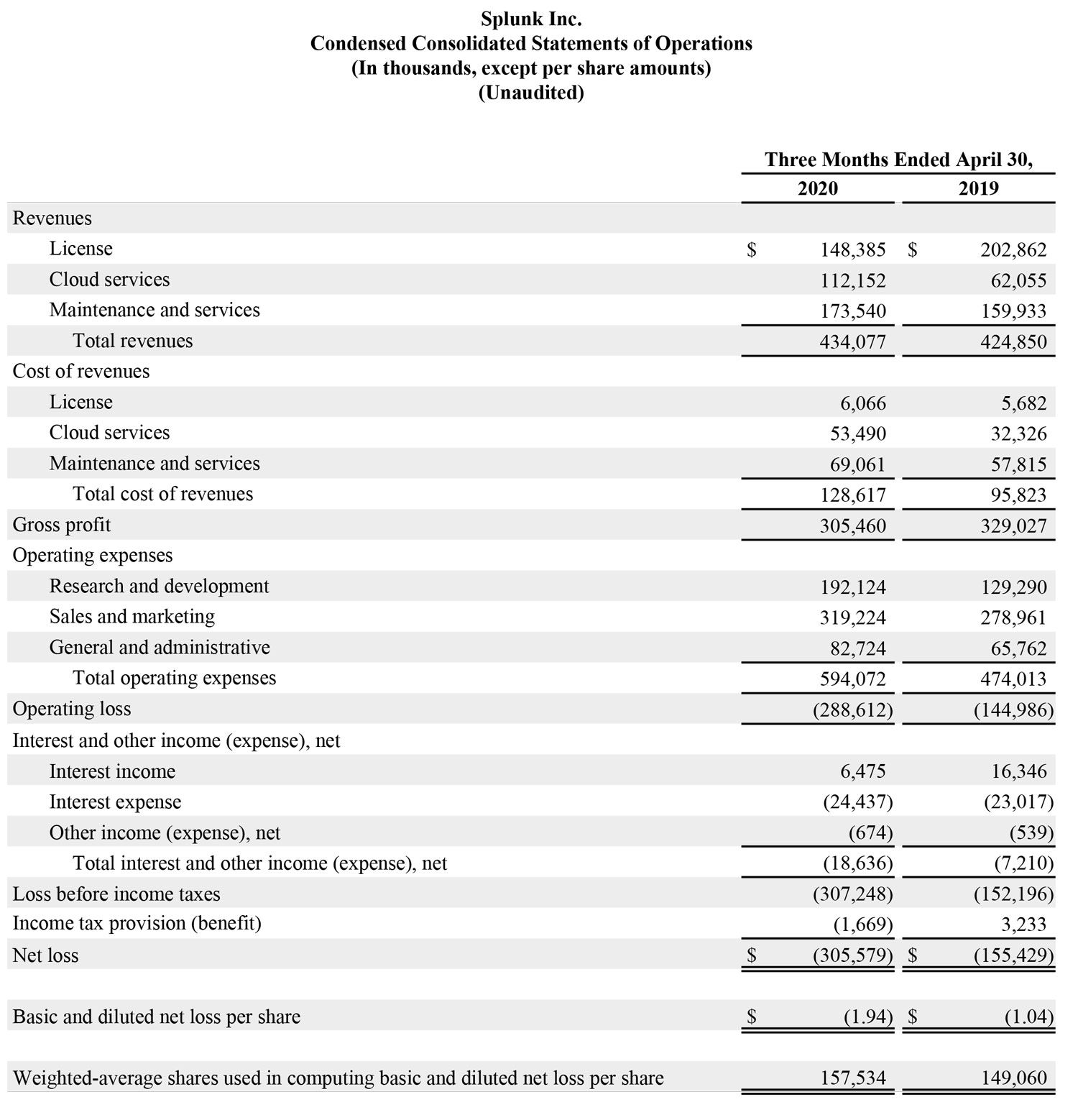

- ARR was $1.775 billion, up 52% year-over-year.

- Cloud revenue was $112 million, up 81% year-over-year.

- Total revenues were $434 million, up 2% year-over-year.

