SAN FRANCISCO – August 23, 2018 – Splunk Inc. (NASDAQ: SPLK), first in delivering “aha” moments from machine data, today announced results for its fiscal second quarter ended July 31, 2018.

Second Quarter 2019 Financial Highlights

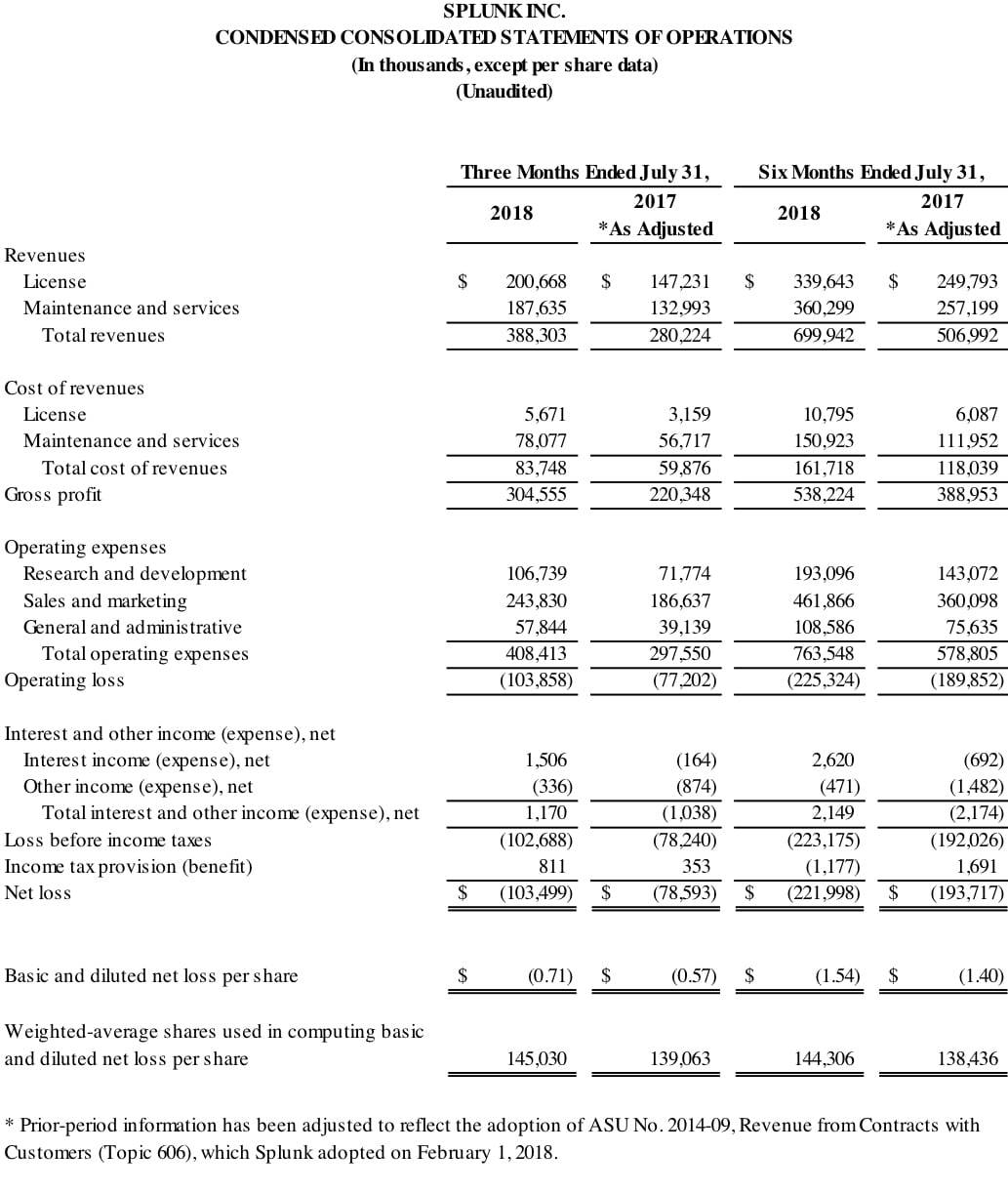

- Total revenues were $388.3 million, up 39% year-over-year.

