SAN FRANCISCO - May 30, 2013 - Splunk Inc. (NASDAQ: SPLK), the leading software platform for real-time operational intelligence, today announced results for its fiscal first quarter ended April 30, 2013.

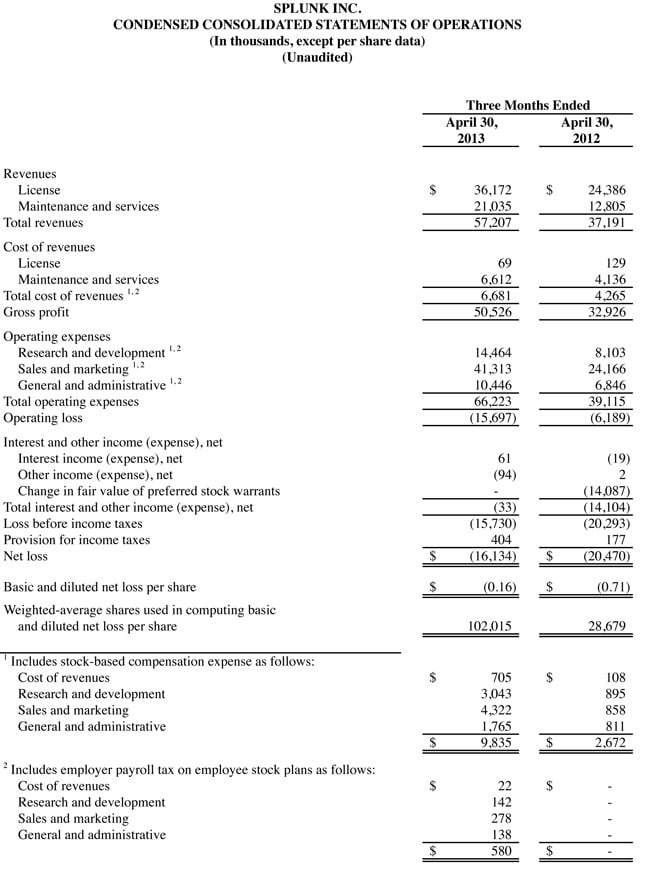

- Total revenue was $57.2 million, up 54% year-over-year.

- License revenue was $36.2 million, up 48% year-over-year.

- GAAP operating loss was $15.7 million or negative 27.4% of revenues.

- Non-GAAP operating loss was $5.3 million or negative 9.2% of revenues.

- GAAP loss per share was $0.16; non-GAAP loss per share was $0.06.

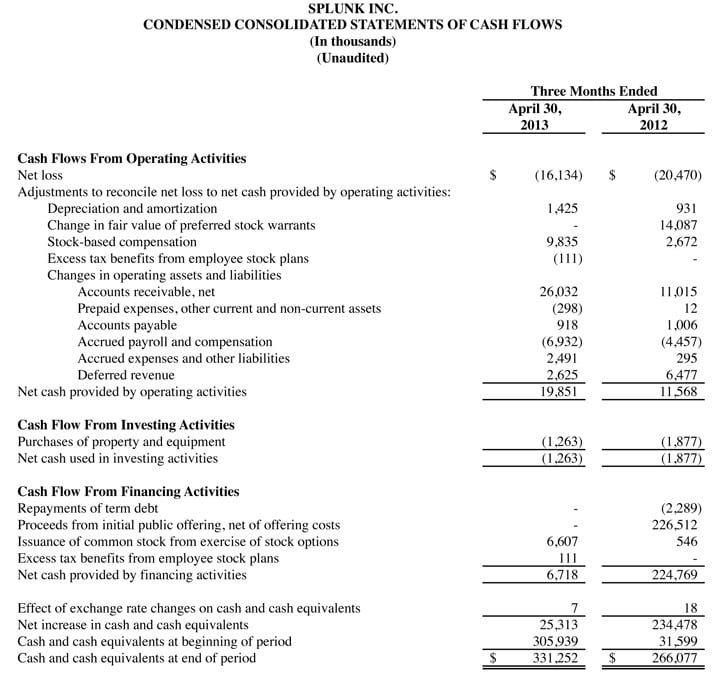

- Operating cash flow was $19.9 million with free cash flow of $18.6 million.