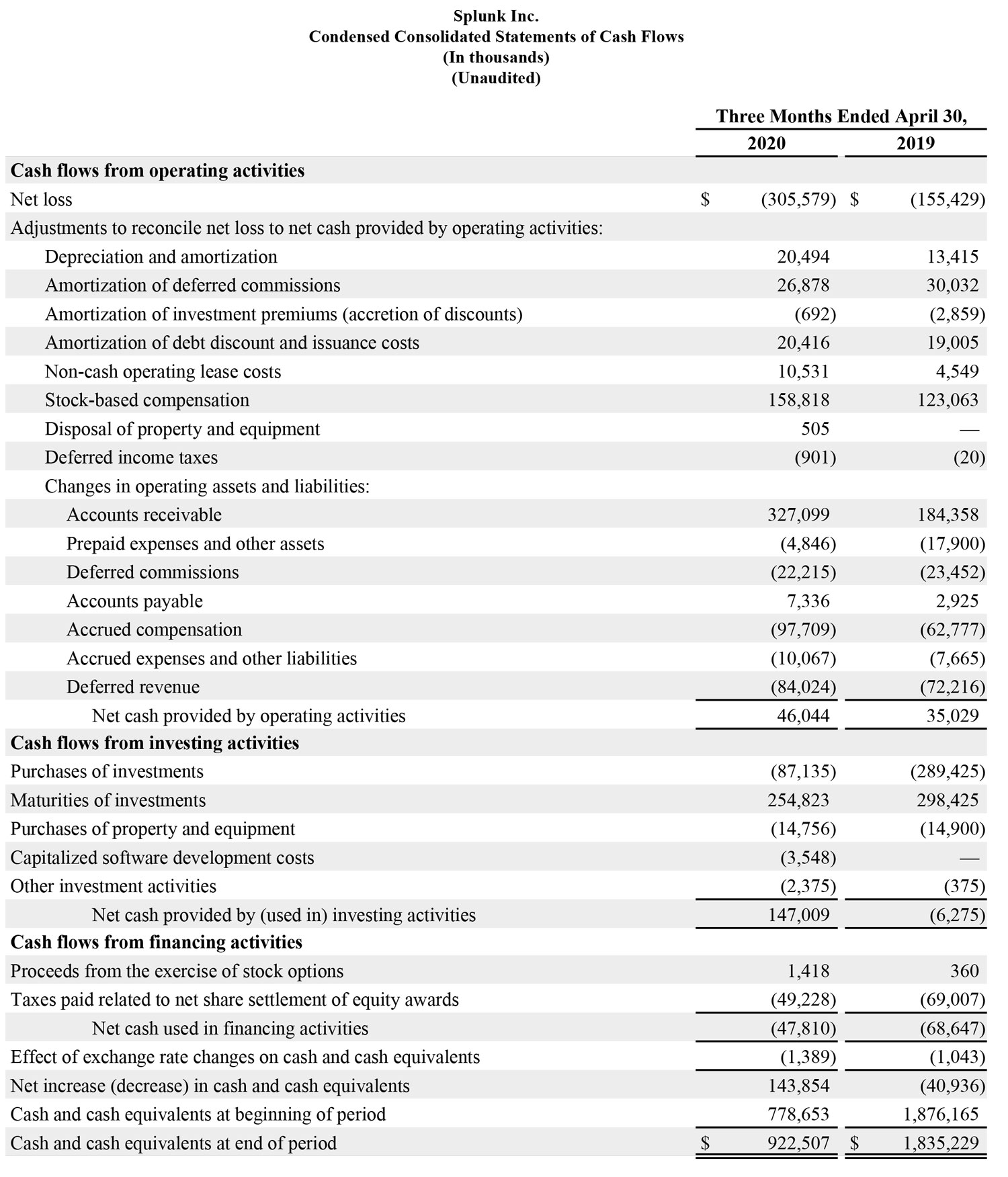

- GAAP loss per share was $1.94; non-GAAP loss per share was $0.56.

