SAN FRANCISCO – November 29, 2018 – Splunk Inc. (NASDAQ: SPLK), delivering actions and outcomes from the world of data, today announced results for its fiscal third quarter ended October 31, 2018.

Third Quarter 2019 Financial Highlights

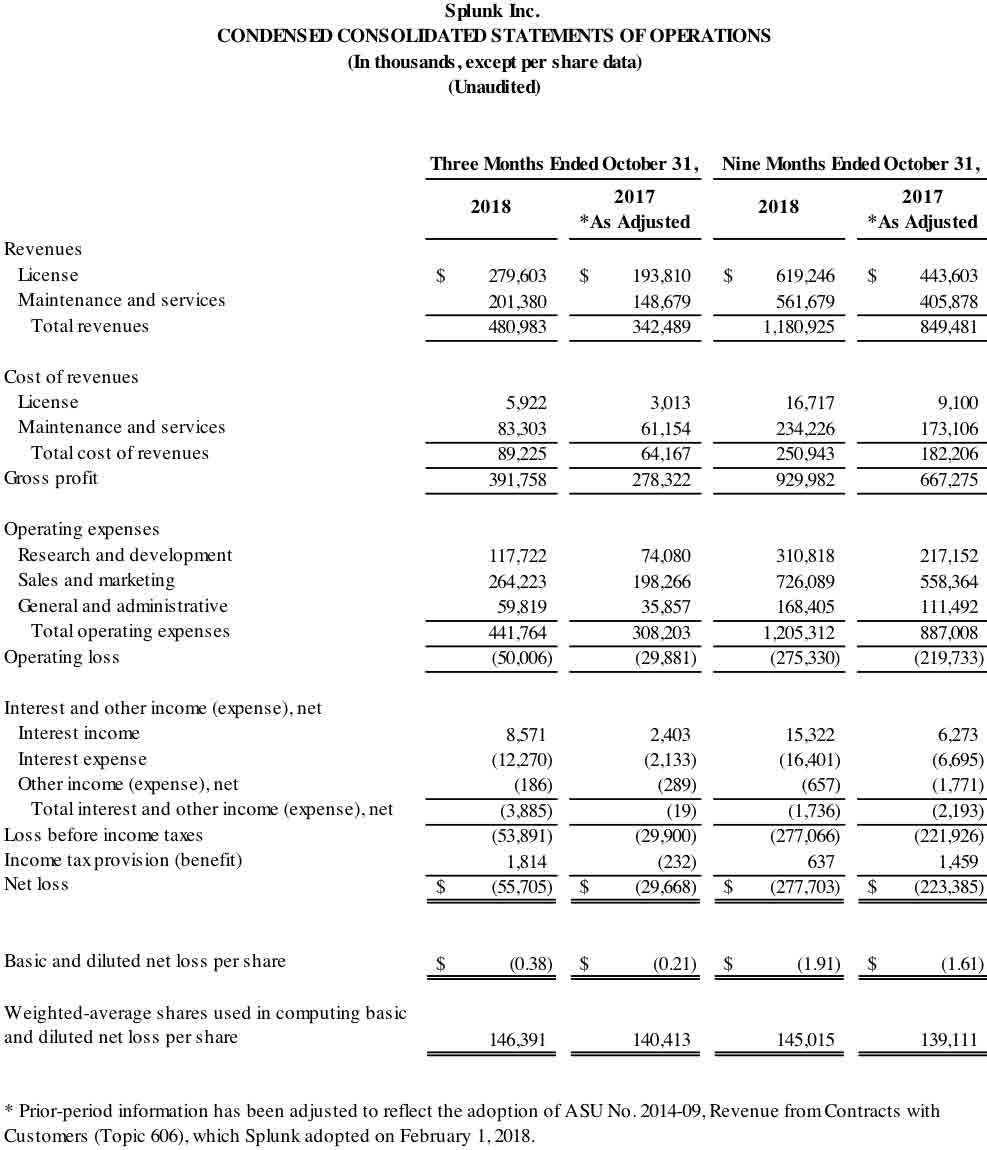

- Software revenues were $325 million, up 49% year-over-year.

- Total revenues were $481 million, up 40% year-over-year.

- GAAP operating loss was $50 million; GAAP operating margin was negative 10.4%.

- Non-GAAP operating income was $65.4 million; non-GAAP operating margin was 13.6%.