"We are off to a strong start in the first quarter and I'm pleased with our new customer acquisition and financial performance," said Godfrey Sullivan, Chairman and CEO. "Years of investment and product innovation have resulted in recognition that Splunk is disrupting the enterprise software space. In the security market, Splunk was recognized as a leader in the 2013 Gartner Security Information and Event Management (SIEM) Magic Quadrant and SC Magazine named Splunk Enterprise Best SIEM solution in North America and Best Enterprise Security Solution for Europe. In IT operations management, Gartner recognized Splunk as one of the fastest growing vendors in the category. And Fast Company named Splunk one of the world's most innovative companies and ranked Splunk as the number one innovator in big data. We will continue to invest heavily in our data platform, content and SaaS offerings to deliver customer success."

First Quarter 2014 and Recent Business Highlights

Customers:

- Signed more than 350 new enterprise customers, ending the quarter with approximately 5,600 customers worldwide. Signed more than 70 new Splunk Storm® customers, ending the quarter with more than 200 Splunk Storm customers worldwide.

- New license customers include: Allconnect, Altstoff Recycling Austria AG, Arizona Department of Transportation, The Bank of New York Mellon Corporation, Baylor University, Department of Energy, Idaho State Tax Commission, Genesis Energy (ANZ), Kordia (ANZ), Level 3 Communications, Inc., Ministry of Presidential Affairs (UAE), Mission Australia, Mitsui Bussan Secure Directions, Inc. (APAC), NBNCo Limited (APAC), Nomura Securities CO LTD (APAC), Oregon State Lottery, The Qatar Computer Emergency Response Team (QCERT), Transaction Solutions (ANZ), VicTrack (APAC), Winn-Dixie.

- Expansion customers include: Arizona State University, Bank of New Zealand, Box, Inc., Blackrock Inc., Comcast Corporation, D. Swarovski & Co., Major League Baseball, Nanyang Technological University, NASA Johnson Space Center, Nordstrom, Novagalicia (NCG) Banco (Spain), Oregon Army National Guard, Orange France, Penn State Hershey Medical Center, Riverbed Technology, ServiceNow, State of Texas - Health and Human Services, University of California Irvine, U.S. Department of Health and Human Services, U.S. Army.

Product:

- Announced the general availability (GA) of version 2.4 of the Splunk App for Enterprise Security. Splunk® Enterprise and the Splunk App for Enterprise Security are a security intelligence platform that helps organizations discover unknown threats in real time with out-of-the-box content, including searches, dashboards and visualizations that enable rich statistical analysis of machine data.

- Announced the GA of the Splunk App for Palo Alto Networks 3.0 to enable users to leverage their machine-generated big data to analyze risk, improve security posture and compliance and address a number of additional operational and regulatory concerns.

- Released the GA version of Splunk DB Connect to deliver real-time integration between Splunk Enterprise and relational databases.

- Released version 5.0 of the Splunk App for Windows, which delivers enterprise-class monitoring for Microsoft® Windows Server.

- Released the latest version of the Splunk App for HadoopOps to improve the ability to collect Hadoop metrics.

- Released the Splunk App for NetApp ONTAP to enable users to gain visibility into the NetApp storage system with Splunk.

- Released a new Splunk App for Symantec allowing users of Splunk Enterprise and Symantec to better monitor, investigate and eliminate endpoint threats as reported by Symantec Endpoint Protection (SEP). This app contains real-time dashboards, panels and search fields to easily view and investigate SEP data.

- Released an update to the Splunk App for Blue Coat ProxySG which enables users of Splunk Enterprise and Blue Coat to better monitor, investigate and secure their Internet traffic as reported by Blue Coat ProxySG. This app contains real-time dashboards, panels and search fields to easily view and investigate ProxySG data.

Recognition:

- Splunk has been named a leader in the 2013 Gartner Magic Quadrant for SIEM. For the report, Gartner evaluated Splunk Enterprise and the Splunk App for Enterprise Security. Splunk Enterprise is used as a big data security intelligence platform by more than 2,000 organizations around the world.