“COVID-19 has transformed the world into one that requires rapidly accelerated digital transformation to keep organizations moving - we are seeing some resilient customers complete three-to-five year projects in just months. As customers continue to adapt to this new normal, data matters more than ever, evidenced by our continued strong momentum this quarter,” said Doug Merritt, President and CEO, Splunk. “Data helps save lives. Data reimagines business. I’m extremely proud of our team’s product vision and tenacity as we help our customers bring data to COVID-19 response and help get the world back to work.”

“Our shift to a SaaS model is accelerating with cloud driving nearly half of total software bookings in the quarter with ARR growing 52% year over year,” said Jason Child, chief financial officer, Splunk. “We are also thrilled to have been recently added to the Fortune 1000, which is monumental recognition for a software company and a testament to the importance of data in today’s world.”

Recent Business Highlights:

New and Expansion Customers Include: Allied Irish Bank (Ireland), Autodesk, Experian, Hitachi Capital (England), Kayak, Mount Sinai Health System, Santander Bank (Spain), Shopify, State of Illinois, Statkraft (Norway), Square Enix (Japan), Take-Two Interactive Software, TD Ameritrade, Transurban (Australia), Zoom

- Splunk Helps Bring Data to COVID-19 Response: Splunk is focused on supporting its customers, partners, employees and communities throughout COVID-19. To help address new challenges facing every business, Splunk released a series of free, downloadable resources including Splunk Remote Work Insights, which helps organizations take action on data, gain real-time visibility across disparate systems, and maintain workforce productivity and high performance of critical business activities.

- Splunk & Coalition Launches COVID-19 Testing and Data Response Platform: Splunk, along with Accenture, Adobe, Oracle, NuHarbor Security, DataHouse, Globant, Whyline and the nonprofit Alliance for Innovation, announced the release of the COVID-19 Testing and Data Response Platform. The free platform provides an end-to-end COVID-19 test management process, including online COVID-19 risk screening and critical symptom evaluation, test scheduling, test site management and data analytics and dashboarding for use by public health officials. The platform is now in use in its pilot jurisdiction, Tarrant County, TX.

- New DevOps Solutions Help Customers Unlock Real-Time Observability: Splunk continues to bring DevOps value to customers, recently announcing the newest version of SignalFx Microservices APM. The only application performance monitoring solution that provides complete observability into modern, cloud-native environments, SignalFx helps produce meaningful business outcomes regardless of scale.

- Splunk & Google Cloud Turn Data Into Doing: Splunk’s robust partner ecosystem continues to grow, with the company announcing a new, strategic partnership with Google Cloud. The partnership will bring Splunk Cloud to Google Cloud, allowing customers to unlock the value of their data, drive actionable insights and enable fast decisions across the enterprise.

- Splunk & AWS Help Customers Bring Data to Everything: Splunk continues to strengthen its strategic relationship with AWS, working across product, go-to-market and the field. Recently, Splunk and AWS launched the Workload Migration Program to help migrate on-premises legacy Splunk Enterprise workloads to Splunk Cloud running on AWS. Splunk and AWS also announced the newly launched AWS Service Ready program, Lambda Ready, which recognizes Splunk’s proven solutions for customers to build, manage and run serverless applications.

- Splunk Achieves #1 Market Share According to Gartner: Splunk earned the No. 1 market share for Performance Analysis in the AIOps, ITIM and Other Monitoring Tools subsegment according to Gartner’s Market Share: Enterprise Infrastructure Software, Worldwide, 2019. According to the report, Splunk is ranked No. 1 with 16.5% market share. Gartner’s Market Share: Security Software, Worldwide, 2019 report also recognized Splunk as the No. 1 market share vendor for Security Software subsegment, Security Information Event Management (SIEM). In the report, Splunk is ranked No. 1 with 26% market share. **Gartner, Market Share: Enterprise Infrastructure Software, Worldwide, 2019, April 2020

Financial Outlook

The company is providing the following guidance for its fiscal second quarter 2021 (ending July 31, 2020):

- Total revenues are expected to be approximately $520 million.

- Non-GAAP operating margin is expected to be between negative 10% and negative 15%.

The company is withdrawing its previous guidance for its fiscal year 2021 (ending January 31, 2021).