- Software revenues were $239.7 million, up 43% year-over-year.

- GAAP operating loss was $103.9 million; GAAP operating margin was negative 26.7%.

- Non-GAAP operating income was $11.4 million; non-GAAP operating margin was 2.9%.

- GAAP loss per share was $0.71; non-GAAP income per share was $0.08.

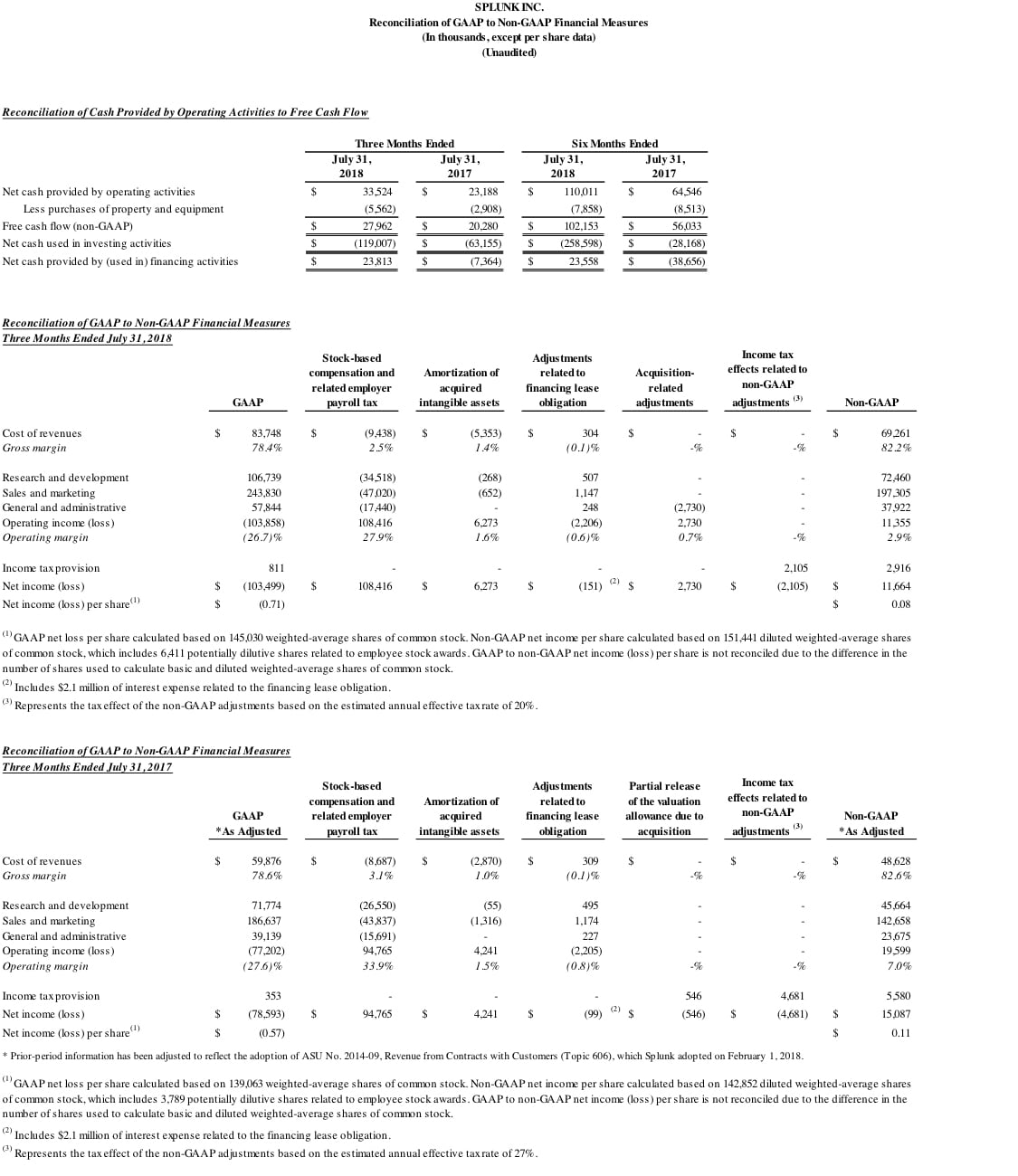

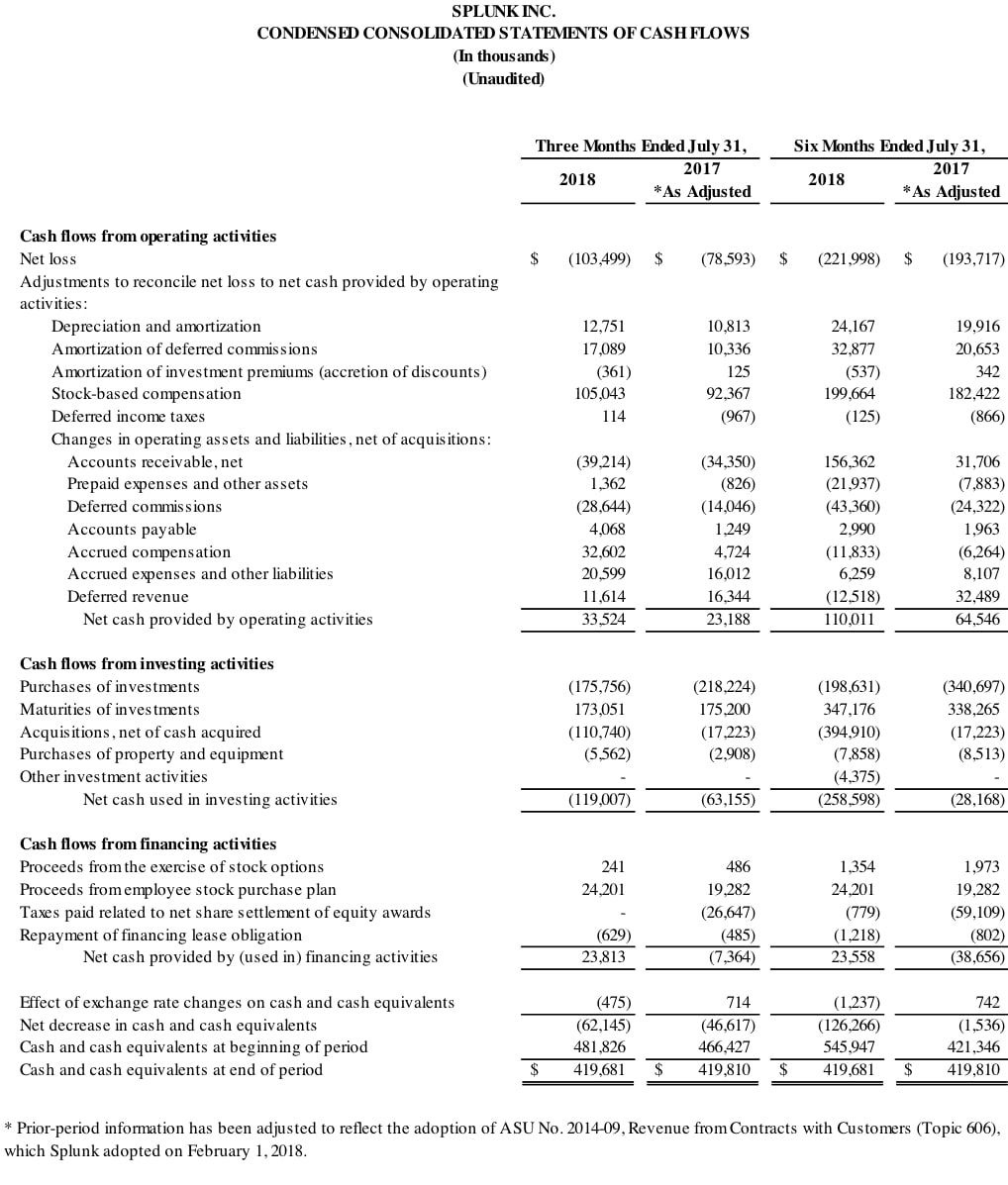

- Operating cash flow was $33.5 million with free cash flow of $28.0 million.

