SAN FRANCISCO - May 28, 2015 - Splunk Inc. (NASDAQ: SPLK), provider of the leading software platform for real-time Operational Intelligence, today announced results for its fiscal first quarter ended April 30, 2015.

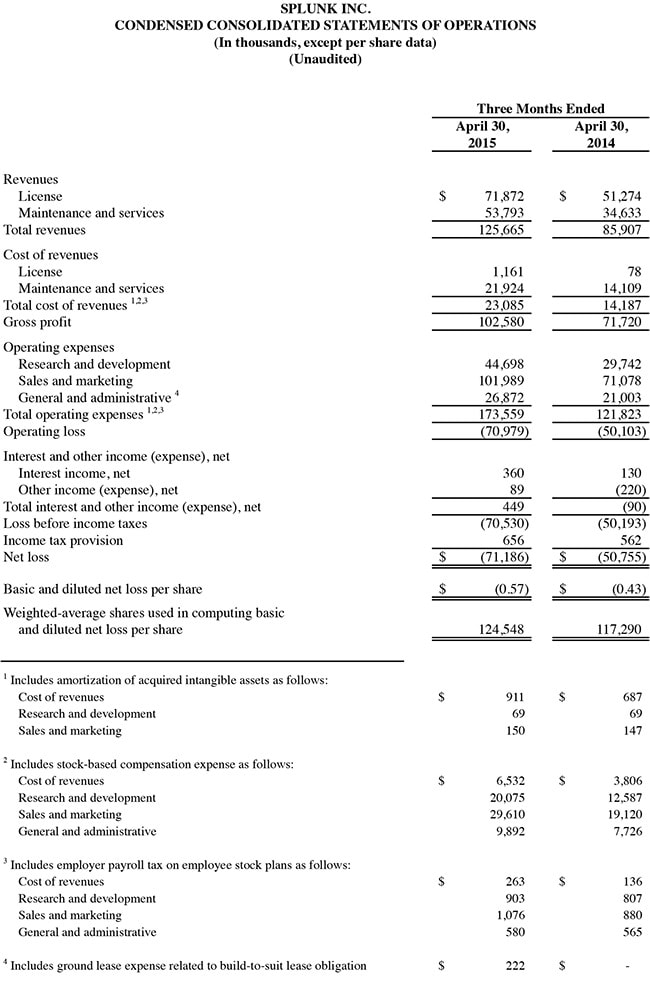

First Quarter 2016 Financial Highlights

- Total revenues were $125.7 million, up 46% year-over-year.

- License revenues were $71.9 million, up 40% year-over-year.

- GAAP operating loss was $71.0 million; GAAP operating margin was negative 56.5%.

- Non-GAAP operating loss was $0.7 million; non-GAAP operating margin was negative 0.6%.

- GAAP loss per share was $0.57; non-GAAP loss per share was $0.01.

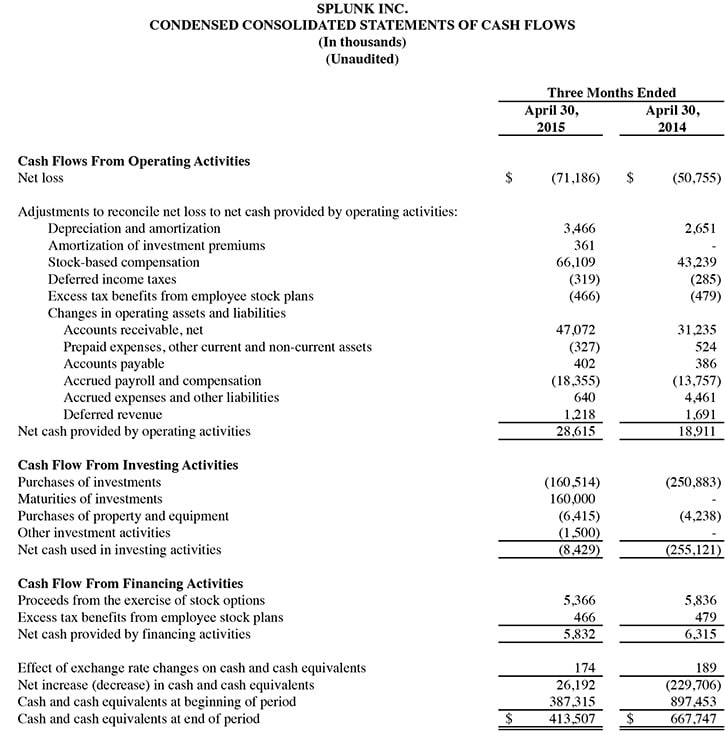

- Operating cash flow was $28.6 million with free cash flow of $22.2 million.