- GAAP loss per share was $0.38; non-GAAP income per share was $0.38.

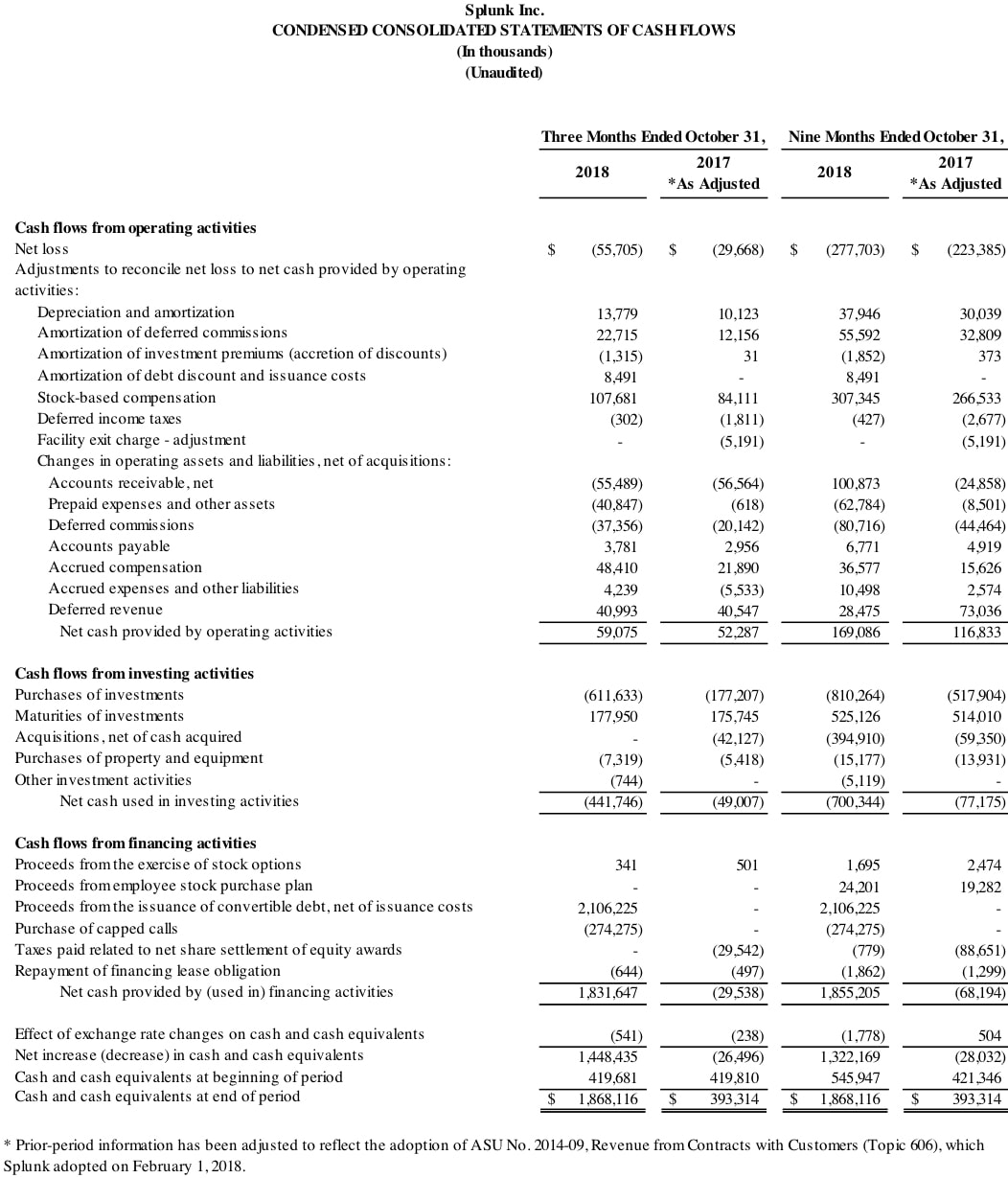

- Operating cash flow was $59.1 million with free cash flow of $51.8 million.