- SC Magazine named Splunk Enterprise best SIEM solution in North America and Best Enterprise Security Solution for Europe.

- Fast Company named Splunk one of the World's Most Innovative Companies. Splunk is ranked fourth overall and also ranked the number one innovator in Big Data for "bringing big data to the masses."

- Splunk was named to the CRN Big Data 100 in the Business Analytics category.

- Received the 2013 North American New Product Innovation Award for Big Data Security Intelligence Solutions from Frost and Sullivan.

- Named as one of the San Francisco Bay Area's "Best Places to Work" by The San Francisco Business Times and Silicon Valley / San Jose Business Journal for a sixth consecutive year.

Appointments:

- Named Patricia B. Morrison to the company's Board of Directors. Ms. Morrison has been Executive Vice President of Customer Care Shared Services and Chief Information Officer for Cardinal Health since 2009.

- Named Declan Morris as vice president of IT and cloud operations and Dejan Deklich as vice president of cloud engineering.

Financial Outlook

The company is providing the following guidance for its fiscal second quarter 2014 (ending July 31, 2013):

- Total revenue is expected to be between $61 million and $63 million.

- Non-GAAP operating margin is expected to be between negative 4% and negative 6%.

The company is updating its previous guidance for its fiscal year 2014 (ending January 31, 2014):

- Total revenue is expected to be between $266 million and $274 million (was previously expected to be between $260 million and $270 million as of Feb. 28, 2013).

- Non-GAAP operating margin is expected to be approximately zero (unchanged from Feb. 28, 2013).

All forward-looking non-GAAP financial measures contained in this section "Financial Outlook" exclude estimates for stock-based compensation expenses and employer payroll tax expense related to employee stock plans.

While a reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis, the company has provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for its fiscal first quarter 2014 non-GAAP results included in this press release.

Conference Call and Webcast

Splunk's executive management team will host a conference call today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the company's financial results and business highlights. Interested parties may access the call by dialing (866) 501-1535. International parties may access the call by dialing (216) 672-5582. A live audio webcast of the conference call will be available through Splunk's Investor Relations website at http://investors.splunk.com/events.cfm. A replay of the call will be available through June 6, 2013 by dialing (855) 859-2056 and referencing Conference ID# 57800854.

Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including statements regarding Splunk's revenue and non-GAAP operating margin targets for the company's fiscal second quarter and fiscal year 2014 in the paragraphs under "Financial Outlook" above and other statements regarding momentum in the company's business, growth in the number of new customers, existing customer usage, expansion of Splunk software use cases and product investments and developments. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: Splunk's limited operating history, particularly as a relatively new public company; risks associated with Splunk's rapid growth, particularly outside of the U.S.; and general market, political, economic and business conditions.

Additional information on potential factors that could affect Splunk's financial results is included in the company's Annual Report on Form 10-K for the year ended January 31, 2013, which is on file with the U.S. Securities and Exchange Commission. Splunk does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) provides the engine for machine data™. Splunk® software collects, indexes and harnesses the machine-generated big data coming from the websites, applications, servers, networks, sensors and mobile devices that power business. Splunk software enables organizations to monitor, search, analyze, visualize and act on massive streams of real-time and historical machine data. 5,600 enterprises, universities, government agencies and service providers in over 90 countries use Splunk Enterprise to gain Operational Intelligence that deepens business and customer understanding, improves service and uptime, reduces cost and mitigates cyber-security risk. Splunk Storm®, a cloud-based subscription service, is used by organizations developing and running applications in the cloud.

To learn more, please visit www.splunk.com/company.

SPLUNK INC.