“Our customers are moving towards enterprise-wide adoption of our products and solutions for a growing set of use cases,” said Godfrey Sullivan, Chairman and CEO. “Q1 was a strong quarter and we appreciate and thank our 9,500 customers, which now include 80 of the Fortune 100. We welcomed a record number of new customers to Splunk Cloud driven by the compelling value delivered by our solutions across on-premises, cloud and hybrid environments.”

First Quarter 2016 and Recent Business Highlights

Customers:

- Signed more than 450 new enterprise customers, ending the quarter with over 9,500 customers worldwide.

New and Expansion Customers Include: Adobe, AOL, Al Rajhi Bank (Saudi Arabia), Bloomberg, City of Los Angeles, Denver International Airport, Laing O’Rourke (Australia), Measat Broadcast Network Systems (Malaysia), New South Wales Electoral Commission (Australia), Partners HealthCare, Recreational Equipment Inc. (REI), Saudi Arabian Airlines, Shazam (United Kingdom), SIX Swiss Exchange, Société Générale (France), Sony Playstation Network, Sky Brasil, Sun Hung Kai Real Estate (Hong Kong), Swisscom, TASER International, Thomson Reuters, University of Hong Kong, University of California San Diego and Vivint.

Products:

- Introduced Splunk Light, a new and more affordable way for individuals and small IT environments to get started with Splunk software, with prices starting at $75 per month.

- Announced the international availability of Splunk Cloud through nine Amazon Web Services global regions.

- Announced a new version of the Splunk App for Enterprise Security, which doubled its customer base in fiscal 2015.

- Released a new version of Splunk MINT that enables advanced insight on mobile app performance, problems and usage.

- Began Windows 2008 R2 and Windows 7 support for the Splunk App For Stream, adding further operability beyond the pre-existing options for Linux and Mac.

Recognition:

- Splunk Enterprise selected as the Best Fraud Prevention Solution in the U.S. 2015 SC Awards.

- Splunk Enterprise selected for the 2015 Leading Edge Award for Interoperability from Healthcare Informatics.

- Splunk’s Partner+ Program named a CRN 5-Star Partner Program.

- Splunk named one of the “Best Places to Work” for the eighth consecutive year by the San Francisco Business Times.

- Splunk recognized in the CRN 2015 Big Data 100 'Business Analytics' category.

Appointments:

- Appointed Snehal Antani as chief technology officer.

- Appointed Amy Chang to the Splunk Board of Directors.

Financial Outlook

The company is providing the following guidance for its fiscal second quarter 2016 (ending July 31, 2015):

- Total revenues are expected to be between $138 million and $140 million.

- Non-GAAP operating margin is expected to be between 1% and 2%.

The company is updating its previous guidance for its fiscal year 2016 (ending January 31, 2016):

- Total revenues are expected to be between $610 million and $614 million (was approximately $600 million per prior guidance provided on February 26, 2015).

- Non-GAAP operating margin is expected to be between 2% and 3%.

All forward-looking non-GAAP financial measures contained in this section “Financial Outlook” exclude estimates for stock-based compensation expenses, employer payroll tax expense related to employee stock plans, amortization of acquired intangible assets and ground lease expense related to a build-to-suit lease obligation.

While a reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis, the company has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fiscal first quarter 2016 non-GAAP results included in this press release.

Conference Call and Webcast

Splunk’s executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company’s financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk’s Investor Relations website at http://investors.splunk.com/events.cfm. A replay of the call will be available through June 4, 2015 by dialing (855) 859-2056 and referencing Conference ID 41466777.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk’s revenue and non-GAAP operating margin targets for the company’s fiscal second quarter and fiscal year 2016 in the paragraphs under “Financial Outlook” above and other statements regarding momentum in the company’s business, customer growth, customer adoption of our products and planned investments. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: Splunk’s limited operating history and experience developing and introducing new products; including its cloud offerings; risks associated with Splunk’s rapid growth, particularly outside of the U.S.; Splunk’s inability to realize value from its significant investments in its business, including product and service innovations; Splunk’s transition to a multi-product software and services business; Splunk’s inability to successfully integrate acquired businesses and technologies; and general market, political, economic and business conditions.