“The rapid digitization of every organization, coupled with Splunk’s increasing innovation, is driving our continued momentum,” said Doug Merritt, President and CEO, Splunk. “Every organization needs to monitor, analyze and investigate data to make faster decisions and take action, and I am pleased that Splunk is the platform of choice. I am looking forward to .conf18 where we’ll reveal the next generation of product innovations to help our customers succeed during this exciting time in their digital evolution.”

Second Quarter 2019 and Recent Business Highlights:

Customers:

- Signed more than 550 new enterprise customers.

- New and Expansion Customers Include: ADP, Dartmouth College, California Department of Technology, Grab (Singapore), Nordea (Sweden), Sheetz, SMSGlobal (Australia), Southwestern Energy Company Inc., UK Ministry of Defence, UNC Greensboro, University Hospitals Bristol (UK), U.S. Department of Defense, Worldpay

Products:

- Released Splunk UBA 4.1, which helps to stop threats you cannot see. Splunk UBA 4.1 delivers greater scalability, streamlined investigation and improved administration.

- Released Splunk Machine Learning Toolkit 3.3, which enables quicker investigation and anomaly detection, and Splunk Machine Learning Toolkit 3.4, which introduces new visualizations and an out-of-the-box neural network algorithm.

- Announced an open beta for Splunk’s reimagined mobile solutions, which will improve key mobile functionality and be a more intuitive user experience.

Corporate:

- Acquired VictorOps, a leader in DevOps incident management, to help modern development teams innovate faster.

- Announced the speaker and presentation lineup for .conf18, which takes place from October 1-4 at the Walt Disney World Swan and Dolphin Resort in Orlando, Florida.

- Celebrated Pride globally and sponsored San Francisco’s 2018 Pride Parade, in which over 500 Splunkers participated, aligning with Splunk’s commitment to diversity and inclusion.

Strategic and Channel Partners:

- BAE Systems announced a new collaboration with Splunk to use machine learning to help secure U.S. Government cloud infrastructures and respond to security threats. Federated Secure Cloud, developed by BAE Systems and Dell EMC, integrates Splunk Enterprise into its government cloud solution.

- Announced Splunk Connect for Kubernetes, a new Splunk integration with Amazon Web Services that makes it easy for Splunk customers to deploy, manage and scale containerized applications Kubernetes on AWS.

Recognition:

- Splunk was recognized as a 2018 Gartner Peer Insights Customer’s Choice for SIEM.

- Splunk Enterprise Security was chosen as the Outstanding Data Security Solution at the Computing Big Data Excellence Awards 2018.

- Splunk Enterprise Security won the SIEM category of Computerworld’s Hong Kong Awards 2018 for the third consecutive year.

- Splunk President of Worldwide Field Operations, Susan St. Ledger was named to the San Francisco Business Times’ 2018 list of the Most Influential Women in Business.

- Six Splunk employees were named to CRN’s 2018 “Women of the Channel” list

Financial Outlook

The company is providing the following guidance for its fiscal third quarter 2019 (ending October 31, 2018):

- Total revenues are expected to be between $430 million and $432 million.

- Non-GAAP operating margin is expected to be approximately 13%.

The company is updating its previous guidance provided on May 24, 2018 for its fiscal year 2019 (ending January 31, 2019):

- Total revenues are expected to be approximately $1.685 billion (was approximately $1.645 billion).

- Non-GAAP operating margin is expected to be approximately 11.5% (unchanged from prior guidance).