All forward-looking non-GAAP financial measures contained in this section “Financial Outlook” exclude estimates for stock-based compensation and related employer payroll tax, acquisition-related adjustments, amortization of acquired intangible assets and capitalized software costs.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of these costs and expenses that may be incurred in the future. The company has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fiscal first quarter 2021 non-GAAP results included in this press release.

Conference Call and Webcast

Splunk’s executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company’s financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk’s Investor Relations website at http://investors.splunk.com/events-presentations. A replay of the call will be available through May 28, 2020 by dialing (855) 859-2056 and referencing Conference ID 5894108.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk’s revenue and non-GAAP operating margin targets for the company’s fiscal second quarter in the paragraphs under “Financial Outlook” above and other statements regarding our market opportunity, including the impact of COVID-19 on the business environment, including the pace of customer digital transformation and the growing importance of data, the market for data-related products and trends in this market, future growth and related targets, including trends in our cloud software business mix, momentum, strategy, technology and product innovation, expectations for our industry and business, including our business model, customer demand, our partner relationships, customer success and feedback, expanding use of Splunk by customers, and expected benefits and scale of our products. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: risks associated with Splunk’s rapid growth, particularly outside of the United States; Splunk’s inability to realize value from its significant investments in its business, including product and service innovations and through acquisitions; Splunk’s shift from sales of perpetual licenses in favor of sales of term licenses and subscription agreements for our cloud services which impact the timing of revenue, cash collections and margins; Splunk’s transition to a multi-product software and services business; Splunk’s inability to successfully integrate acquired businesses and technologies; Splunk’s inability to service its debt obligations or other adverse effects related to our convertible notes; the impact of COVID-19 and the responses of government and private industry thereto, as well as the impact of COVID-19 on the overall economic environment; and general market, political, economic, business and competitive market conditions.

Additional information on potential factors that could affect Splunk’s financial results is included in the company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2020, which is on file with the U.S. Securities and Exchange Commission (“SEC”) and Splunk’s other filings with the SEC. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) turns data into doing with the Data-to-Everything Platform. Splunk technology is designed to investigate, monitor, analyze and act on data at any scale.

Splunk, Splunk>, Data-to-Everything, D2E and Turn Data Into Doing are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2020 Splunk Inc. All rights reserved.

Splunk Inc.

Operating Metrics

Total Annual Recurring Revenue (“ARR”) represents the annualized revenue run-rate of active subscription, term license, and maintenance contracts at the end of a reporting period. Contracts are annualized by dividing the total contract value by the number of days in the contract term and then multiplying by 365.