“The strength of our results is a testament to Splunk’s pioneering innovation and the rising demand for data-driven insights across all industries,” said Doug Merritt, President and CEO, Splunk. “At .conf18, we announced the largest wave of product innovation in our history, unveiled Splunk Next - our vision to take Splunk beyond IT and security at scale, and released our first Internet of Things product, Splunk for Industrial IoT. Customer feedback is overwhelmingly positive, and Splunk is positioned to continue to lead through this data revolution.”

CFO Future Retirement

Dave Conte has decided to retire in March 2020, after what will be more than eight years with Splunk. Conte will remain CFO until a successor is named and will facilitate a smooth transition. Splunk will initiate a search to identify the company’s next CFO.

“I speak for all us at Splunk when I say it has been an honor to work alongside Dave, who is an invaluable partner to the company and me,” said Merritt. “Dave has been instrumental in helping us grow from $120 million at the time of our IPO to over $2 billion in expected revenue next year and in building our high growth culture.”

“After so many years with the company, I’m proud of everything we’ve accomplished including transforming our business model to one that is primarily renewable on our way to delivering more than $2 billion in revenue,” said Conte. “Splunk has never been better positioned for success, and I’m looking forward to continuing our execution over the next year.”

Third Quarter 2019 and Recent Business Highlights:

Customers:

- Signed more than 500 new enterprise customers.

- New and Expansion Customers Include: ATB Financial (Canada), Chicago Public Schools, City of Austin, Clemson University, Department of Home Affairs (Australia), Fleetcor Technologies, GVB (Netherlands), Jabil, Norfolk Southern, Paddy Power Betfair (Ireland), Randstad (Netherlands), Softbank (Japan), SundaySky (Israel), Teachers Mutual Bank (Australia), University of Portsmouth (UK), Vanderbilt University Medical Center

Products:

- Announced the general availability of Splunk Enterprise 7.2 and a new version of Splunk Cloud, which make it easier to ask questions, take precise actions and drive meaningful business outcomes with data no matter where it lives.

- Announced Splunk Next, a continually evolving series of visionary beta technologies that brings the power of Splunk to more data sources and more people. Splunk Next includes Splunk Data Stream Processor, Splunk Data Fabric Search, Splunk Mobile, Splunk Developer Cloud, Splunk Natural Language, Splunk Augmented Reality and Splunk TV.

- Announced the general availability of Splunk for Industrial IoT, Splunk’s first product for the Internet of Things, to help industrial organizations minimize downtime, shift operations from reactive to proactive and save money.

- Released new versions across the security portfolio including; Splunk Enterprise Security 5.2 which introduces event sequencing and a new use case library to accelerate investigations; Splunk User Behavior Analytics 4.2, which includes new anomaly scoring rules to improve insider threat detection models; and Splunk Phantom 4.0, which includes clustering support to improve scale and an indicator view to give analysts a threat intelligence-centered view for investigations.

- Announced the general availability of Splunk ITSI 4.0 to help IT Operations teams better predict and prevent problems with machine learning.

- Announced integrations with Amazon Web Services (AWS) Security Hub, released a new integration with AWS Web Access Firewall, and made it easier to ingest AWS data into Splunk solutions via Trumpet.

Recognition:

- Named to Forbes Digital 100 list, ranking #9 in the top 100 public companies that are shaping the digital economy.

- Recognized by IDC’s ‘Worldwide IT Operations Management Software Market Shares, 2017: Hybrid Management Drives Growth’ report as the fastest growing vendor in the IT Operations market.

- Recognized by Gartner’s ‘Market Share Analysis: ITOM, Performance Analysis Software, Worldwide, 2017’ report as #2 in the AIOps/ITIM/Other Monitoring Tools category for the second year in a row.

- Recognized as gaining network security market share “at the expense of SIEM vendors” in IDC’s ‘Worldwide Security and Vulnerability Management Market Shares 2017: Defending the Boundaryless Network’ report.

Appointments:

- Appointed Lenny Stein to the newly created position of Senior Vice President of Global Affairs.

- Appointed Scott Morgan to General Counsel and Secretary.

- Appointed Jake Loomis to the newly created position of Chief Digital Officer.

Financial Outlook

The company is providing the following guidance for its fiscal fourth quarter 2019 (ending January 31, 2019):

- Total revenues are expected to be approximately $560 million.

- Non-GAAP operating margin is expected to be between 25% and 26%.

The company is updating its previous guidance provided on August 23, 2018 for its fiscal year 2019 (ending January 31, 2019):

- Total revenues are expected to be approximately $1.740 billion (was approximately $1.685 billion).