Additional information on potential factors that could affect Splunk’s financial results is included in the company’s Annual Report on Form 10-K for the year ended January 31, 2015, which is on file with the U.S. Securities and Exchange Commission. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) provides the leading software platform for real-time Operational Intelligence. Splunk® software and cloud services enable organizations to search, monitor, analyze and visualize machine-generated big data coming from websites, applications, servers, networks, sensors and mobile devices. More than 9,500 enterprises, government agencies, universities and service providers in more than 100 countries use Splunk software to deepen business and customer understanding, mitigate cybersecurity risk, prevent fraud, improve service performance and reduce cost. Splunk products include Splunk® Enterprise, Splunk Cloud™, Hunk®, Splunk Light™, Splunk MINT and premium Splunk Apps. To learn more, please visit http://www.splunk.com/company.

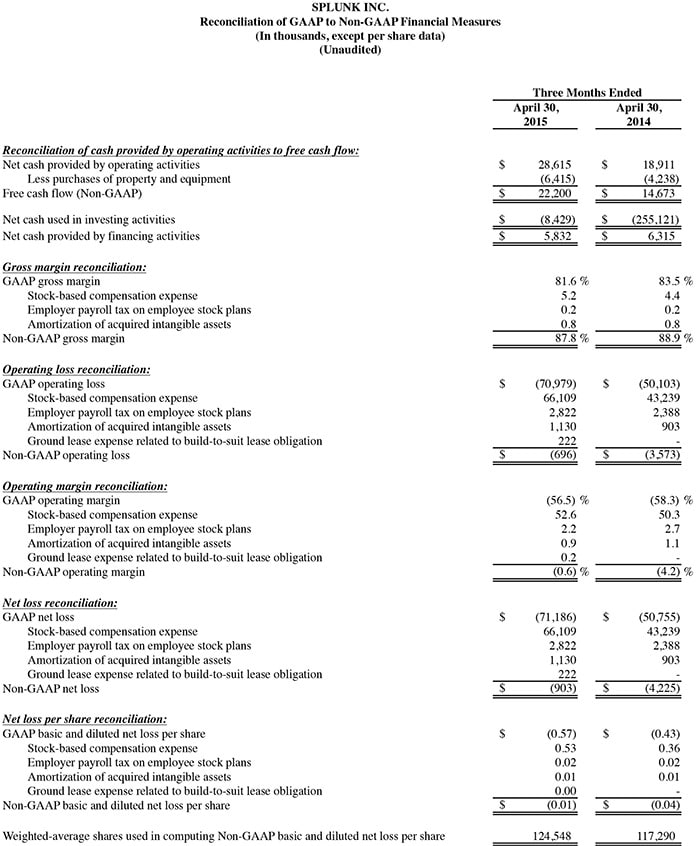

SPLUNK INC.

Non-GAAP financial measures and reconciliations

To supplement Splunk's consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States ("GAAP"), Splunk provides investors with certain non-GAAP financial measures, including non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss) and non-GAAP net income (loss) per share (collectively the "non-GAAP financial measures"). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation table): stock-based compensation expense, employer payroll tax expense related to employee stock plans, amortization of acquired intangible assets, ground lease expense related to a build-to-suit lease obligation, impairment of a long-lived asset, acquisition-related costs and the partial release of the valuation allowance due to acquisition. In addition, non-GAAP financial measures include free cash flow, which represents cash from operations less purchases of property and equipment. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk's operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors' operating results.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk's operational performance. In particular, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use under FASB ASC Topic 718, Splunk believes that providing non-GAAP financial measures that exclude this expense allows investors the ability to make more meaningful comparisons between Splunk's operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk's operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk's common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk's business. Splunk also excludes the non-cash charge for previously capitalized Storm research and development expense (reflected as an impairment of a long-lived asset) as a result of its strategic decision to start making its Storm product available at no cost to customers, a decision that Splunk expects to be infrequent in nature. Splunk also excludes acquisition-related costs, amortization of acquired intangible assets and ground lease expense related to its build-to-suit lease obligation from its non-GAAP financial measures because these are considered by management to be outside of Splunk's core operating results. Splunk further excludes the partial release of the valuation allowance due to acquisition from non-GAAP net income (loss) and non-GAAP net income (loss) per share because it is also considered by management to be outside Splunk's core operating results. Accordingly, Splunk believes that excluding these expenses provides investors and management with greater visibility to the underlying performance of its business operations, facilitates comparison of its results with other periods and may also facilitate comparison with the results of other companies in its industry. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in its business, making strategic acquisitions and strengthening its balance sheet.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk's competitors and exclude expenses that may have a material impact upon Splunk's reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in Splunk's business and an important part of the compensation provided to Splunk's employees. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following table reconciles Splunk's non-GAAP results to Splunk's GAAP results included in this press release.

Splunk, Splunk>, Listen to Your Data, The Engine for Machine Data, Hunk, Splunk Cloud, Splunk Light, SPL and Splunk MINT are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2015 Splunk Inc. All rights reserved.