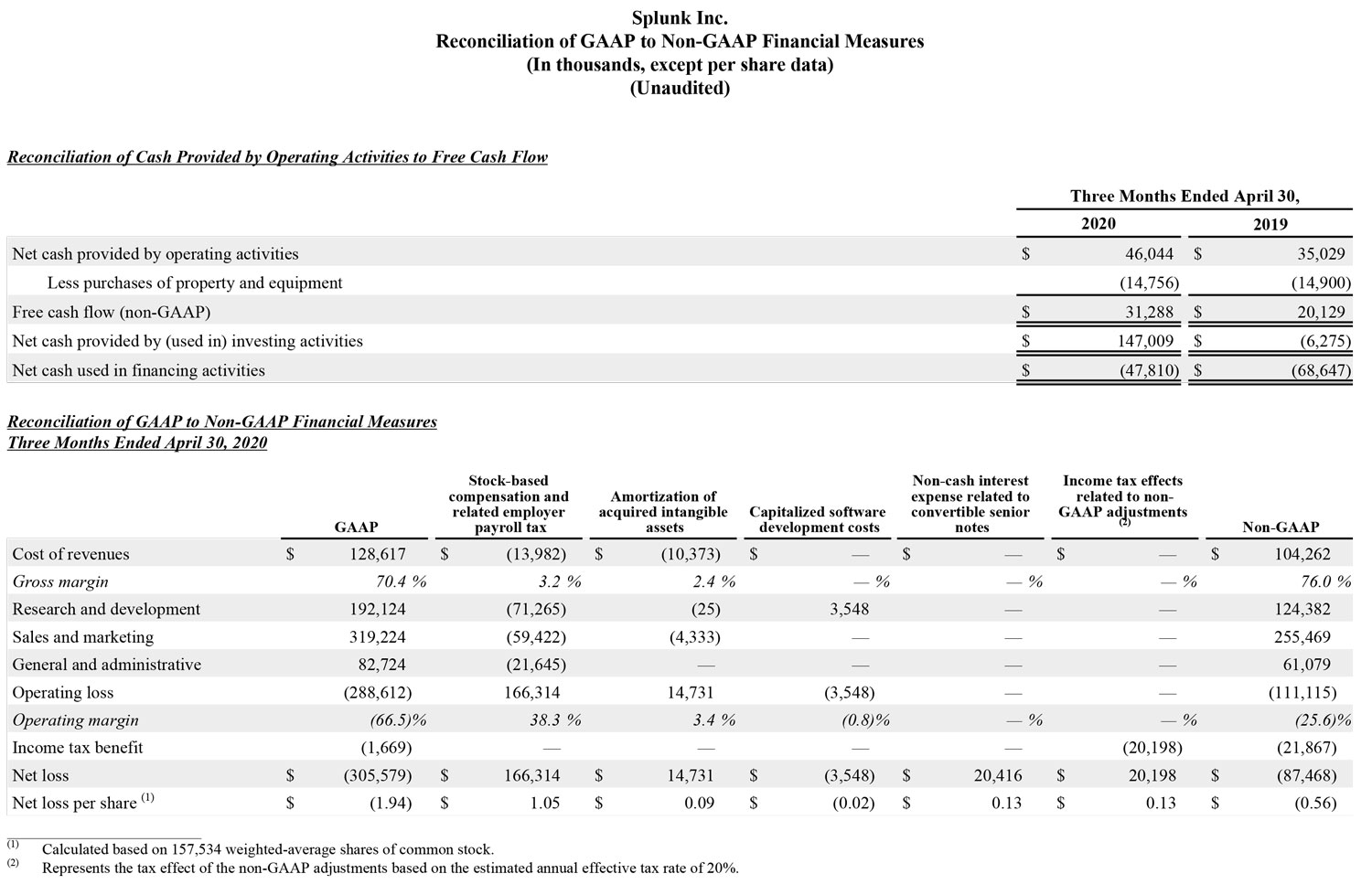

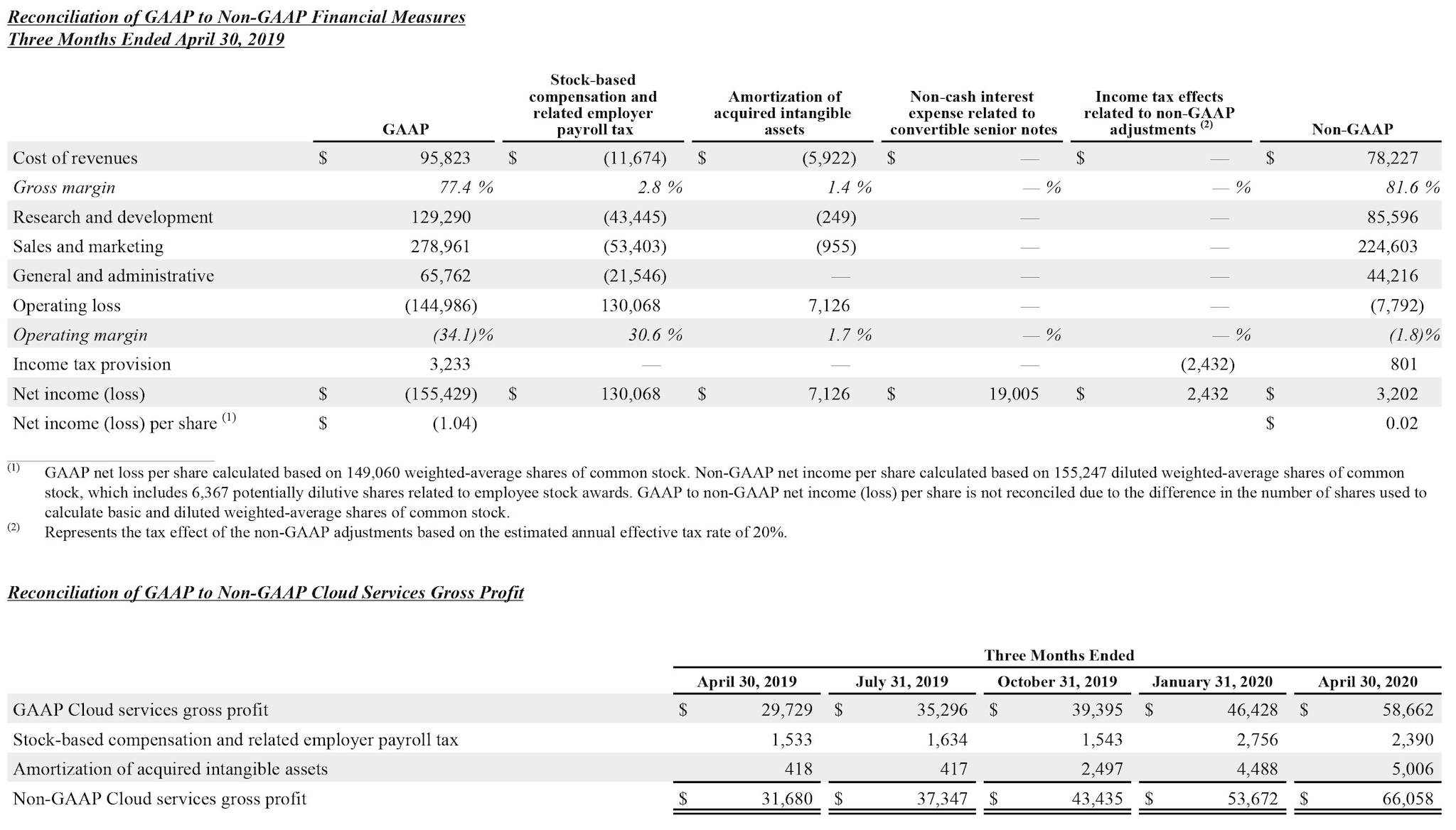

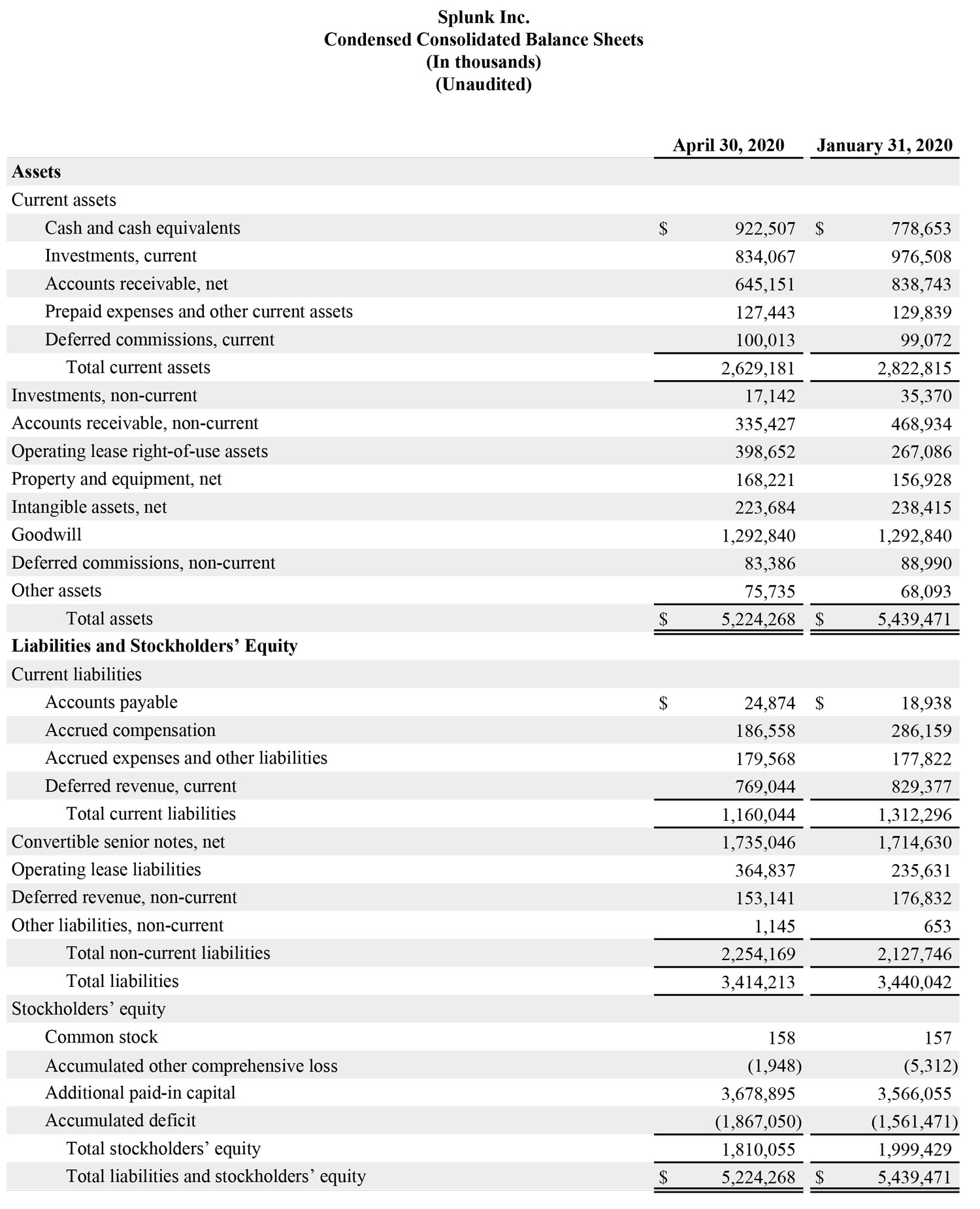

Non-GAAP Financial Measures and Reconciliations

To supplement Splunk’s condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Splunk provides investors with the following non-GAAP financial measures: cost of revenues, cloud services gross profit, gross margin, research and development expense, sales and marketing expense, general and administrative expense, operating income (loss), operating margin, income tax provision (benefit), net income (loss), net income (loss) per share and free cash flow (collectively the “non-GAAP financial measures”). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation tables): expenses related to stock-based compensation and related employer payroll tax, amortization of acquired intangible assets, acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions, capitalized software development costs and non-cash interest expense related to convertible senior notes that were issued in the third quarter of fiscal 2019. The non-GAAP financial measures are also adjusted for Splunk's estimated tax rate on non-GAAP income (loss). To