- Non-GAAP operating margin is expected to be between 11.5% and 12.0% (was approximately 11.5%).

The company is updating its previous guidance for its fiscal year 2020 (ending January 31, 2020):

- Total revenues are expected to be approximately $2.15 billion (was approximately $2.0 billion).

All forward-looking non-GAAP financial measures contained in this section “Financial Outlook” exclude estimates for stock-based compensation and related employer payroll tax, amortization of acquired intangible assets, adjustments related to a financing lease obligation, interest expense related to convertible debt and acquisition-related adjustments, which may be significant.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of these costs and expenses that may be incurred in the future. The company has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fiscal third quarter 2019 non-GAAP results included in this press release.

Conference Call and Webcast

Splunk’s executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company’s financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk’s Investor Relations website at http://investors.splunk.com/events-presentations. A replay of the call will be available through December 6, 2018 by dialing (855) 859-2056 and referencing Conference ID 7482069.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk’s revenue and non-GAAP operating margin targets for the company’s fiscal fourth quarter and fiscal years 2019 and 2020 in the paragraphs under “Financial Outlook” above and other statements regarding our market opportunity, the market for data-related products. future growth, momentum, strategy, technology and product innovation, expectations for our industry and business, customer demand, customer success and feedback, expanding use of Splunk by customers, and expected benefits and scale of our products. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: Splunk’s limited operating history and experience developing and introducing new products, including its cloud offerings; risks associated with Splunk’s rapid growth, particularly outside of the United States; Splunk’s inability to realize value from its significant investments in its business, including product and service innovations and through acquisitions; Splunk’s shift from sales of perpetual licenses in favor of sales of term licenses and subscription agreements for our cloud services; Splunk’s transition to a multi-product software and services business; Splunk’s inability to successfully integrate acquired businesses and technologies; Splunk’s inability to service its debt obligations or other adverse effects related to our convertible notes; and general market, political, economic, business and competitive market conditions.

Additional information on potential factors that could affect Splunk’s financial results is included in the company’s Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2018, which is on file with the U.S. Securities and Exchange Commission (“SEC”) and Splunk’s other filings with the SEC, including the Quarterly Report on Form 10-Q for the fiscal quarter ended October 31, 2018 which will be filed with the SEC. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) helps organizations ask questions, get answers, take actions and achieve business outcomes from their data. Organizations use market-leading Splunk solutions with machine learning to monitor, investigate and act on all forms of business, IT, security, and Internet of Things data. Join millions of passionate users and try Splunk for free today.

Splunk, Splunk>, Listen to Your Data, The Engine for Machine Data, Splunk Cloud, Splunk Light and SPL are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2018 Splunk Inc. All rights reserved.