All forward-looking non-GAAP financial measures contained in this section “Financial Outlook” exclude estimates for stock-based compensation and related employer payroll tax, amortization of acquired intangible assets, adjustments related to a financing lease obligation and acquisition-related adjustments.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, many of these costs and expenses that may be incurred in the future. The company has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fiscal second quarter 2019 non-GAAP results included in this press release.

Conference Call and Webcast

Splunk’s executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company’s financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk’s Investor Relations website at http://investors.splunk.com/events-presentations. A replay of the call will be available through August 30, 2018 by dialing (855) 859-2056 and referencing Conference ID 1282768.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk’s revenue and non-GAAP operating margin targets for the company’s fiscal third quarter and fiscal year 2019 in the paragraphs under “Financial Outlook” above and other statements regarding our market opportunity, future growth, current momentum, strategy, innovation, expectations for our industry and business, customer demand and penetration, our partner relationships, customer success, expanding use of Splunk by customers, and expected benefits of new products, product innovations and acquisitions, in particular VictorOps. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: Splunk’s limited operating history and experience developing and introducing new products, including its cloud offerings; risks associated with Splunk’s rapid growth, particularly outside of the United States; Splunk’s inability to realize value from its significant investments in its business, including product and service innovations and through acquisitions; Splunk’s shift from sales of perpetual licenses in favor of sales of term licenses and subscription agreements for our cloud services; Splunk’s transition to a multi-product software and services business; Splunk’s inability to successfully integrate acquired businesses and technologies; and general market, political, economic, business and competitive market conditions.

Additional information on potential factors that could affect Splunk’s financial results is included in the company’s Quarterly Report on Form 10-Q for the fiscal quarter ended April 30, 2018, which is on file with the U.S. Securities and Exchange Commission (“SEC”) and Splunk’s other filings with the SEC. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) turns machine data into answers. Organizations use market-leading Splunk solutions with machine learning to solve their toughest IT, Internet of Things and security challenges. Join millions of passionate users and discover your “aha” moment with Splunk today: http://www.splunk.com.

Splunk, Splunk>, Listen to Your Data, The Engine for Machine Data, Splunk Cloud, Splunk Light and SPL are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2018 Splunk Inc. All rights reserved.