determine the annual non-GAAP tax rate, Splunk evaluates a financial projection based on its non-GAAP results. The annual non-GAAP tax rate takes into account other factors including Splunk's current operating structure, its existing tax positions in various jurisdictions and key legislation in major jurisdictions where Splunk operates. The non-GAAP tax rate applied to the three months ended April 30, 2020 was 20%. Splunk provides updates to this rate on an annual basis, or more frequently if material changes occur. The applicable fiscal 2020 tax rates are noted in the reconciliations. In addition, non-GAAP financial measures include free cash flow, which represents operating cash flow less purchases of property and equipment. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated or used by the business.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk’s operational performance and allows investors the ability to make more meaningful comparisons between Splunk’s operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk’s operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk’s common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk’s business. Splunk also excludes amortization of acquired intangible assets, adjustments related to a financing lease obligation, acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions, adjustments related to restructuring charges and facility exits, capitalized software development costs, a legal settlement charge and non-cash interest expense related to convertible senior notes from the applicable non-GAAP financial measures because these expenses are considered by management to be outside of Splunk’s core operating results.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk’s competitors and exclude expenses that may have a material impact upon Splunk’s reported financial results. Further, stock-based compensation expense has been and will continue to be, for the foreseeable future, a significant recurring expense in Splunk’s business and an important part of the compensation provided to Splunk’s employees. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk’s operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors’ operating results. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following tables reconcile Splunk’s GAAP results to Splunk’s non-GAAP results included in this press release.