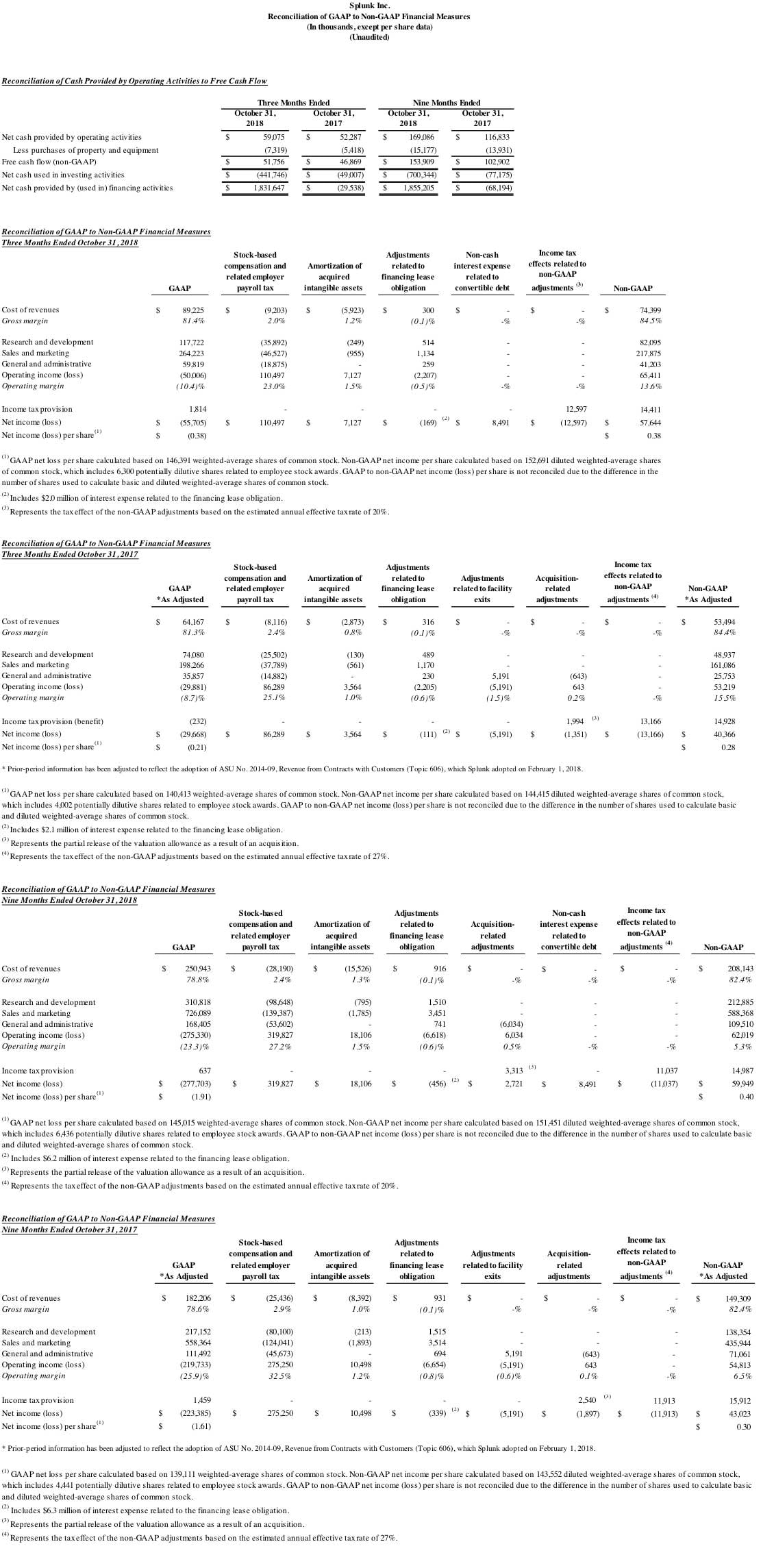

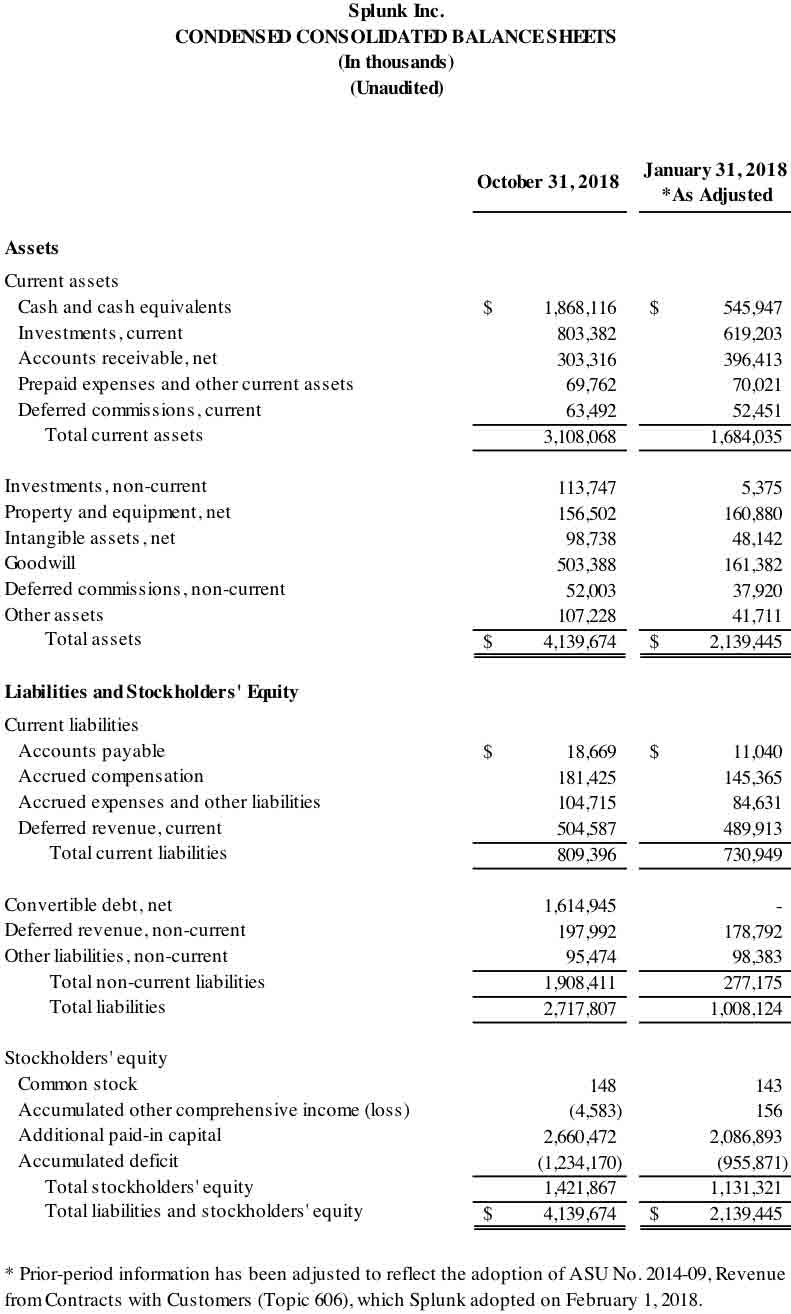

SPLUNK INC.

Non-GAAP financial measures and reconciliations

To supplement Splunk’s condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Splunk provides investors with certain non-GAAP financial measures, including non-GAAP cost of revenues, non-GAAP gross margin, non-GAAP research and development expense, non-GAAP sales and marketing expense, non-GAAP general and administrative expense, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP income tax provision (benefit), non-GAAP net income (loss) and non-GAAP net income (loss) per share (collectively the “non-GAAP financial measures”). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation tables): expenses related to stock-based compensation and related employer payroll tax, amortization of acquired intangible assets, adjustments related to a financing lease obligation, adjustments related to facility exits, acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions and non-cash interest expense related to convertible debt. The adjustments for the financing lease obligation are to reflect the expense Splunk would have recorded if its build-to-suit lease arrangement had been deemed an operating lease instead of a financing lease and is calculated as the net of actual ground lease expense, depreciation and interest expense over estimated straight-line rent expense. We issued convertible notes in the third quarter of fiscal 2019, and therefore, are excluding non-cash interest expense related to convertible debt for the first time in the third quarter of fiscal 2019. The non-GAAP financial measures are also adjusted for Splunk's estimated tax rate on non-GAAP income (loss). To determine the annual non-GAAP tax rate, Splunk evaluates a financial projection based on its non-GAAP results. The annual non-GAAP tax rate takes into account other factors including Splunk's current operating structure, its existing tax positions in various jurisdictions and key legislation in major jurisdictions where Splunk operates. The non-GAAP tax rate applied to the three and nine months ended October 31, 2018 was 20%. Splunk expects to utilize this annual non-GAAP tax rate in fiscal 2019 and will provide updates to this rate on an annual basis, or more frequently if material changes occur. In addition, non-GAAP financial measures includes free cash flow, which represents cash from operations less purchases of property and equipment. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk’s operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors’ operating results.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk’s operational performance and allows investors the ability to make more meaningful comparisons between Splunk’s operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk’s operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk’s common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk’s business. Splunk also excludes amortization of acquired intangible assets, adjustments related to a financing lease obligation, adjustments related to facility exits, acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions, and non-cash interest expense related to convertible debt from its non-GAAP financial measures because these are considered by management to be outside of Splunk’s core operating results. Accordingly, Splunk believes that excluding these expenses provides investors and management with greater visibility to the underlying performance of its business operations, facilitates comparison of its results with other periods and may also facilitate comparison with the results of other companies in its industry. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in its business, making strategic acquisitions and strengthening its balance sheet.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk’s competitors and exclude expenses that may have a material impact upon Splunk’s reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in Splunk’s business and an important part of the compensation provided to Splunk’s employees. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following tables reconcile Splunk’s GAAP results to Splunk’s non-GAAP results included in this press release.