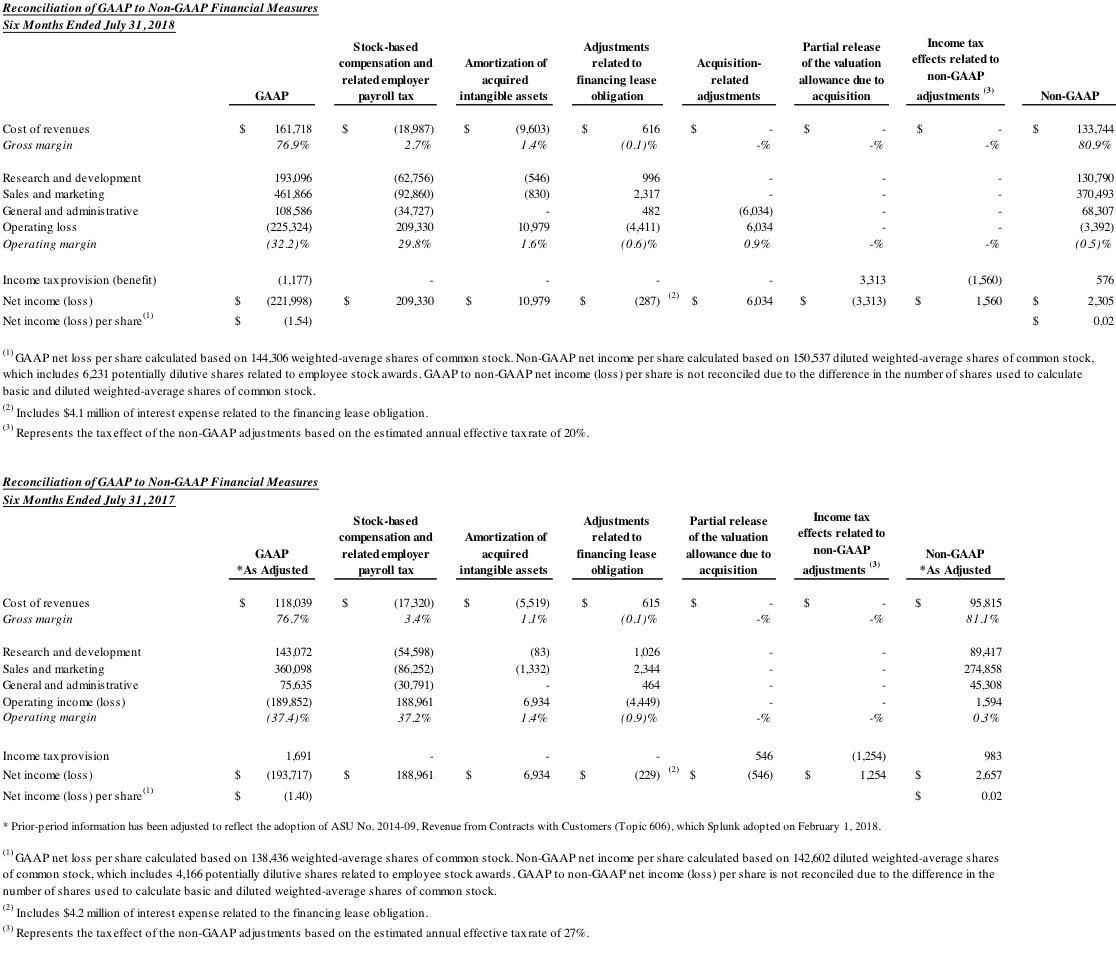

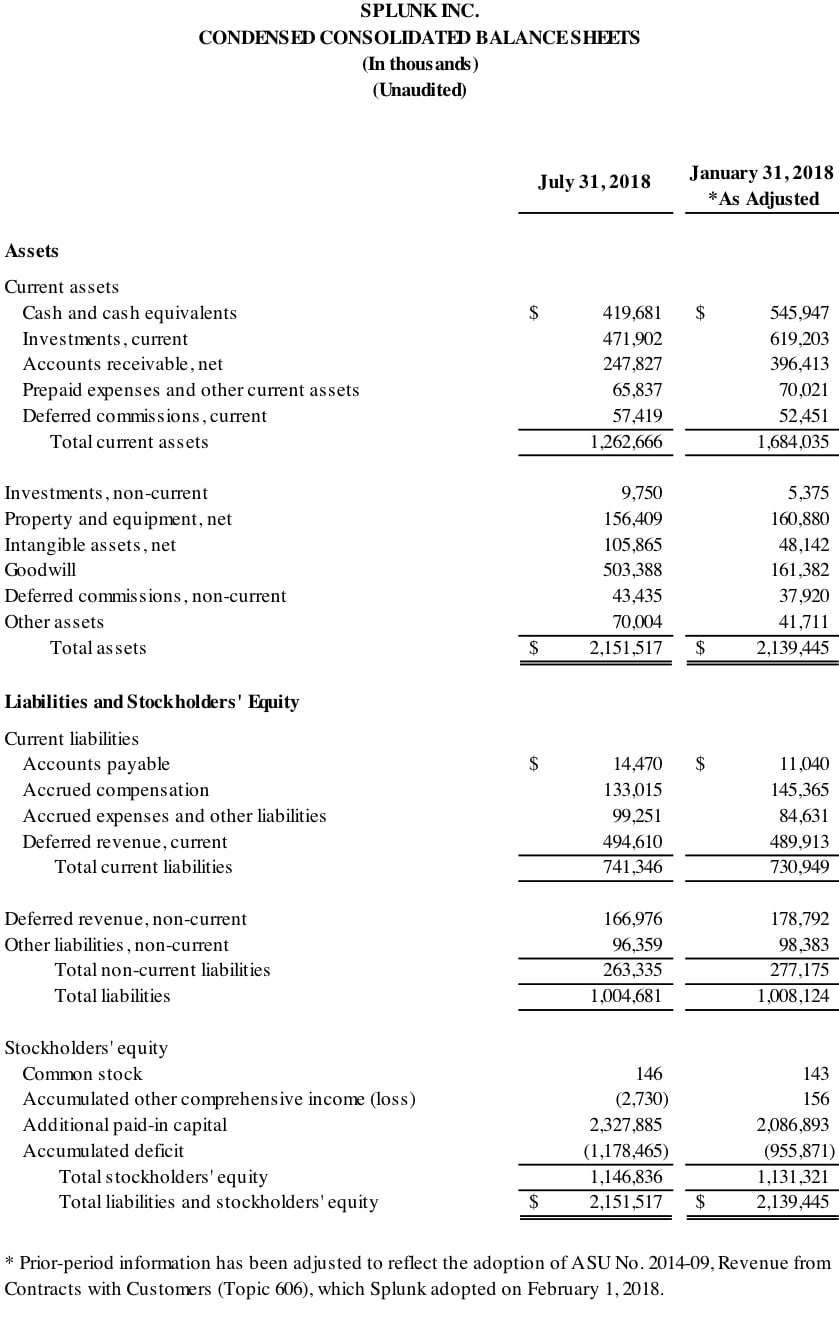

SPLUNK INC.

Non-GAAP financial measures and reconciliations

To supplement Splunk’s condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Splunk provides investors with certain non-GAAP financial measures, including non-GAAP cost of revenues, non-GAAP gross margin, non-GAAP research and development expense, non-GAAP sales and marketing expense, non-GAAP general and administrative expense, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss) and non-GAAP net income (loss) per share (collectively the “non-GAAP financial measures”). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation tables): expenses related to stock-based compensation and related employer payroll tax, amortization of acquired intangible assets, adjustments related to a financing lease obligation and acquisition-related adjustments, including the partial release of the valuation allowance due to acquisitions. The adjustments for the financing lease obligation are to reflect the expense Splunk would have recorded if its build-to-suit lease arrangement had been deemed an operating lease instead of a financing lease and is calculated as the net of actual ground lease expense, depreciation and interest expense over estimated straight-line rent expense. The non-GAAP financial measures are also adjusted for Splunk's estimated tax rate on non-GAAP income (loss). To determine the annual non-GAAP tax rate, Splunk evaluates a financial projection based on its non-GAAP results. The annual non-GAAP tax rate takes into account other factors including Splunk's current operating structure, its existing tax positions in various jurisdictions and key legislation in major jurisdictions where Splunk operates. The non-GAAP tax rate applied to the three and six months ended July 31, 2018 was 20%. Splunk will utilize this annual non-GAAP tax rate in fiscal 2019 and will provide updates to this rate on an annual basis, or more frequently if material changes occur. In addition, non-GAAP financial measures includes free cash flow, which represents cash from operations less purchases of property and equipment. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk’s operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors’ operating results.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk’s operational performance and allows investors the ability to make more meaningful comparisons between Splunk’s operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk’s operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk’s common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk’s business. Splunk also excludes amortization of acquired intangible assets, acquisition-related costs, including the partial release of the valuation allowance due to acquisitions, and makes adjustments related to a financing lease obligation from its non-GAAP financial measures because these are considered by management to be outside of Splunk’s core operating results. Accordingly, Splunk believes that excluding these expenses provides investors and management with greater visibility to the underlying performance of its business operations, facilitates comparison of its results with other periods and may also facilitate comparison with the results of other companies in its industry. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in its business, making strategic acquisitions and strengthening its balance sheet.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk’s competitors and exclude expenses that may have a material impact upon Splunk’s reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in Splunk’s business and an important part of the compensation provided to Splunk’s employees. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following tables reconcile Splunk’s GAAP results to Splunk’s non-GAAP results included in this press release.