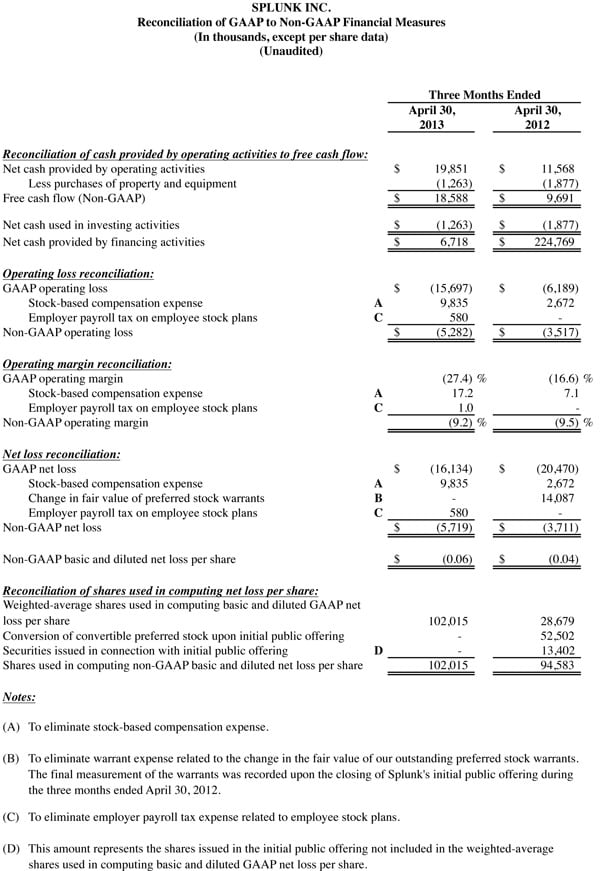

Non-GAAP financial measures and reconciliations

To supplement Splunk's consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States ("GAAP"), Splunk provides investors with certain non-GAAP financial measures, including non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss) and non-GAAP net income (loss) per share (collectively the "non-GAAP financial measures"). These non-GAAP financial measures exclude all or a combination of the following (as reflected in the following reconciliation table): stock-based compensation expense, employer payroll tax expense related to employee stock plans, amortization of acquired intangible assets, ground lease expense related to a build-to-suit lease obligation, impairment of a long-lived asset, acquisition-related costs and the partial release of the valuation allowance due to acquisition. In addition, non-GAAP financial measures include free cash flow, which represents cash from operations less purchases of property and equipment. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Splunk uses these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Splunk believes that these non-GAAP financial measures provide useful information about Splunk's operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. In addition, these non-GAAP financial measures facilitate comparisons to competitors' operating results.

Splunk excludes stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding Splunk's operational performance. In particular, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use under FASB ASC Topic 718, Splunk believes that providing non-GAAP financial measures that exclude this expense allows investors the ability to make more meaningful comparisons between Splunk's operating results and those of other companies. Splunk excludes employer payroll tax expense related to employee stock plans in order for investors to see the full effect that excluding that stock-based compensation expense had on Splunk's operating results. These expenses are tied to the exercise or vesting of underlying equity awards and the price of Splunk's common stock at the time of vesting or exercise, which may vary from period to period independent of the operating performance of Splunk's business. Splunk also excludes the non-cash charge for previously capitalized Storm research and development expense (reflected as an impairment of a long-lived asset) as a result of its strategic decision to start making its Storm product available at no cost to customers, a decision that Splunk expects to be infrequent in nature. Splunk also excludes acquisition-related costs, amortization of acquired intangible assets and ground lease expense related to its build-to-suit lease obligation from its non-GAAP financial measures because these are considered by management to be outside of Splunk's core operating results. Splunk further excludes the partial release of the valuation allowance due to acquisition from non-GAAP net income (loss) and non-GAAP net income (loss) per share because it is also considered by management to be outside Splunk's core operating results. Accordingly, Splunk believes that excluding these expenses provides investors and management with greater visibility to the underlying performance of its business operations, facilitates comparison of its results with other periods and may also facilitate comparison with the results of other companies in its industry. Splunk considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in its business, making strategic acquisitions and strengthening its balance sheet.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by Splunk's competitors and exclude expenses that may have a material impact upon Splunk's reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in Splunk's business and an important part of the compensation provided to Splunk's employees. The non-GAAP financial measures are meant to supplement and be viewed in conjunction with GAAP financial measures.

The following table reconciles Splunk's non-GAAP results to Splunk's GAAP results included in this press release.

Splunk, Splunk>, Listen to Your Data, The Engine for Machine Data, Hunk, Splunk Cloud, Splunk Light, SPL and Splunk MINT are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other brand names, product names, or trademarks belong to their respective owners. © 2015 Splunk Inc. All rights reserved.